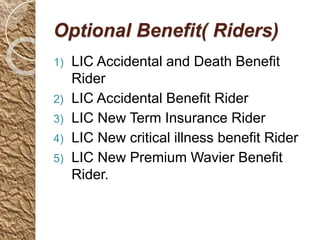

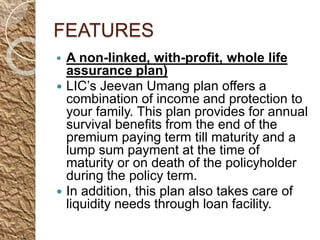

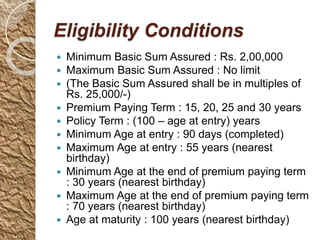

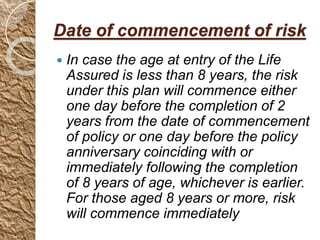

This document summarizes the key features of LIC's Jeevan Umang whole life insurance plan. It provides annual survival benefits after the premium paying term until maturity, as well as a lump sum payment at maturity or on death of the policyholder. Eligibility includes a minimum basic sum assured of Rs. 200,000 with no upper limit, and premium paying terms of 15-30 years. The plan offers death and maturity benefits, paid-up value options, policy loans, participation in profits, and optional riders.

![BENEFITS

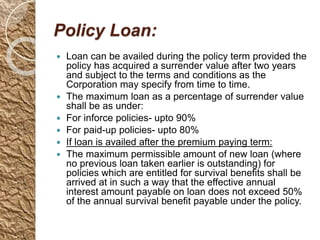

PAID UP VALUE:

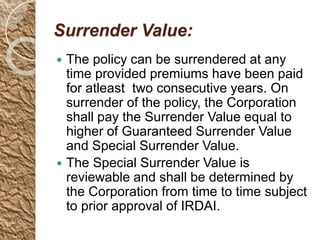

If less than two years’ premiums have been paid and any

subsequent premium be not duly paid, all the benefits under

the policy shall cease after the expiry of grace period and

nothing shall be payable.

If at least Two years’ premiums have been paid and any

subsequent premiums be not duly paid, the policy shall not be

void but shall continue as a paid-up policy till the end of policy

term.

The Sum Assured on Death under a paid-up policy shall be

reduced to a sum called “Death Paid-up Sum Assured” and

shall be equal to [(Number of premiums paid /Total number of

premiums payable) * Sum Assured on Death].

The Sum Assured on Maturity under a paid-up policy shall

be reduced to a sum called “Maturity Paid-up Sum

Assured” and shall be equal to [(Number of premiums paid

/Total number of premiums payable)*(Sum Assured on

Maturity)].](https://image.slidesharecdn.com/jeevanumang-200211105022/85/Jeevan-umang-945-9-320.jpg)