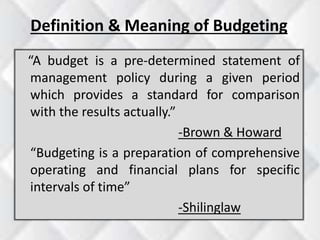

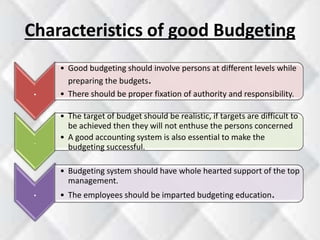

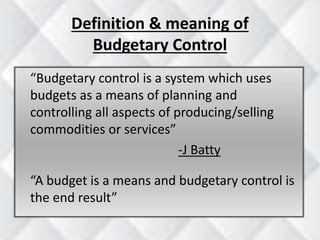

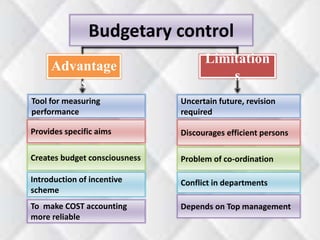

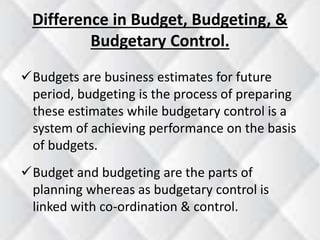

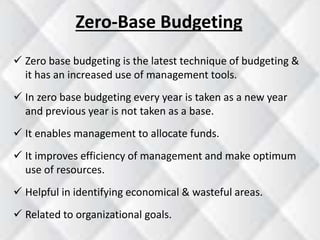

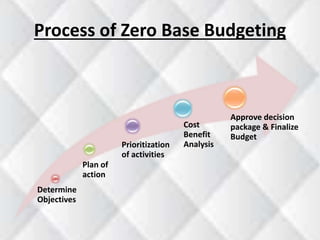

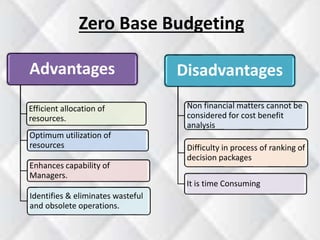

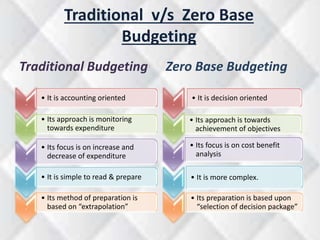

The document discusses budgeting and budgetary control, defining budgeting as a pre-determined management policy and budgetary control as a system that utilizes budgets for planning and controlling operations. It outlines the characteristics of effective budgeting, essentials for budgetary control, and the difference between traditional and zero-based budgeting. Additionally, it highlights the advantages and limitations of budgetary control, emphasizing its role in performance measurement and resource allocation.

![Contents

• Budgeting [characteristics]

• Budgetary control

• Difference in budget, budgeting, budgetary control

• Essentials in budgetary control

• Requisites for budgetary control system

• Merits & limitations

• Zero-based budgeting

• Difference in Traditional & Zero based budgeting.](https://image.slidesharecdn.com/budgetingbudgetarycontrol-140910123149-phpapp02/85/Budget-Budgeting-budgetary-control-2-320.jpg)