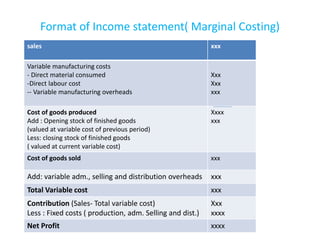

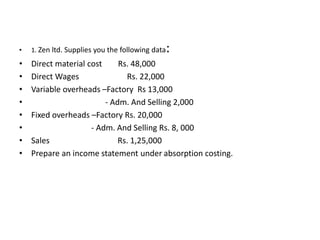

Here is the income statement for Zen Ltd under absorption costing:

Sales Rs. 1,25,000

Cost of Production:

Direct Material Rs. 48,000

Direct Wages Rs. 22,000

Variable Overheads:

Factory Rs. 13,000

Adm and Selling Rs. 2,000

Fixed Overheads:

Factory Rs. 20,000

Adm and Selling Rs. 8,000

Total Cost of Production Rs. 1,13,000

Profit Rs. 12,000