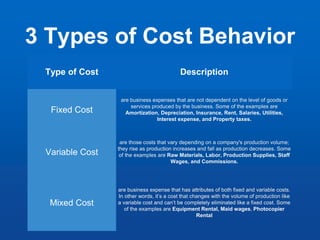

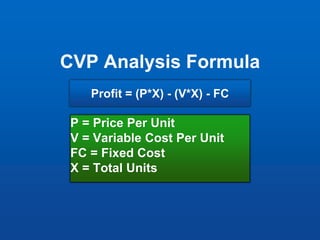

This document discusses various managerial accounting concepts related to cost behavior analysis, decision making, and pricing strategies. It defines three types of cost behavior - fixed costs that do not vary with production, variable costs that vary with production, and mixed costs that have attributes of both. Decision making concepts covered include make-or-buy, keep-or-drop, special order pricing, and product mix decisions. Cost-volume-profit analysis and relevant costing are also summarized. Finally, different pricing strategies such as cost-based pricing, value-based pricing, and strategic pricing are defined.