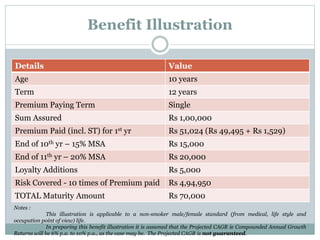

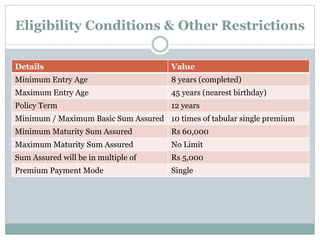

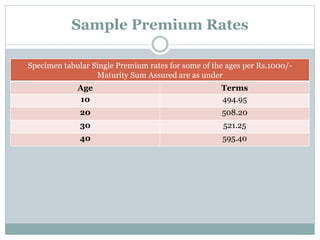

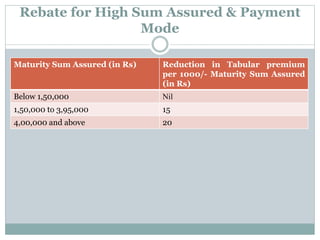

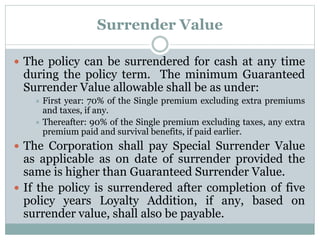

The Jeevan Shagun Plan No. 826 is a single premium, non-linked savings and protection insurance plan that offers death, survival, and maturity benefits based on the chosen maturity sum assured and the life assured's age. The plan includes loan facilities, flexible premium rates, and allows surrendering the policy for cash under specific conditions. Additional details include eligibility criteria, premium rates, and a cooling-off period for policyholders who wish to withdraw within 15 days.