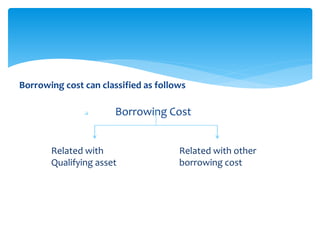

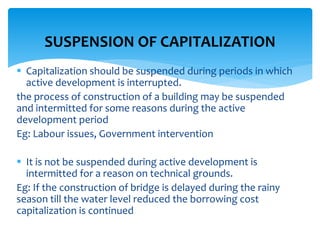

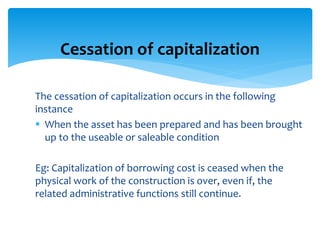

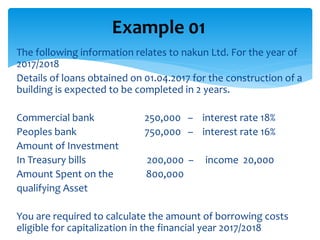

Borrowing costs eligible for capitalization include interest and other costs incurred from funds borrowed for construction or production of a qualifying asset. A qualifying asset is one that takes a substantial period of time to get ready for use or sale. Borrowing costs, such as interest expenses, directly attributable to a qualifying asset form part of the asset's cost. Other borrowing costs are recognized as expenses. The capitalization of borrowing costs begins when expenditures are incurred for the asset, borrowing costs are incurred, and activities necessary to prepare the asset are undertaken. Capitalization continues during active development of the asset and ceases when the asset is substantially ready for use or sale.