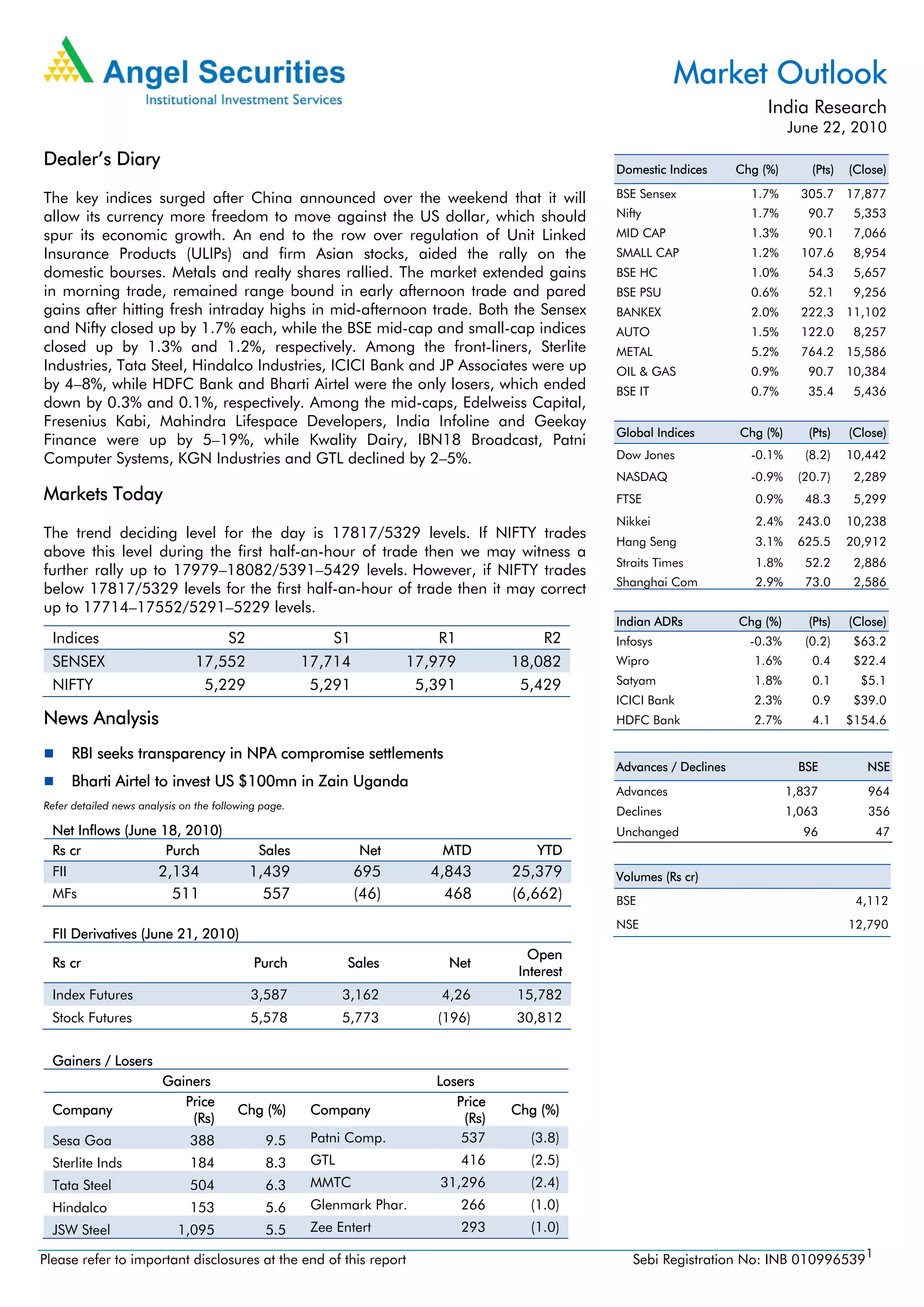

The key Indian indices surged by around 1.7% after China announced it would allow more flexibility in its currency. Metals and realty stocks rallied. The RBI directed banks to make NPA compromises in a transparent manner and express concerns about differing settlement amounts. Bharti Airtel plans to invest $100 million in expanding its network in Uganda over the next two years following its acquisition of Zain's Africa assets.