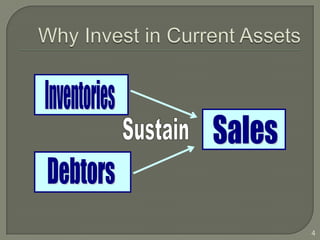

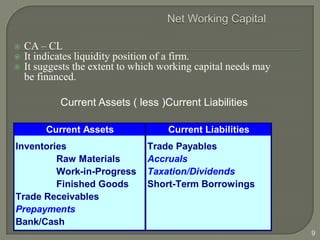

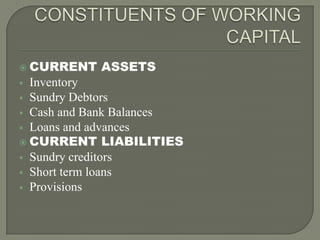

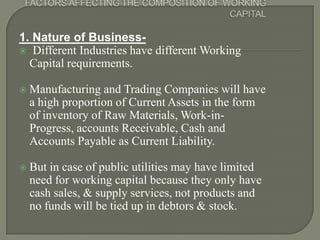

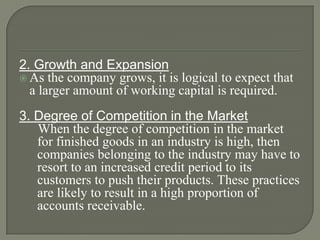

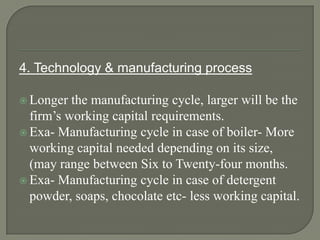

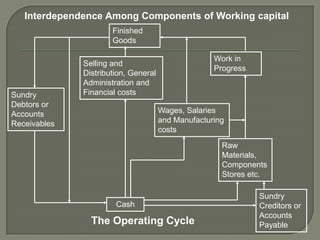

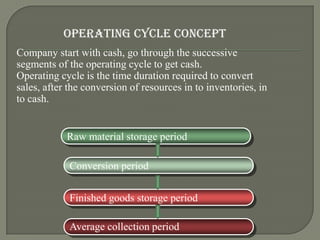

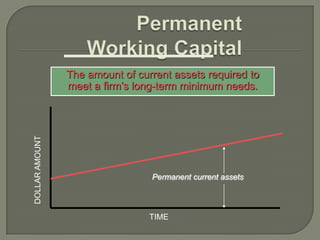

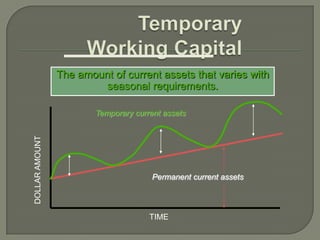

This document discusses working capital and its components. It defines working capital as the capital required to finance short-term operating needs such as inventory, accounts receivable, and cash. It also discusses the operating cycle as the continuous flow of cash being converted into inventory, then receivables, and back into cash. Finally, it notes that companies must determine the optimal level of working capital to support operations without having excess funds tied up in current assets.