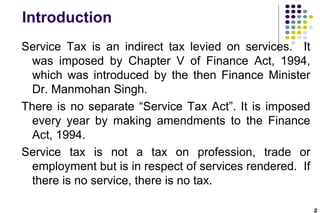

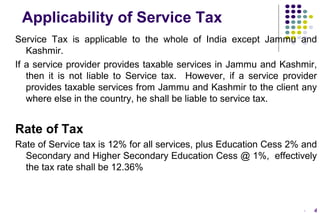

Service tax is an indirect tax levied on services in India. There is no separate Service Tax Act - it is imposed annually through amendments to the Finance Act of 1994. Service tax applies to the entire country except Jammu and Kashmir. The current rate of service tax is 12% plus applicable cess. Certain services are exempt from service tax under various notifications. The valuation of a service for calculating tax payable is based on the gross amount charged or the monetary value of consideration received. Various rules have been introduced to determine the scope of taxable services and calculate service tax payable for different services and situations.

![Service liable to Service Tax

All services are liable to service tax except –

a) Activities specifically excluded in definition of service.

b) Services covered under the negative list

c)

d)

e)

Services covered under Mega Exemption notification.

Services provided outside the taxable territory.

Services received by a unit located in SEZ (subject to conditions).

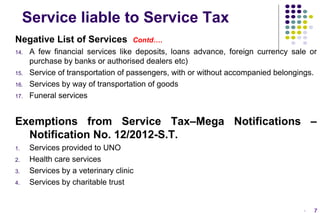

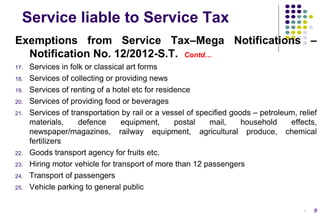

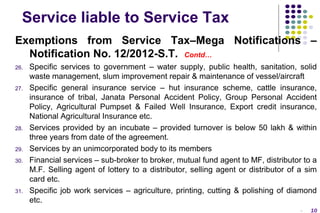

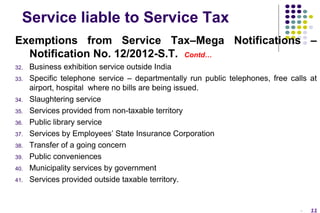

Negative List of Services

There are 17 categories of services which are not chargeable to service tax ––

1. Services provided by Government or local authority. [Except (a) services by Dept

of post by way of speed post, express parcel post, life insurance, and agency

services, (b) services in relation to an aircraft or a vessel, inside or outside the

precincts of a port or an airport, (c) transport of goods or passengers, (d) support

services]

2. Services provided by RBI

-

5](https://image.slidesharecdn.com/servicetax-131226102128-phpapp02/85/Service-tax-5-320.jpg)

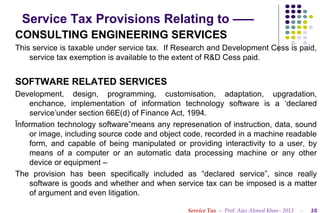

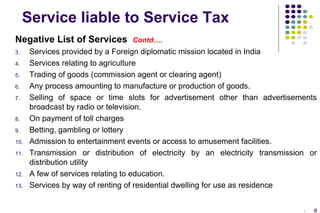

![Service Tax Valuation u/s 67

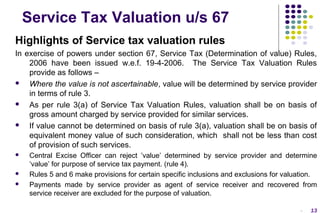

Valuation

Situation

Value

Where total consideration is monetary Taxable value = Gross Amount charged exclusive

consideration

of Service Tax.

Where consideration is in kind (ie.,

non-monetary consideration)

Taxable value = Monetary Equivalent of “nonmonetary consideration”.

• Wholly in kind

Rule 3 of Service Tax Valuation Rules 2006

Method -1 Taxable Value = GAC by service

provider for similar service provided to third party.

•Partly in Kind

Where consideration is “notquantifiable”

Method-2:

Taxable Value = [Monetary

consideration + Mkt Value of Non-monetary

consideration]

{but it shall not be less than the cost of provisioning

of service.

Taxable Value = Value determined in prescribed

manner. Nor manner is prescribed so far – but is

practically best judgment assessment.

-

14](https://image.slidesharecdn.com/servicetax-131226102128-phpapp02/85/Service-tax-14-320.jpg)