Marginal costing is a technique that differentiates between fixed and variable costs. It considers only variable costs for decision making purposes. Some key points:

- Marginal cost is the cost of producing one additional unit of output and includes any additional variable costs.

- Marginal costing focuses on contribution, which is the amount of sales remaining after deducting variable costs. Contribution helps cover fixed costs and determine profit.

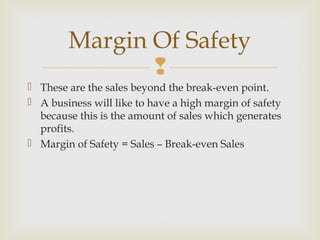

- Important ratios in marginal costing include contribution ratio, break-even point, and margin of safety. These ratios help management with decision making and performance evaluation.

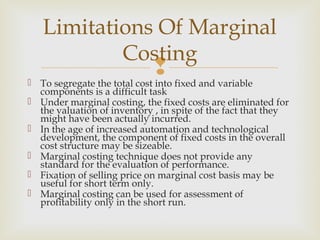

- While marginal costing is useful for short-term decisions, it has limitations such as the difficulty in segreg