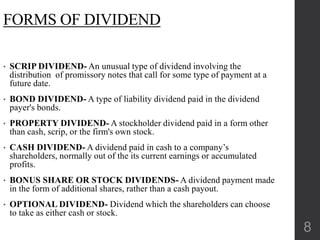

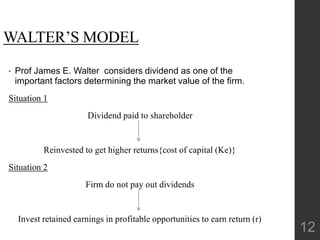

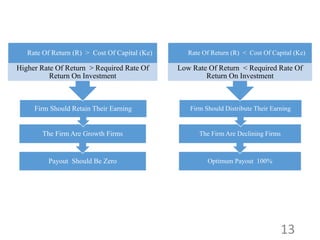

This document discusses dividend decisions and various dividend theories. It begins by defining dividends and explaining their significance for shareholders and companies. It then discusses different dividend theories, including Walter's model, Gordon's model, and the Modigliani-Miller irrelevance theory. Walter's model proposes that the optimal dividend payout depends on a company's growth rate and cost of capital. Gordon's model expresses stock price as a function of dividends, retention rate, and growth rate. The Modigliani-Miller theory argues that dividend policy does not affect firm value under certain assumptions. The document also provides a summary of Reliance Industries' dividend announcements and payments over five years.