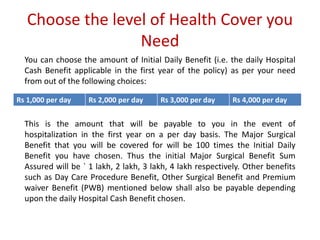

The document describes LIC's Jeevan Arogya health insurance plan. It provides health insurance coverage against specified health risks and helps financially in medical emergencies. The plan offers valuable financial protection for hospitalization, surgery, and increasing health coverage annually. Policyholders can choose their health coverage level between Rs. 1,000-4,000 per day and insure themselves, spouse, children, parents, and parents-in-law under one policy from age 18-75. The plan provides benefits like hospital cash, surgical coverage, day care procedures, ambulance costs, and premium waivers.