Market Outlook - September 20, 2010

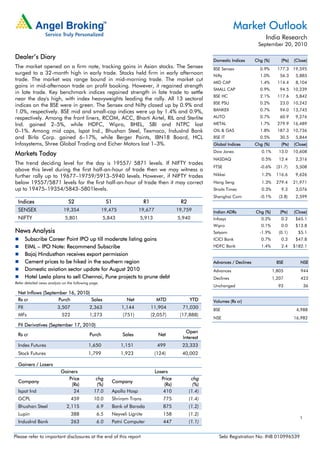

- 1. Market Outlook India Research September 20, 2010 Dealer’s Diary Domestic Indices Chg (%) (Pts) (Close) The market opened on a firm note, tracking gains in Asian stocks. The Sensex BSE Sensex 0.9% 177.3 19,595 surged to a 32-month high in early trade. Stocks held firm in early afternoon Nifty 1.0% 56.3 5,885 trade. The market was range bound in mid-morning trade. The market cut MID CAP 1.4% 114.4 8,104 gains in mid-afternoon trade on profit booking. However, it regained strength SMALL CAP 0.9% 94.5 10,239 in late trade. Key benchmark indices regained strength in late trade to settle BSE HC 2.1% 117.6 5,842 near the day's high, with index heavyweights leading the rally. All 13 sectoral BSE PSU 0.2% 23.0 10,242 indices on the BSE were in green. The Sensex and Nifty closed up by 0.9% and 1.0%, respectively. BSE mid and small-cap indices were up by 1.4% and 0.9%, BANKEX 0.7% 94.0 13,745 respectively. Among the front liners, RCOM, ACC, Bharti Airtel, RIL and Sterlite AUTO 0.7% 60.9 9,276 Ind. gained 2–5%, while HDFC, Wipro, BHEL, SBI and NTPC lost METAL 1.7% 279.9 16,489 0–1%. Among mid caps, Ispat Ind., Bhushan Steel, Texmaco, IndusInd Bank OIL & GAS 1.8% 187.3 10,736 and Birla Corp. gained 6–17%, while Berger Paints, IBN18 Board, HCL BSE IT 0.5% 30.5 5,844 Infosystems, Shree Global Trading and Eicher Motors lost 1–3%. Global Indices Chg (%) (Pts) (Close) Dow Jones 0.1% 13.0 10,608 Markets Today NASDAQ 0.5% 12.4 2,316 The trend deciding level for the day is 19557/ 5871 levels. If NIFTY trades FTSE -0.6% (31.7) 5,508 above this level during the first half-an-hour of trade then we may witness a further rally up to 19677–19759/5913–5940 levels. However, if NIFTY trades Nikkei 1.2% 116.6 9,626 below 19557/5871 levels for the first half-an-hour of trade then it may correct Hang Seng 1.3% 279.4 21,971 up to 19475–19354/5843–5801levels. Straits Times 0.3% 9.3 3,076 Shanghai Com -0.1% (3.8) 2,599 Indices S2 S1 R1 R2 SENSEX 19,354 19,475 19,677 19,759 Indian ADRs Chg (%) (Pts) (Close) NIFTY 5,801 5,843 5,913 5,940 Infosys 0.2% 0.2 $65.1 Wipro 0.1% 0.0 $13.8 News Analysis Satyam -1.9% (0.1) $5.1 Subscribe Career Point IPO up till moderate listing gains ICICI Bank 0.7% 0.3 $47.8 EIML – IPO Note: Recommend Subscribe HDFC Bank 1.4% 2.4 $182.1 Bajaj Hindusthan receives export permission Cement prices to be hiked in the southern region Advances / Declines BSE NSE Domestic aviation sector update for August 2010 Advances 1,805 944 Hotel Leela plans to sell Chennai, Pune projects to prune debt Declines 1,207 423 Refer detailed news analysis on the following page. Unchanged 93 36 Net Inflows (September 16, 2010) Rs cr Purch Sales Net MTD YTD Volumes (Rs cr) FII 3,507 2,363 1,144 11,904 71,030 BSE 4,988 MFs 522 1,273 (751) (2,057) (17,888) NSE 16,982 FII Derivatives (September 17, 2010) Open Rs cr Purch Sales Net Interest Index Futures 1,650 1,151 499 23,333 Stock Futures 1,799 1,923 (124) 40,002 Gainers / Losers Gainers Losers Price chg Price chg Company Company (Rs) (%) (Rs) (%) Ispat Ind 24 17.0 Apollo Hosp 410 (1.4) GCPL 459 10.0 Shriram Trans 775 (1.4) Bhushan Steel 2,115 6.9 Bank of Baroda 875 (1.2) Lupin 388 6.5 Neyveli Lignite 158 (1.2) 1 IndusInd Bank 263 6.0 Patni Computer 447 (1.1) Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Market Outlook | India Research Career Point IPO: Recommend Subscribe IPO details: Career Point Infosystem (CPIL), a Kota-based tutorial services company, is coming out with its IPO for Rs115cr through fresh issue of 0.37cr–0.39cr shares in the price band of Rs295–310/share. The issue proceeds would be utilised for the construction and development of an integrated campus facility, expansion of classroom and office facilities and acquisition and strategic initiatives. A mammoth target market: CPIL services the country’s formal and informal education markets. In case of the informal market, the company provides tutorial services to high school and post-high school students for various competitive exams such as AIEEE, IIT-JEE, AIPMT and AIPDT. The number of students appearing for these competitive exams is rising at a scorching pace, despite subdued increase in the number of seats. We expect demand for these services will remain upbeat, considering that India is more of a services economy (53% to GDP) and the population aged below 14 composes one-third of the total population. In the first four months of FY2011, the enrollment in CPIL for IIT-JEE, AIEEE and AIPMT stood robust and almost comparable to the full year enrollment number of FY2010. Hence, we expect the company to continue its growth momentum on the back of strong volume growth. Valuation and outlook: CPIL reported a strong 28% CAGR in its revenue over FY2007–10, with good profitability growth in EBITDA (11% CAGR) and PAT (14% CAGR). On the back of strong enrollment in the first four months of FY2011, we are confident that CPIL will continue its growth momentum. The setting up of a campus facility from the net proceeds of the IPO will make the company’s business model asset heavy, thereby diluting the company’s return ratios. At the higher end of the price band i.e., Rs310/share, the stock’s implied trailing P/E would be ~25.2x FY2010 EPS. We recommend SUBSCRIBE on this IPO, up till moderate listing gains. September 20, 2010 2

- 3. Market Outlook | India Research EIML IPO Note: Recommend Subscribe IPO Details: Eros International Media (EIML) is making a Rs350cr IPO with a price band of Rs158–175/share, resulting in a public issue of 2.0cr and 2.2cr equity shares with a face value Rs10, resulting in promoter shareholding dilution of 22% and 24% at the upper and lower price band, respectively. The company plans to use the IPO proceeds for acquiring and co-producing Indian films, primarily Hindi language films as well as certain Tamil and other regional language films. The company has already deployed ~Rs54cr towards Hindi and Marathi film projects as on July 31, 2010. However, no funds have been deployed for Tamil films EIML has a proven track record of robust growth both on the top-line and bottom–line fronts. Going forward, we estimate the company to record revenue and earning CAGR of ~21% and ~29% respectively, over FY2010–12E. At the upper price band of Rs175, EIML is available at 19.4x FY2010 fully diluted EPS of Rs9, which we believe is reasonable given: 1) valuable and diversified content library of over 1,000 titles, 2) de-risked business model–co-productions and acquisition, 3) promising movie pipeline (including 8 big-budget Hindi language films), 4) proven execution skills (has successfully released Om Shanti Om, Love Aaj Kal and Karthik Calling Karthik, among others), and 5) derives synergistic advantages from parent Eros plc. We have valued EIML at 9x EV/EBITDA and 25% discount to UTV Software, as it is a pure play on movie production/distribution, while UTV Software is a diversified entertainment conglomerate. We have arrived at a fair value of Rs203, translating into ~16% upside from the upper price band. Hence, we recommend a Subscribe view to the IPO. Key risks to our recommendation: 1) Relative success of films at the box-office, 2) any delay in the release of a film, 3) failure in effectively exploiting film content in the international market, 4) high dependence on maintenance of IPR/piracy, and 5) inexperience in movie production. Bajaj Hindusthan receives export permission Bajaj Hindusthan (BJH) has received the government’s permission to export 200,000tonnes of raw sugar. This indicates the improving domestic demand–supply situation. Internationally, raw sugar prices have risen by 71% from the bottom of 14cents/pound to 24cents/pound. The price increase was driven by the expected lower international production, except India for SY2011. Although, the current raw futures are trading at 24cents/pound, forward nine-month (SY2011) averages are at 22cents/pound, which translate into approximately Rs22/kg. We have assumed realization of Rs24/kg for free sale sugar for BJH; hence, we believe current export would not add substantially to profit. At the current price, the stock is trading at 1.1 SY2011 EV/IC (enterprise value to invested capital), we maintain our Neutral rating on the stock. September 20, 2010 3

- 4. Market Outlook | India Research Cement prices to be hiked in the southern region As per media reports, cement prices are expected to be hiked across the southern region, with effect from September 20, 2010. Our independent dealer check has also revealed that the price hike in the range of Rs30 per 50kg bag is likely. Post this hike, price is expected to be at Rs260 per bag in Chennai and around Rs200 per bag in Hyderabad. The price hike if enforced will be the second hike within a fortnight, as cement manufacturers in the region had carried out a price hike in the Rs35–45 range, with effect from September 7, 2010, to minimise their losses as prices in the region, especially Andhra Pradesh, had fallen close to the cost of production. The pricing pressure has been severe in the region, as it has suffered due to over capacity and a decline in demand. The southern region witnessed the highest capacity addition of 18mtpa over the last 15 months, which accounted for close to 30% of the all-India capacity addition during the period, resulting in over capacity. Demand in the major cement consuming state of Andhra Pradesh has slowed down due to lower off-take from the housing and infrastructure sectors and reduced government spending. The intensification of monsoon has also affected construction activities. Further, the rise in coal and diesel prices and frequent power cuts in Andhra Pradesh have led to cost pressure and negative EBITDA for the companies. All these factors have lead to a second price hike within a fortnight. We feel the price hike is not sustainable and, thus, expect price correction of Rs10–15 per bag in the next few days. We maintain Buy on India Cements and Madras Cements with a Target Price of Rs139, due to their attractive valuations. We maintain Buy on JK Lakshmi Cement with a Target Price of Rs92 and remain Neutral on ACC and Ambuja Cements. Domestic aviation sector update for August 2010 Domestic passenger traffic witnessed growth for the eight consecutive month, but decreased by 2.3% month-on-month to 39.9lakh (40.8lakh) passengers in August 2010. From January 2010 to August 2010, passenger traffic grew by robust 19.3% yoy to 339.1akh (284.2lakh) passengers. In August 2010, SpiceJet witnessed a 12.4% yoy increase in domestic passenger traffic to 5.02lakh (4.5lakh), becoming the fifth largest carrier in the domestic market behind Kingfisher (7.97lakh), Jet Airways (7.79lakh), Air India (7.3lakh) and Indigo (6.56lakh). The industry’s overall load factor witnessed a month-on-month decline in August, primarily due to active monsoons in various parts of the country. During the month, load factors for SpiceJet, Jet Airways and IndiGo declined to 70.3%, 70.4% and 73.2%, respectively. Kingfisher and Air India reported a month-on-month increase in load factors at 80.9% and 65.5%, respectively. At the end of the month, market shares of the major industry players stood at 18.3% for Air India (Domestic), 19.5% for Jet Airways, 7.5% for JetLite, 20.0% for Kingfisher, 12.6% for SpiceJet, 5.7% for GoAir and 16.4% for IndiGo. We continue to maintain a Neutral rating on SpiceJet. September 20, 2010 4

- 5. Market Outlook | India Research Hotel Leela plans to sell Chennai, Pune projects to prune debt Hotel Leela is looking to cash in on the growing real estate market in Chennai, as it plans to partly sell and lease its Leela IT Park in Chennai. The property, spread across 2.75 lakh sq. ft. located in Adyar, is expected to fetch Rs275cr–300cr for the company. The deal for partial sale of the property is expected to be finalised in a month. Moreover, the company has decided not to have a hotel in Pune and instead develop the land for a residential complex. Earnings from that initiative, which could be worth Rs250cr, will also be used to clear debt. The moves would enable the company reduce its debt of Rs2,600cr by Rs550cr–600cr. We believe these initiatives to have a positive impact on the financials of the company, considering the existing high debt on its books. We maintain our Neutral rating on the stock. Economic and Political News Govt. to give diesel subsidy to drought-hit farmers, says Pawar Govt. raises DA to 45%, to cost exchequer Rs9,303cr p.a. India infrastructure boom to boost world growth, says Montek Singh Sugar production may be over 22mn–23mn tonnes in 2010–11, says Pawar US poverty rate hits 15-year high Corporate News IPOs of insurance companies likely before March 2011: CARE Essar ties-up US $1bn for Minnesota operation HPCL eyeing oil blocks in Africa Source: Economic Times, Business Standard, Business Line, Financial Express, Mint September 20, 2010 5

- 6. Market Outlook | India Research Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 September 20, 2010 6