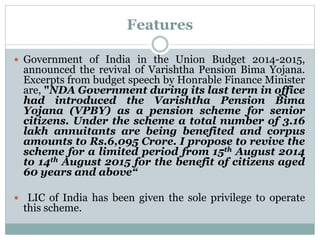

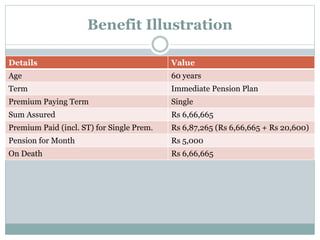

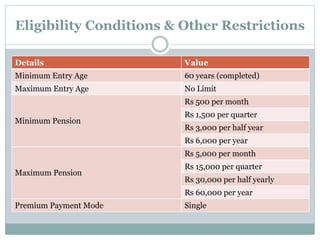

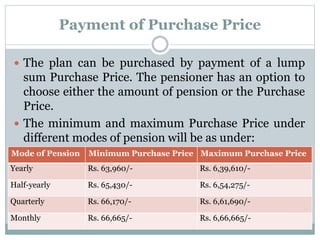

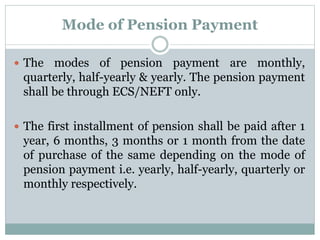

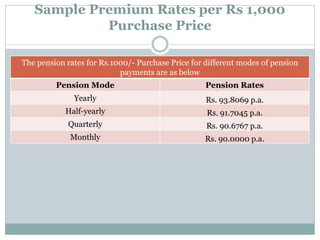

The Varishtha Pension Bima Yojana is a pension scheme for senior citizens aged 60 and above, revived by the Indian government for a limited period until August 2015, with LIC of India as the sole operator. The scheme offers various benefits including immediate annuity, death benefits, and options for pension payments through different modalities, along with provisions for loans and surrender after specific terms. Eligibility requires a minimum entry age of 60, and the scheme includes a free-look period for policyholders dissatisfied with the terms.