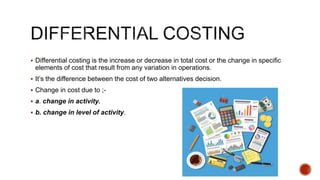

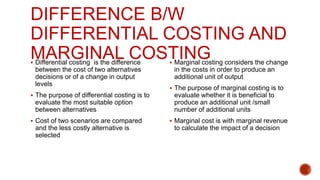

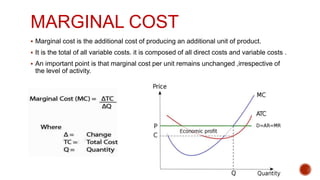

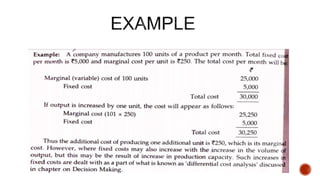

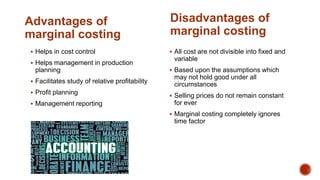

The document discusses different costing techniques including absorption costing, marginal costing, and differential costing, highlighting their advantages and disadvantages. Absorption costing includes both fixed and variable costs in product costs, while marginal costing only accounts for variable costs, impacting inventory valuation and decision-making processes. Differential costing compares costs between alternatives to facilitate better decision-making regarding resource allocation.

![TRADITIONAL/CONVENTIONAL/

FULL COSTING

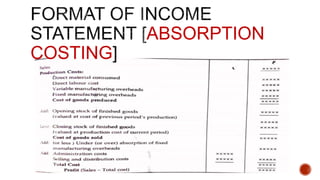

This is a total cost technique under which total cost [i.e. fixed cost as well as variable cost] is

charged as production cost.

In other words the absorption costing ,all manufacturing cost are absorbed in the cost of the

products produced .

In this system the factory overhead are absorbed on the basis of a predetermined overhead

rates , based on normal capacity.

Absorption costing approach is same as used in cost sheet](https://image.slidesharecdn.com/marginalcosting-230805070240-c58ec22f/85/marginal-costing-pptx-2-320.jpg)

![VARIABLE COSTING

/DIRECT COSTING

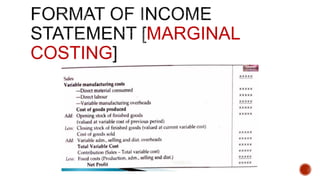

An alternative to absorption costing is marginal costing .

Under this technique only variable costs are changed as product costs and included in

inventory valuation.

Fixed manufacturing costs are not allowed to products but are considered as sand

thus charged directly to profit and loss account of the year.

Fixed cost also do not enter in stock valuation.

Both absorption costing an marginal costing treat on manufacturing costs [i.e.

administration, selling and distribution overheads ]as periods costs.](https://image.slidesharecdn.com/marginalcosting-230805070240-c58ec22f/85/marginal-costing-pptx-6-320.jpg)

![DIFFERENCE B/W ABSORPTION

COSTING AND MARGINAL

COSTING

Total cost [ fixed and variable ] is

charged to the cost of products

Fixed cost is included in the cost of

products

Opening and closing stocks are valued

at total cost which includes fixed as

well as variable cost

Profitability is measured by profit

earned by various products or

departments

Only variable cost is charged to

products

Fixed cost is not included in the cost of

products

Stocks are valued only at variable

costs

Profitability is judged by the

contribution made by the various

products and departments](https://image.slidesharecdn.com/marginalcosting-230805070240-c58ec22f/85/marginal-costing-pptx-8-320.jpg)