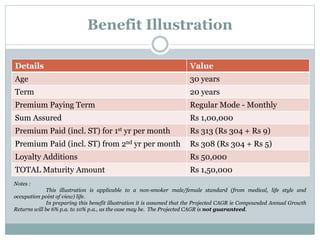

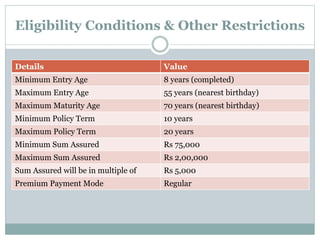

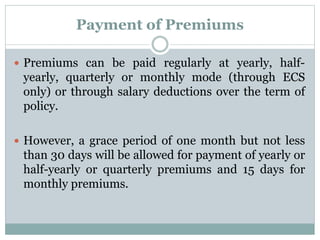

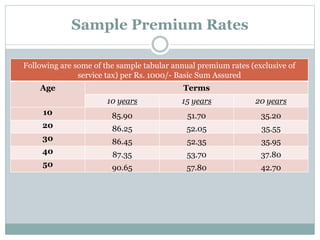

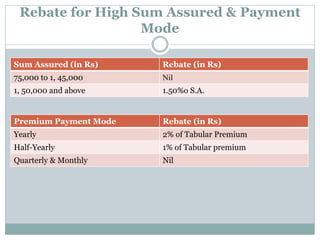

The Jeevan Rakshak Plan No. 827 is a non-linked insurance plan that combines protection and savings, offering benefits in case of the policyholder's death and upon maturity. It provides a death benefit based on the higher of the sum assured, annualized premium, or paid premiums, along with a maturity benefit if all dues are paid. The plan also allows for loans and offers options such as accidental death and disability riders, with various eligibility conditions and premium payment modes.