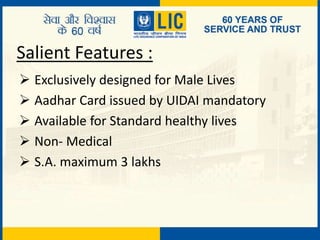

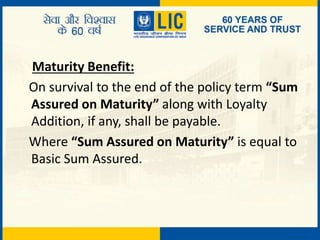

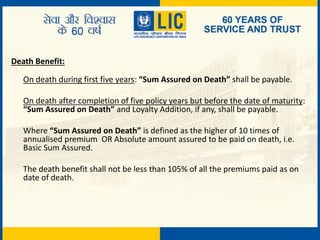

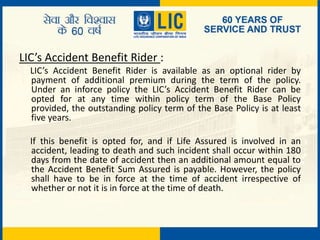

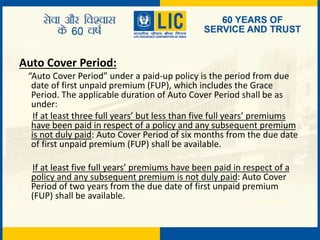

The LICS Aadhar Stambh Plan No. 843 is a non-linked, with-profits regular premium endowment assurance plan available exclusively for male lives, with a maximum sum assured of 3 lakhs. It offers maturity benefits and death benefits, with additional options like an accident benefit rider and an auto cover period for unpaid premiums. Eligibility ranges from ages 8 to 55 for the base plan, with premium payments available in various modes and potential rebates for certain conditions.

![The benefits payable under a paid-up policy during Auto Cover Period

shall be as follows:

On death:

Death benefit, as payable under an inforce policy will be paid after

deduction of

(a) the unpaid premium(s) in respect of the base policy with interest

thereon upto the date of death, and

(b) the balance premium(s) for the base policy falling due from the date of

death and before the next policy anniversary, if any.

On maturity:

“Maturity Paid-up Sum Assured” is payable and shall be equal to

[(Number of premiums paid/Total Number of premiums payable) x

(Sum Assured on Maturity)]. In addition to the Maturity Paid-up Sum

Assured, Loyalty Addition, if any, shall also be payable on maturity.](https://image.slidesharecdn.com/licaadharstambhplanno-170420064220/85/LIC-AADHAR-STAMBH-Plan-No-843-8-320.jpg)

![The benefits payable under a paid-up policy after the expiry of Auto Cover

Period shall be as follows:

On death:

“Death Paid-up Sum Assured” is payable and shall be equal to [Sum Assured

on Death * (Number of premiums paid / Total number of premiums

payable)]. In addition to the Death Paid-up Sum Assured Loyalty Addition, if

any, shall also be payable on death after the expiry of Auto Cover Period.

On maturity:

“Maturity Paid-up Sum Assured” is payable and shall be equal to [(Number

of premiums paid/Total Number of premiums payable) x (Sum Assured on

Maturity)]. In addition to the Maturity Paid-up Sum Assured, Loyalty

Addition, if any, shall also be payable on maturity.](https://image.slidesharecdn.com/licaadharstambhplanno-170420064220/85/LIC-AADHAR-STAMBH-Plan-No-843-9-320.jpg)