Ramesh Kumar N presents information on capital budgeting analysis. He has over 32 years of experience in banking and finance. Capital budgeting is the process of analyzing long-term investment projects to determine if they will increase shareholder value. It is a critical decision for companies, as projects involve large investments and risks. Techniques for evaluating projects include payback period, net present value (NPV), internal rate of return (IRR), and profitability index. NPV is the preferred method as it considers all cash flows and time value of money, consistent with maximizing shareholder wealth.

![Ramesh Kumar N C2

Presenter’s background

RAMESH KUMAR NANJUNDAIYA – MS (Belgium), MBA (US)

Associate Partner & Head - Finance/Business set-up and Family Office of M/s. Insta Solu Venture

Consultants, LLP, Bangalore, India

Certified as “Independent Corporate Director”, by World Council For Corporate Governance,

London, UK [License # WCFCG/IID/DCD/2011/1711] – 2011

Visiting Guest Faculty in “International Marketing”and “Corporate Finance” course for final year

MBA students at a known institutions in Bangalore, India.

Professional overview

An accomplished professional with over 32 years’ of experience in banking and the financial

sector with established credentials in Corporate Banking and Marketing, Financial Management,

Venture & PE Capital sourcing, setting up JVs and with forte in Start ups to promote new

commercial banks, ventures, undertaking IPO groundwork & Listing for SMEs.

Senior banker with working experience gained in known international banks as BNP, SCB,

Citibank, EBIL, Barclays Bank, Banque Saudi Fransi in such diverse countries as the Middle East

(GCC) region, West Europe and India.

Trainer in Corporate Banking and Credit, International Trade and Marketing and Business

Consultation.](https://image.slidesharecdn.com/capitalbudgetinganalysis-130703010310-phpapp01/85/Capital-budgeting-analysis-2-320.jpg)

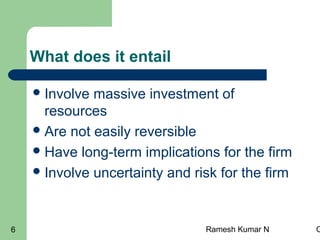

![Ramesh Kumar N C15

Profitability index [PI]

A part of discounted cash flow family

PI = PV of Cash Inflows/initial investment

Accept a project if PI ≥ 1.0, which means positive

NPV

Usually, PI consistent with NPV

PI may be in conflict with NPV if

– Projects are mutually exclusive

Scale of projects differ

Pattern of cash flows of projects is different

When in conflict with NPV, use NPV](https://image.slidesharecdn.com/capitalbudgetinganalysis-130703010310-phpapp01/85/Capital-budgeting-analysis-15-320.jpg)