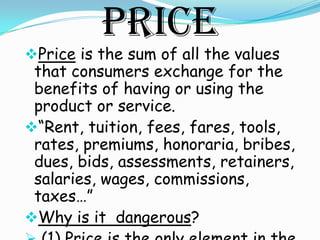

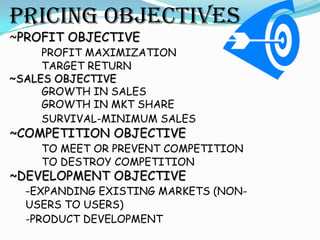

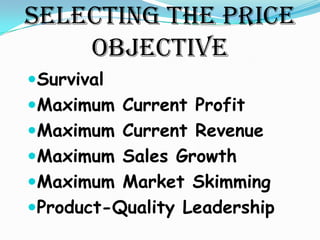

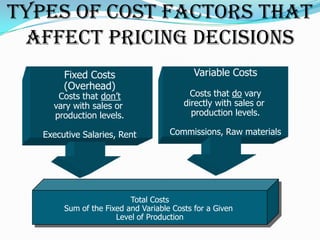

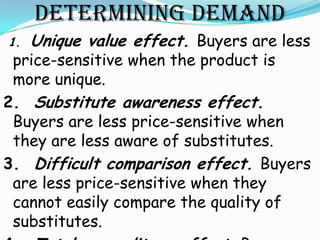

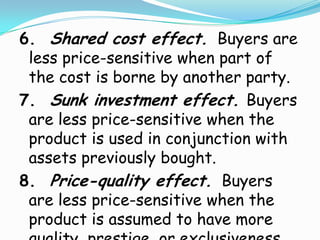

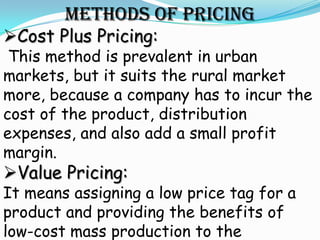

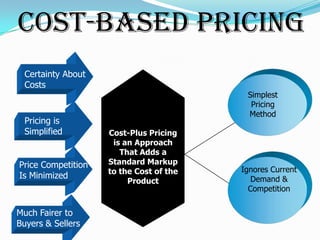

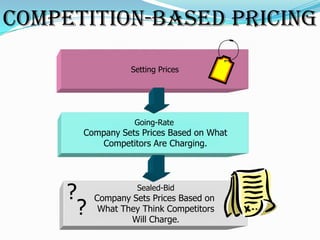

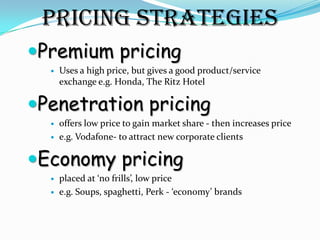

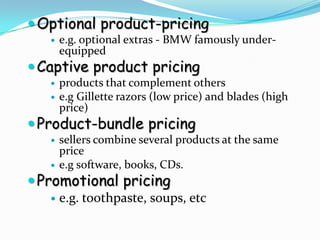

This document discusses pricing concepts including price, pricing objectives, factors affecting pricing decisions, determining demand, methods of pricing, and pricing strategies. It defines price and lists common pricing objectives like profit maximization, sales growth, and competition. It outlines internal factors like marketing objectives and external factors like costs that influence pricing decisions. It describes methods for determining demand and different approaches to setting prices including cost-based pricing, competition-based pricing, and various pricing strategies.