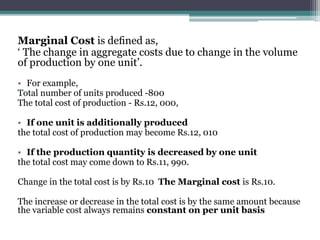

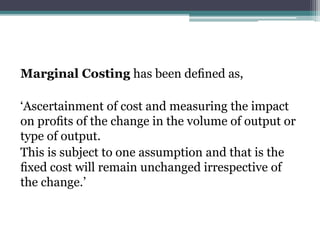

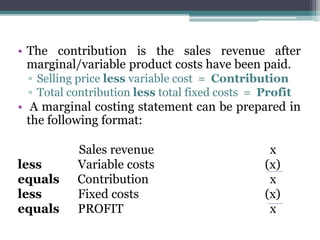

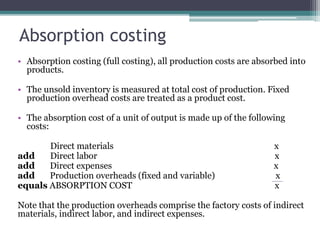

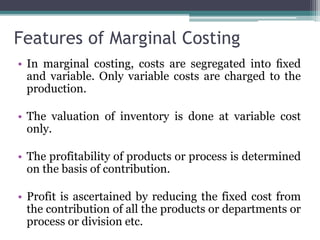

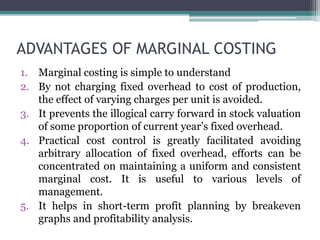

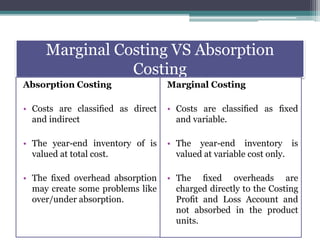

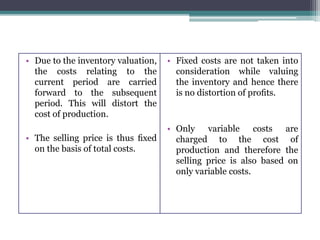

Marginal costing focuses on the change in costs due to fluctuations in production volume, emphasizing variable costs while treating fixed costs as constant. It aids in short-term decision-making by calculating the contribution margin, which is sales revenue minus variable costs, and ultimately determines profit. In contrast, absorption costing allocates all production costs to products, valuing unsold inventory at total cost, which can lead to issues like over/under absorption.