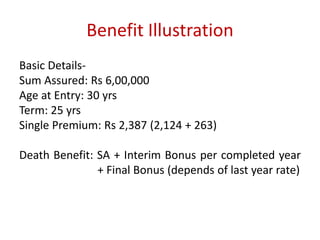

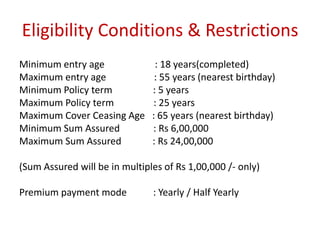

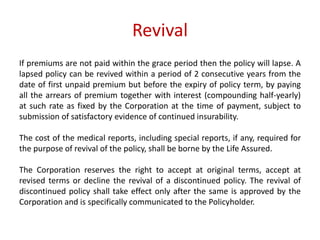

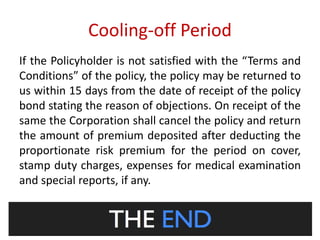

This document summarizes the features of LIC's Anmol Jeevan - II plan. It is a term life insurance plan that provides a death benefit to the insured's family if death occurs during the policy term. The plan offers a sum assured if death occurs, but no maturity benefit is paid if the insured survives to the end of the policy term. Eligibility includes a minimum entry age of 18, maximum term of 25 years, and minimum sum assured of Rs. 6,00,000. The plan allows revival within 2 years if premiums are unpaid and includes a 15-day free look period.