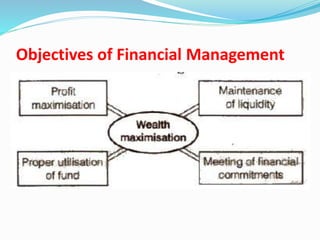

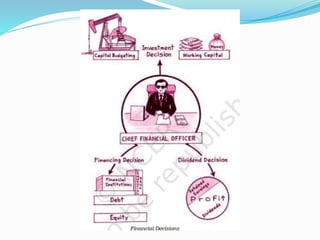

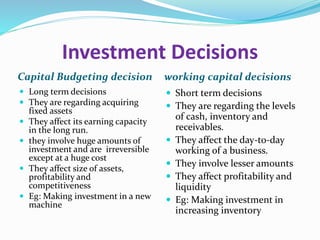

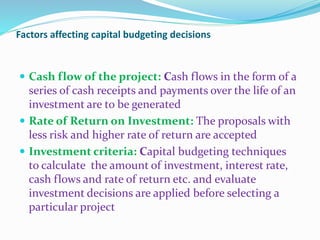

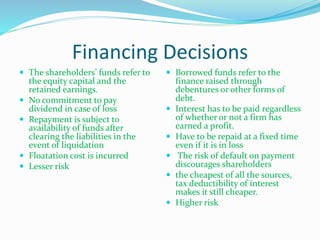

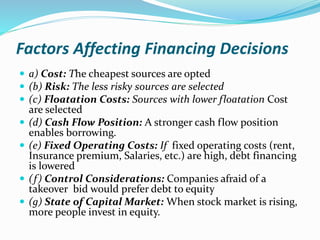

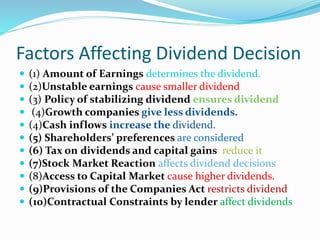

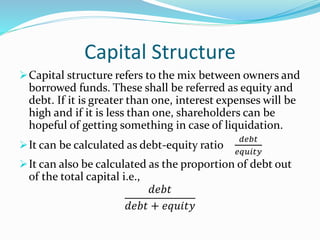

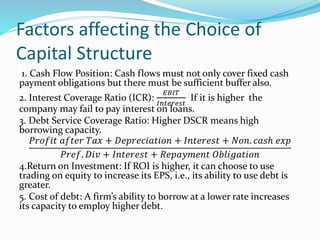

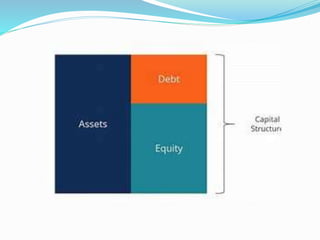

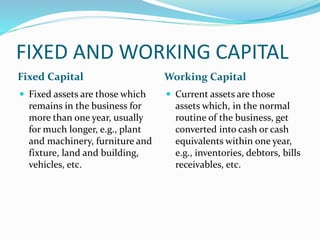

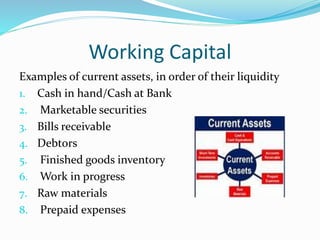

Business finance refers to the money required to establish, operate, expand or diversify a business. It is needed to acquire both tangible and intangible assets. Financial management involves optimally procuring and using finance at the lowest possible cost. Its aims include minimizing funding costs, managing risk, and ensuring adequate funds are available as needed. Financial decisions include investment, financing, and dividend decisions. Investment decisions involve allocating funds to fixed assets or working capital. Financing decisions concern raising equity or debt. Dividend decisions determine how much profit to distribute versus retain.