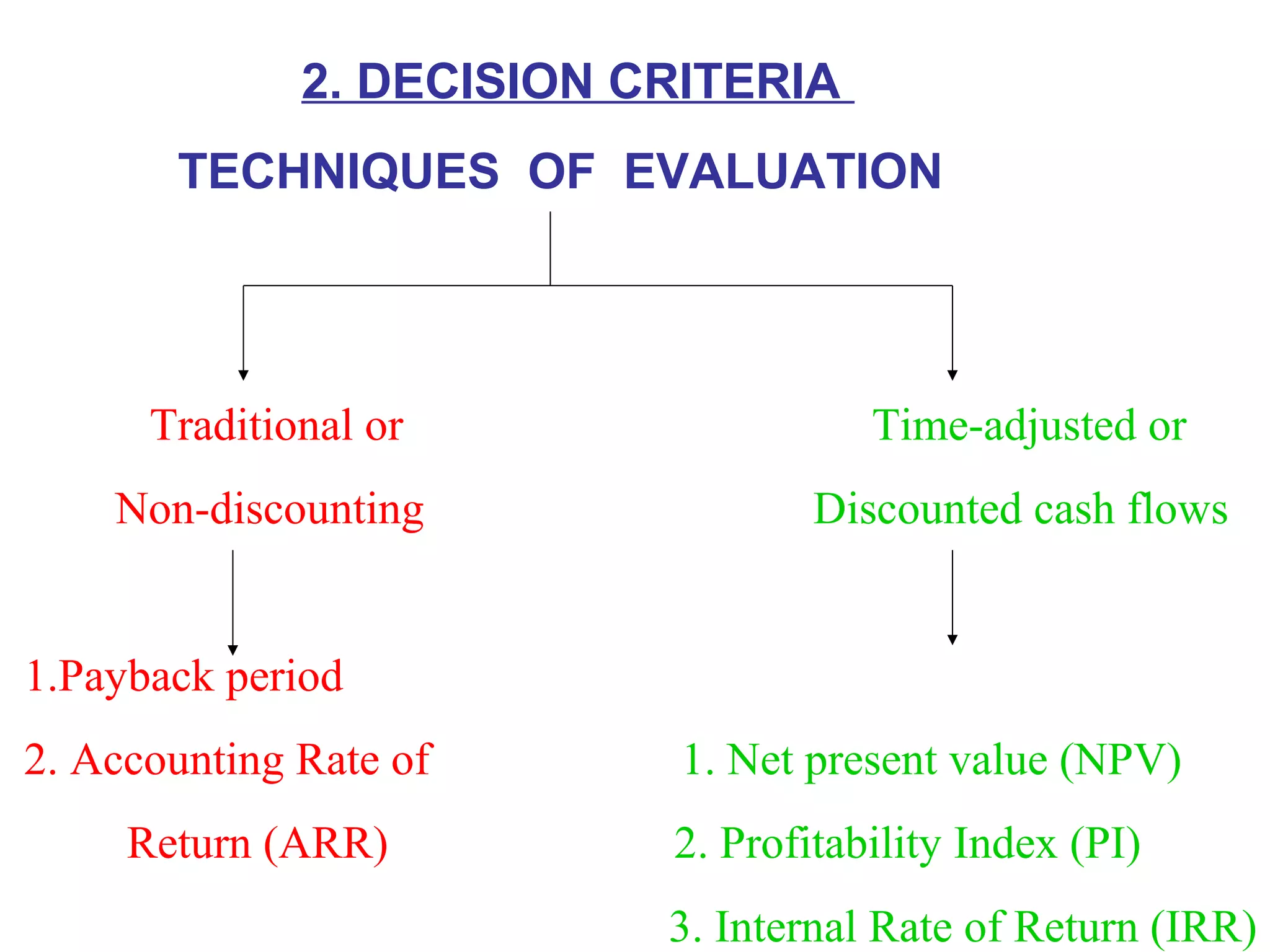

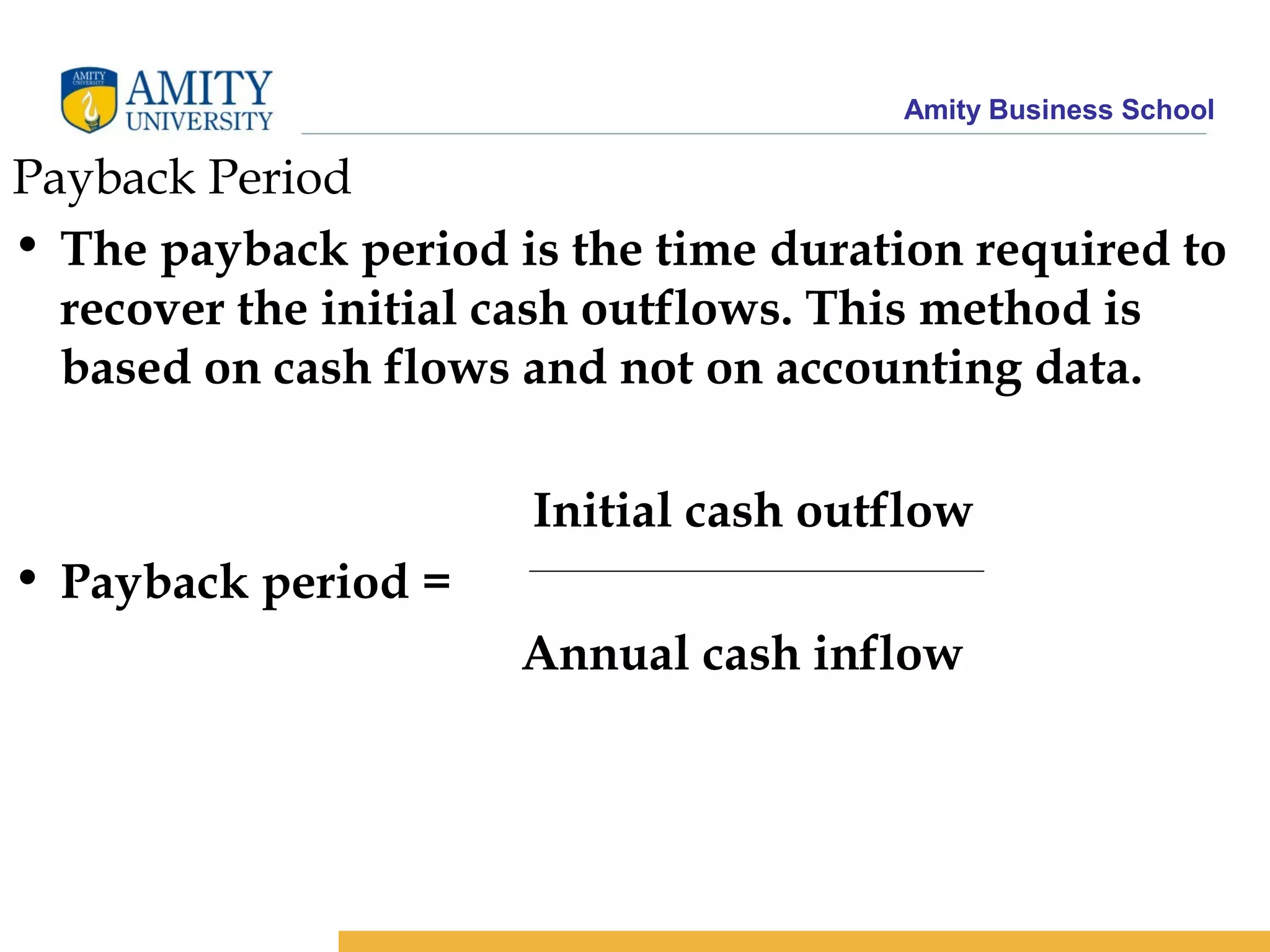

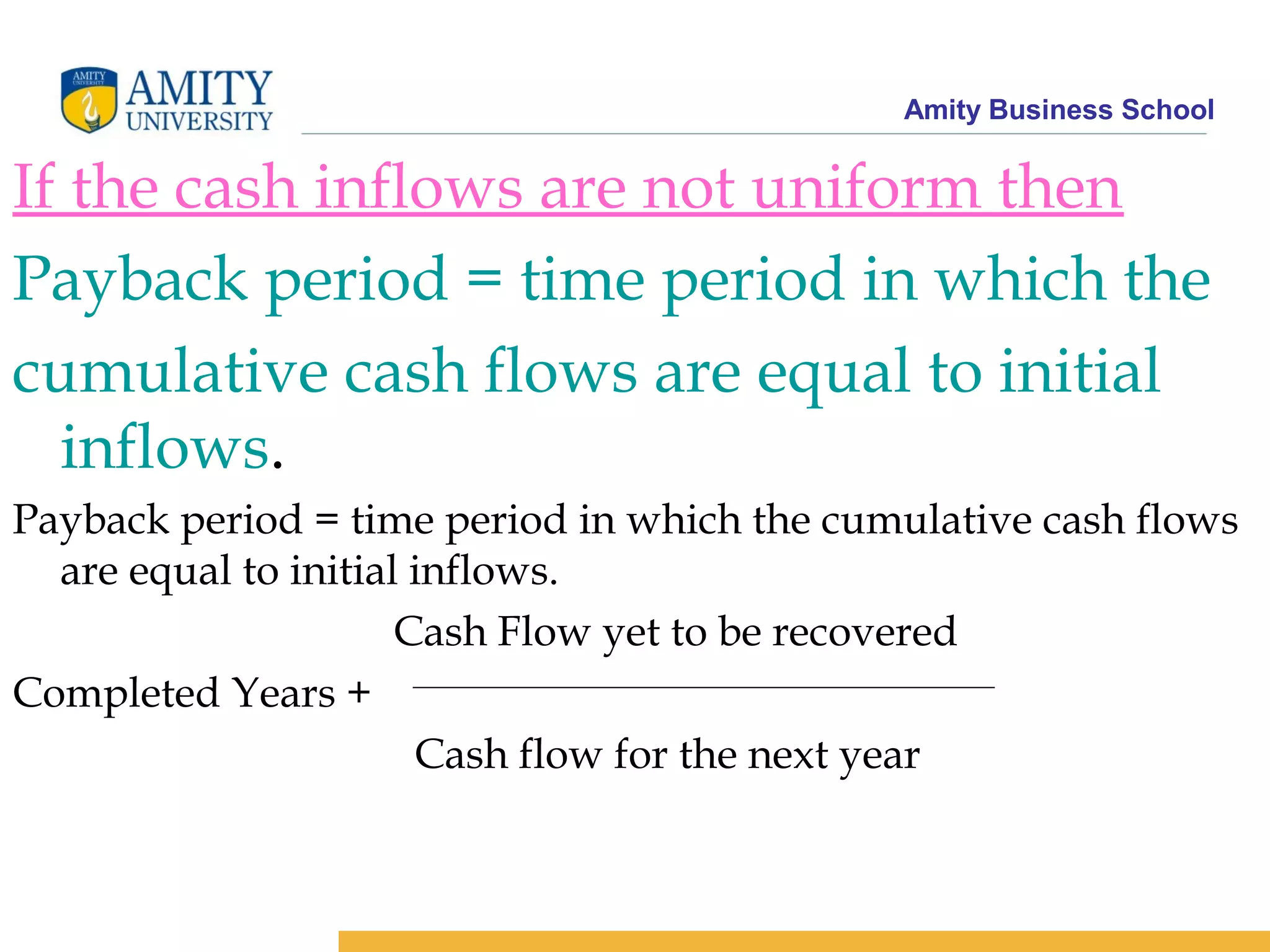

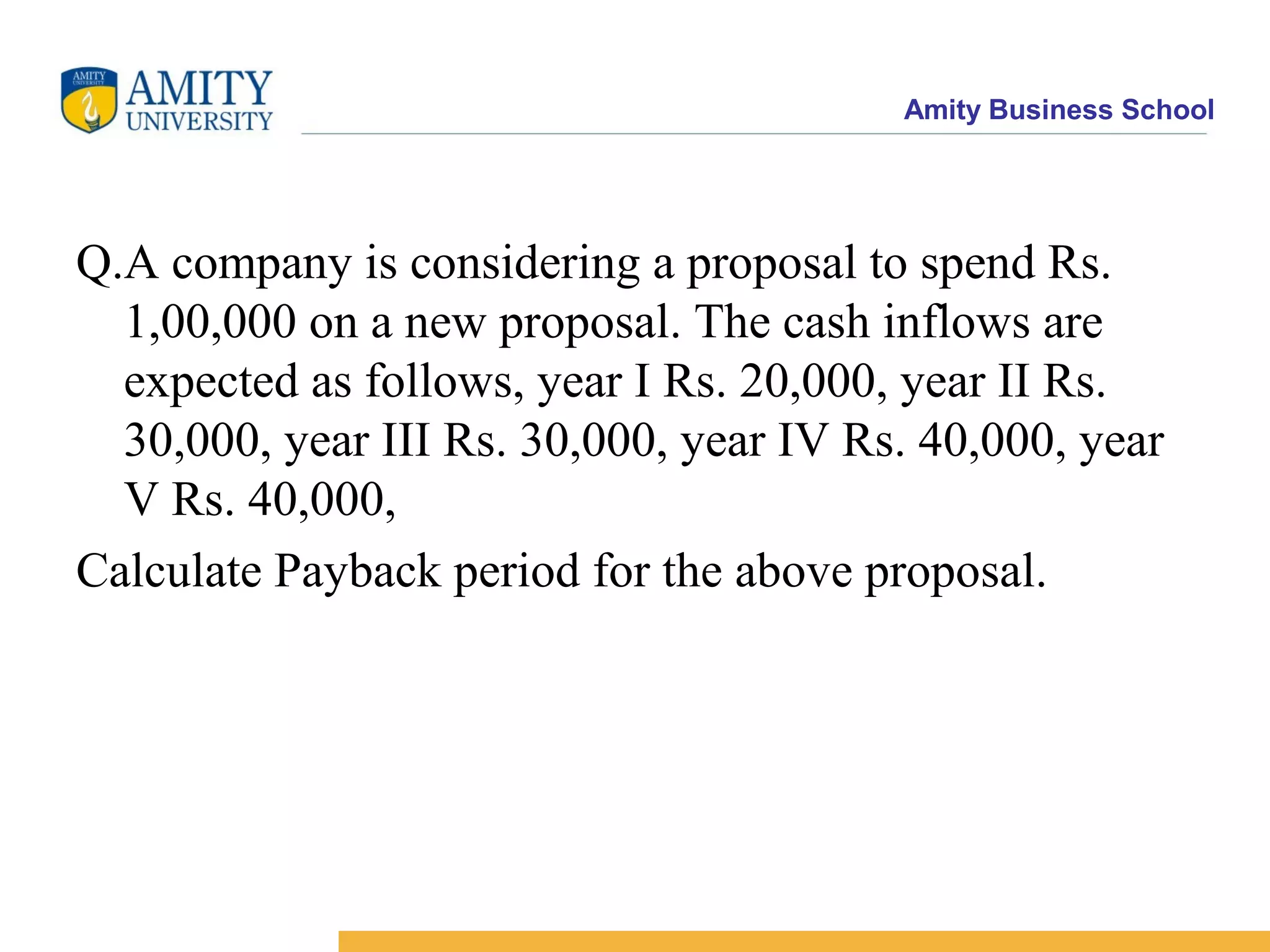

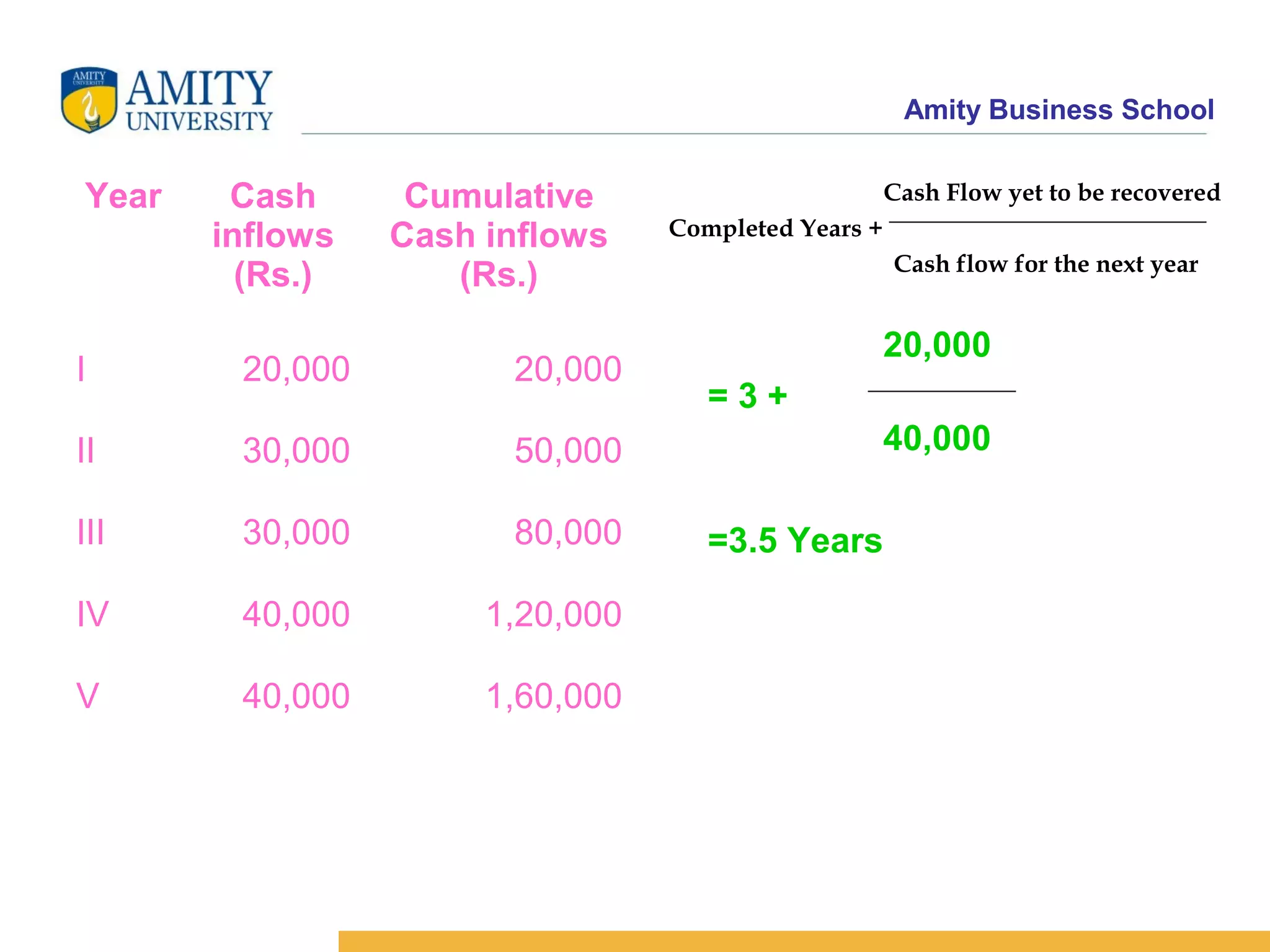

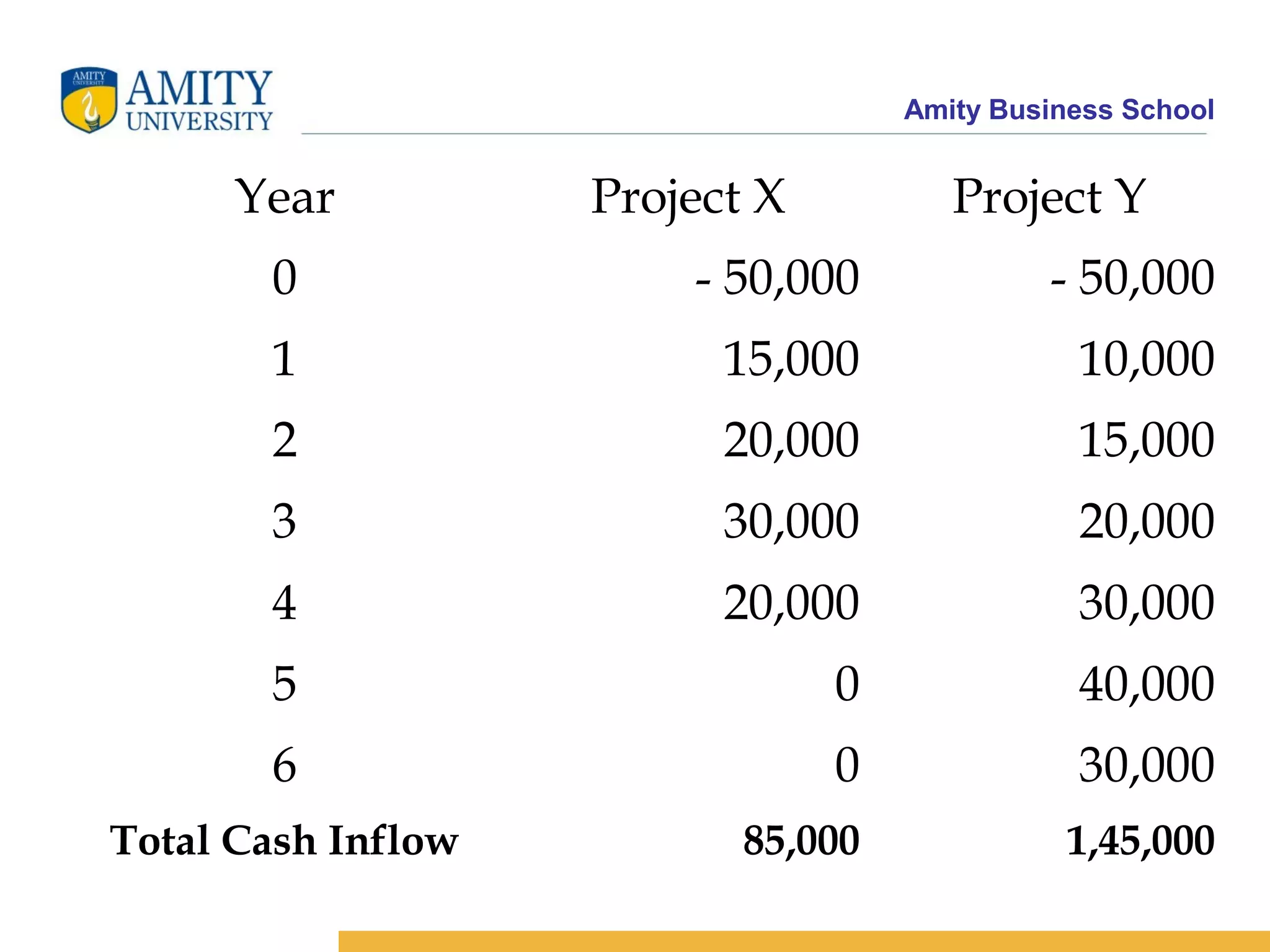

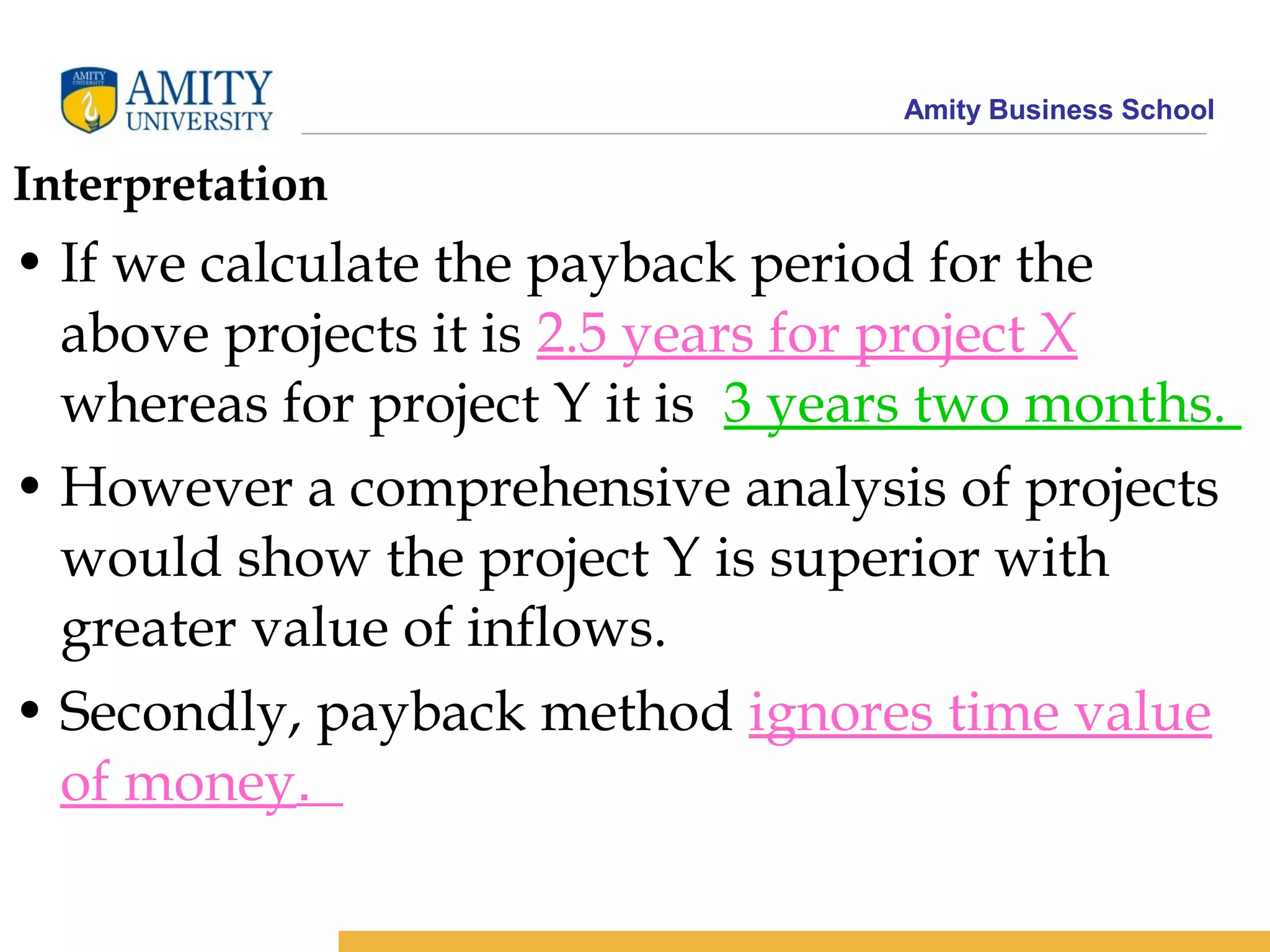

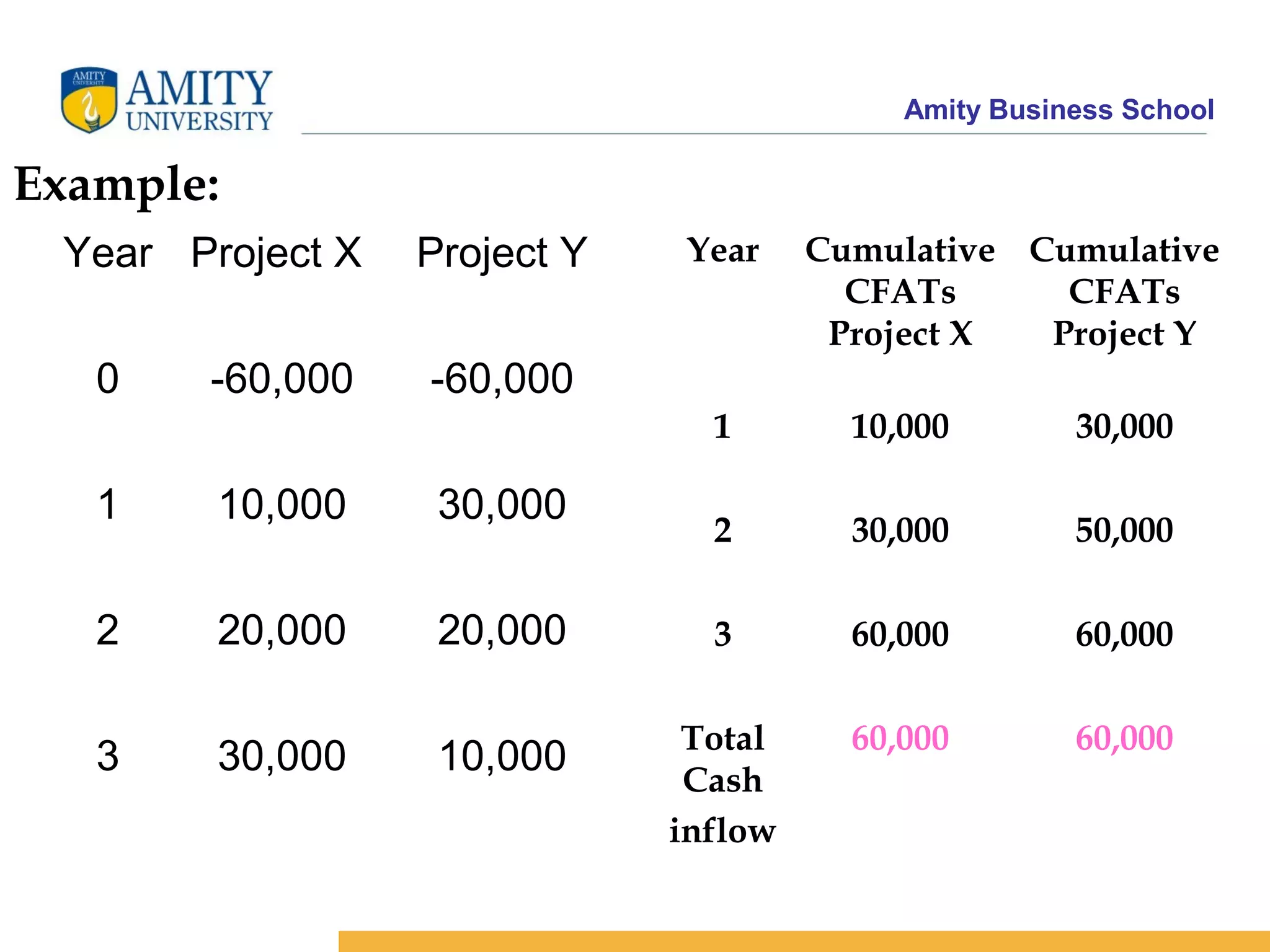

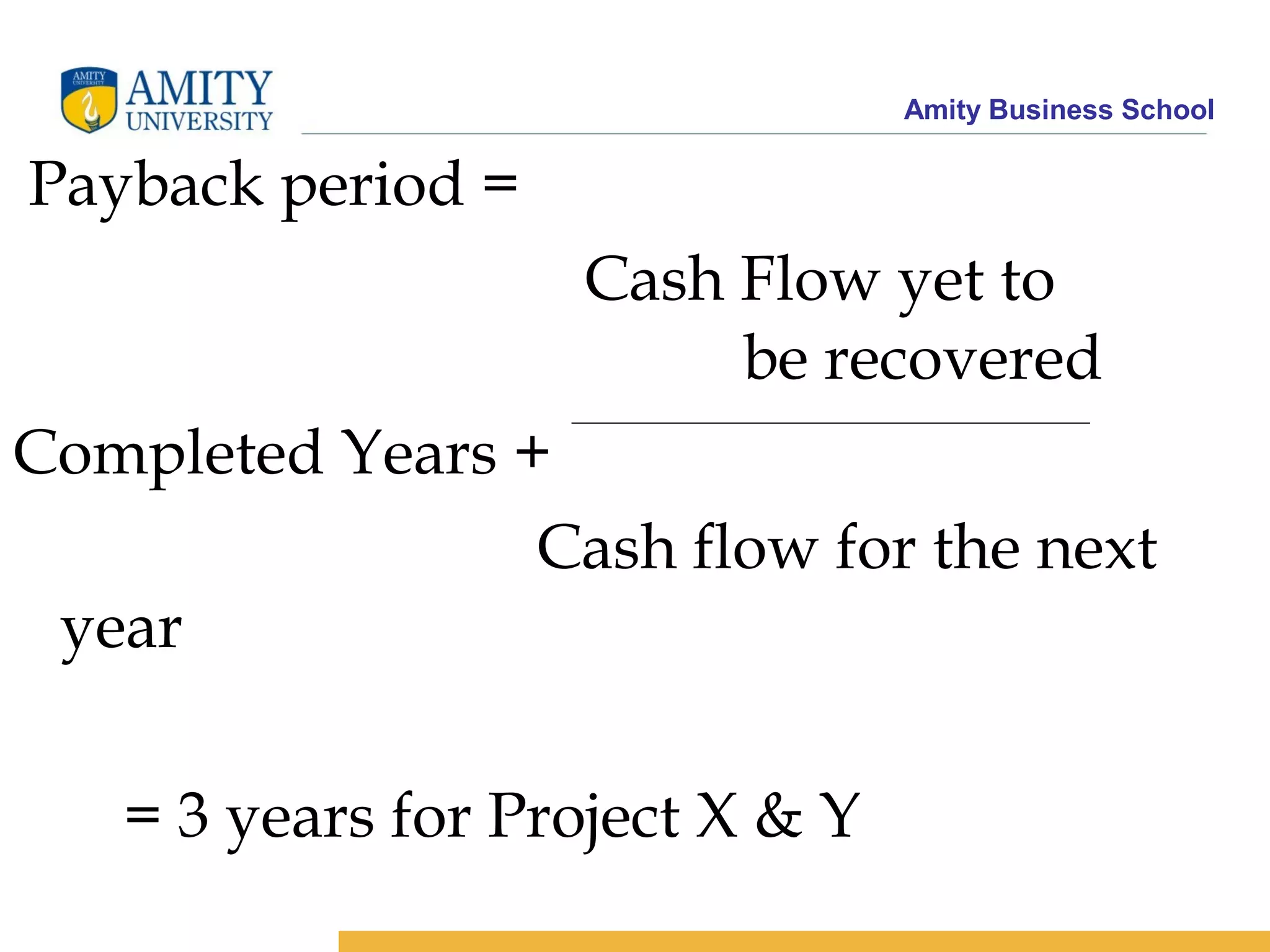

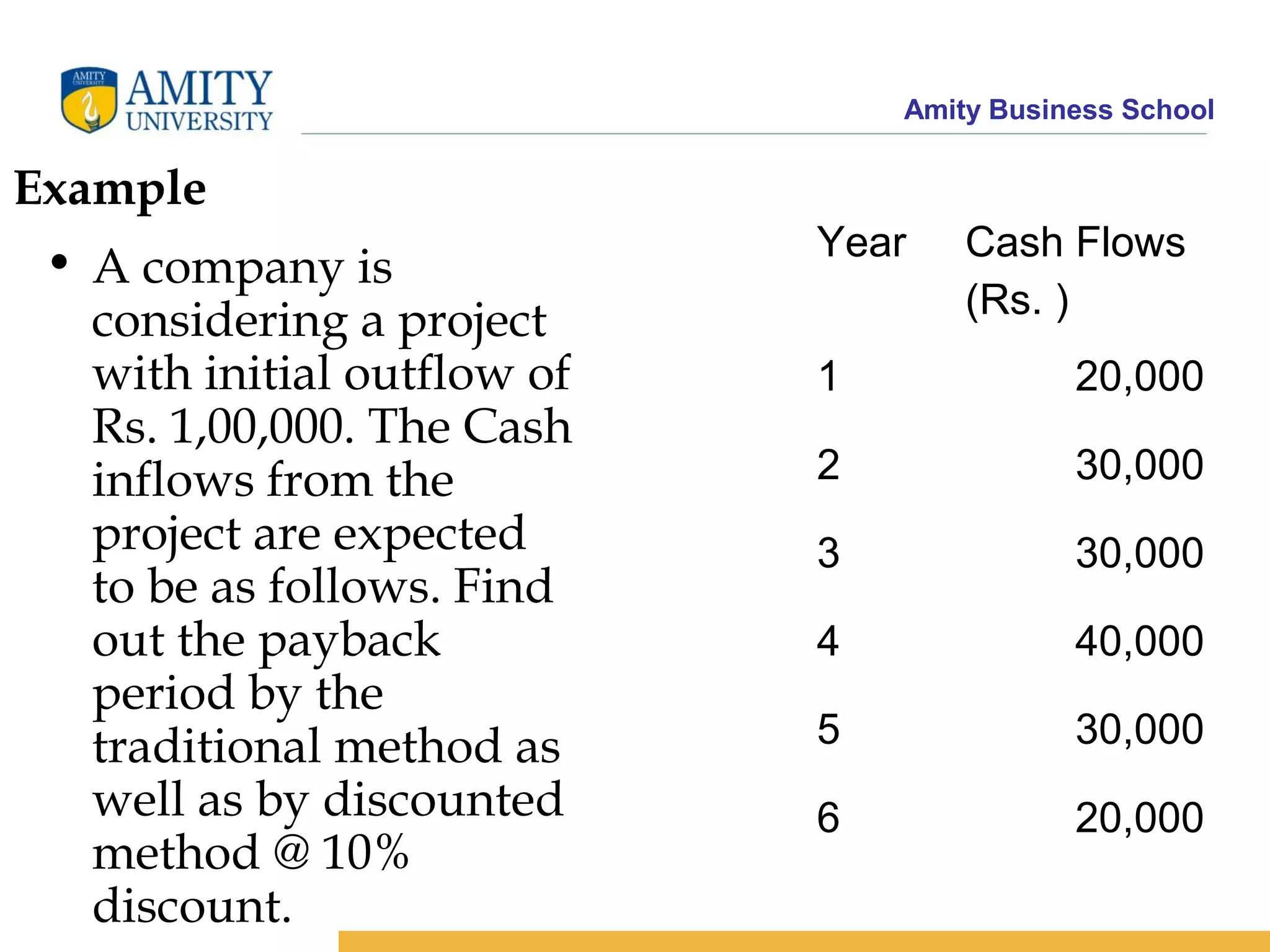

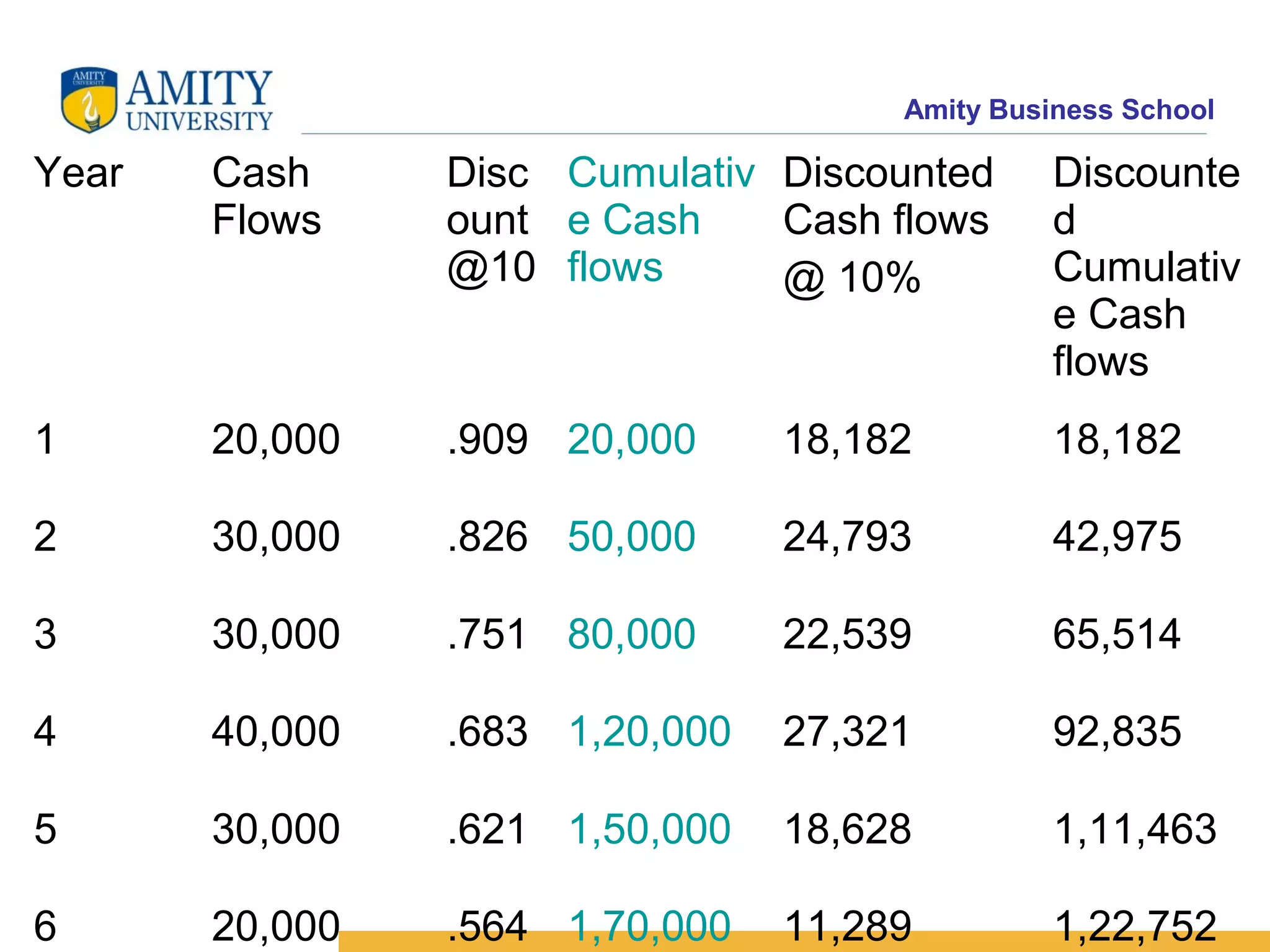

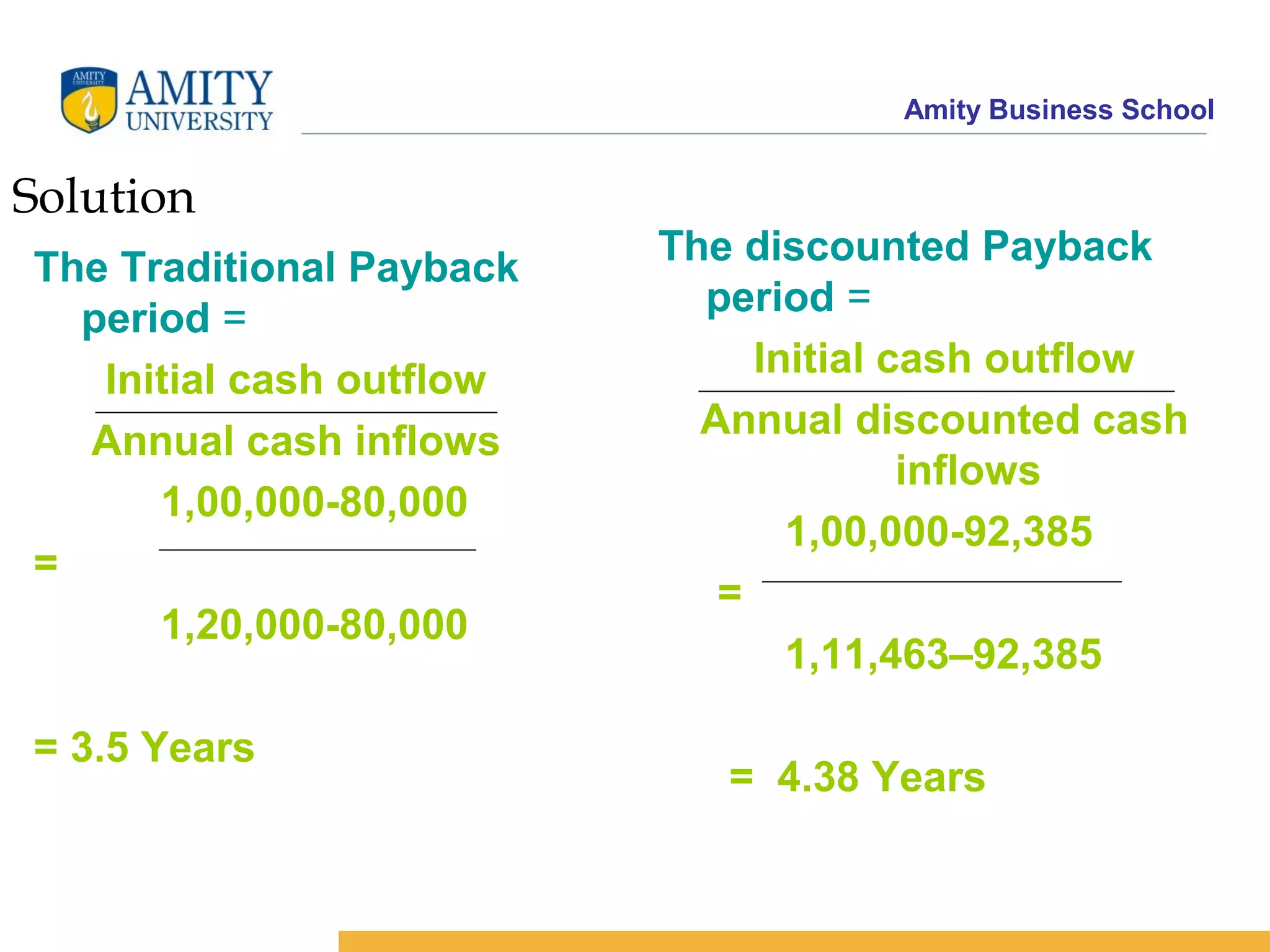

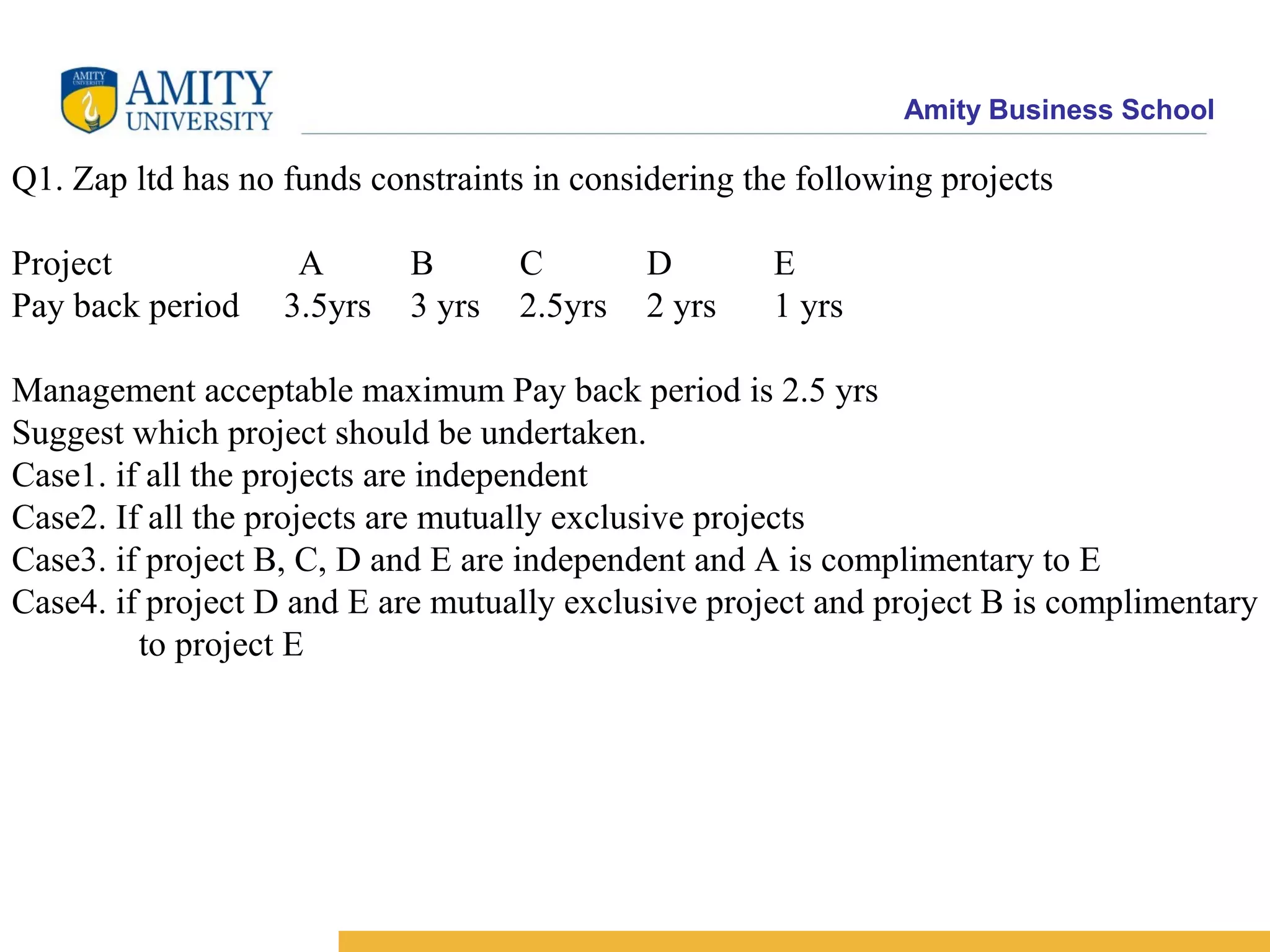

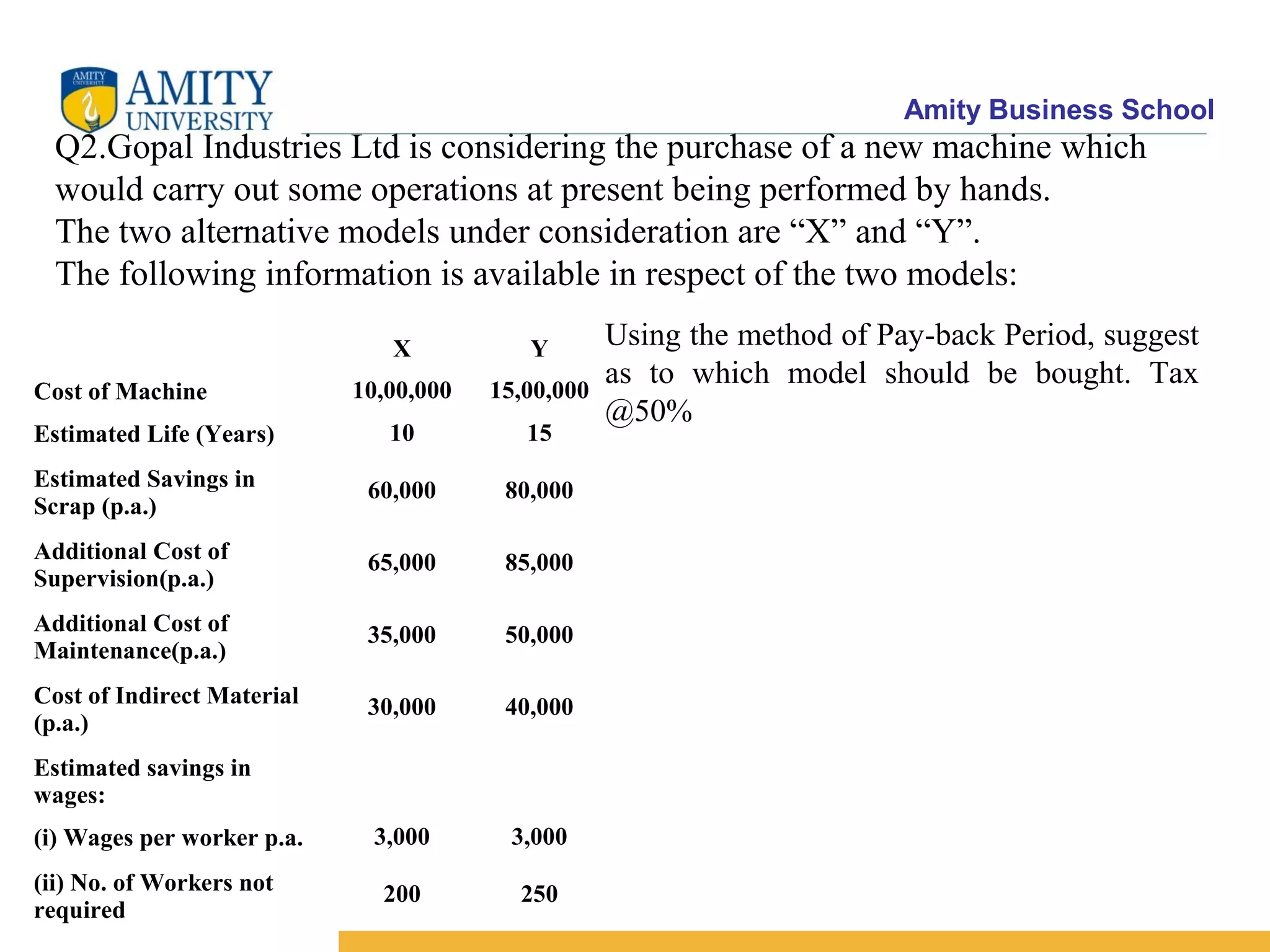

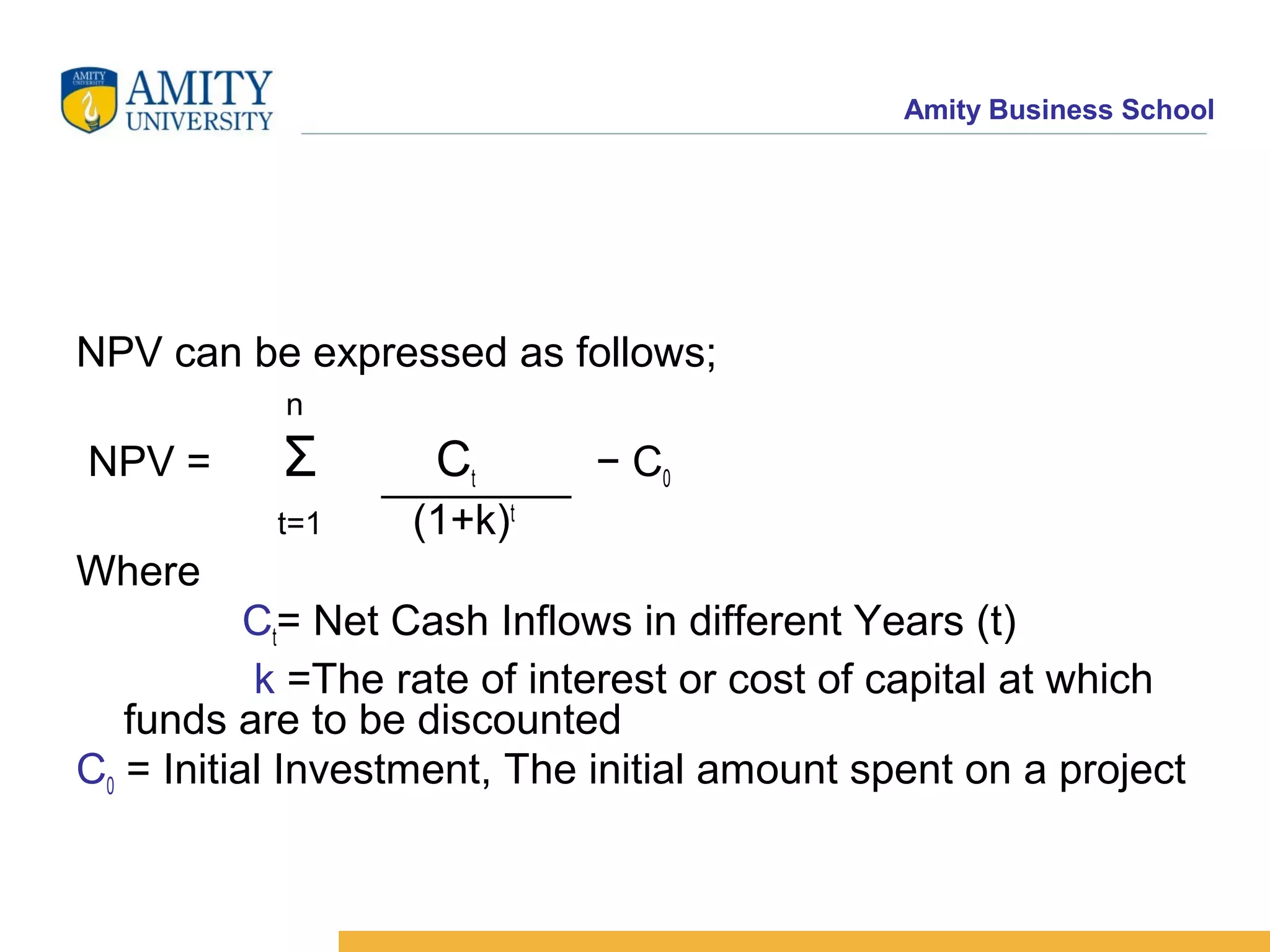

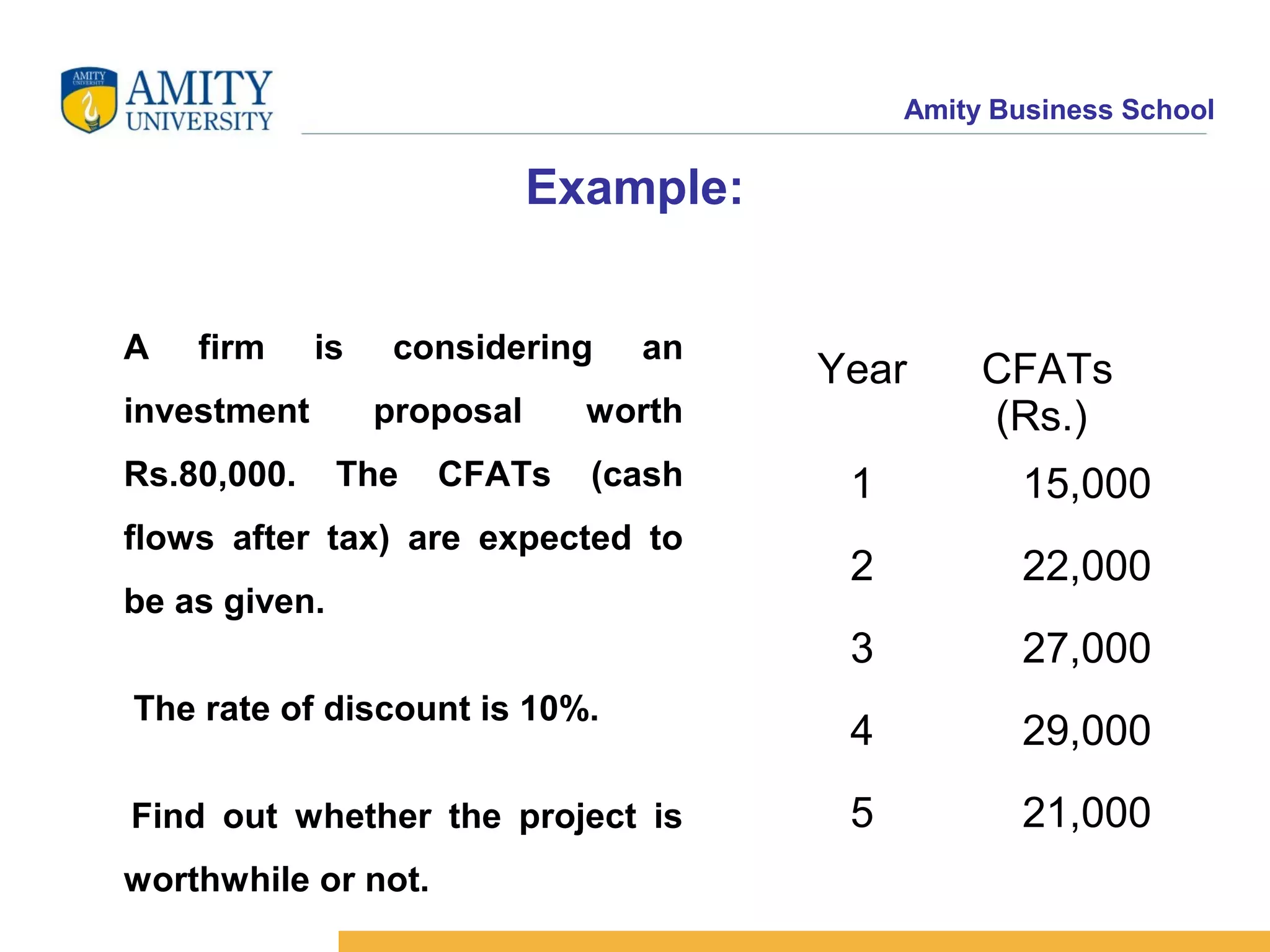

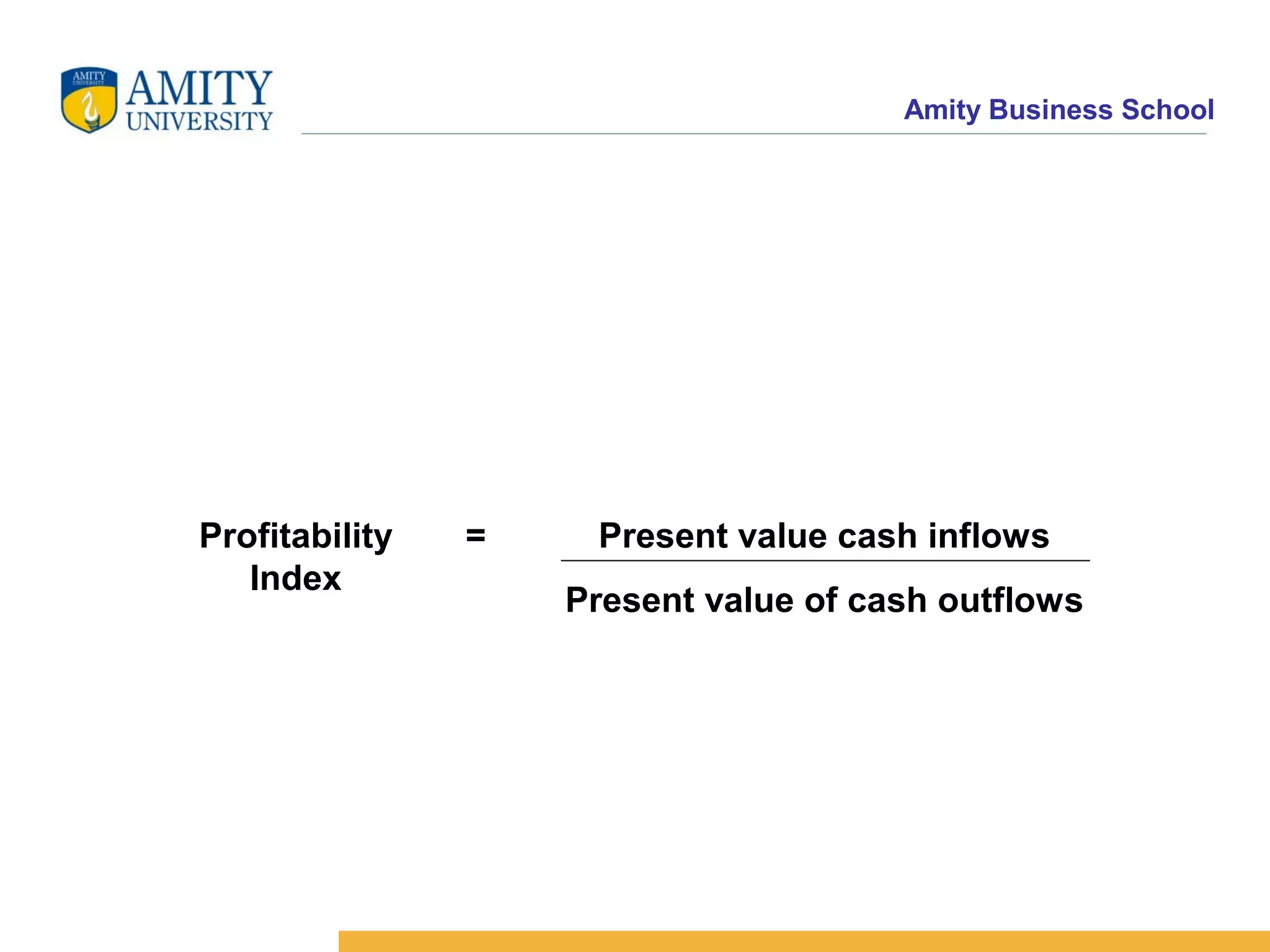

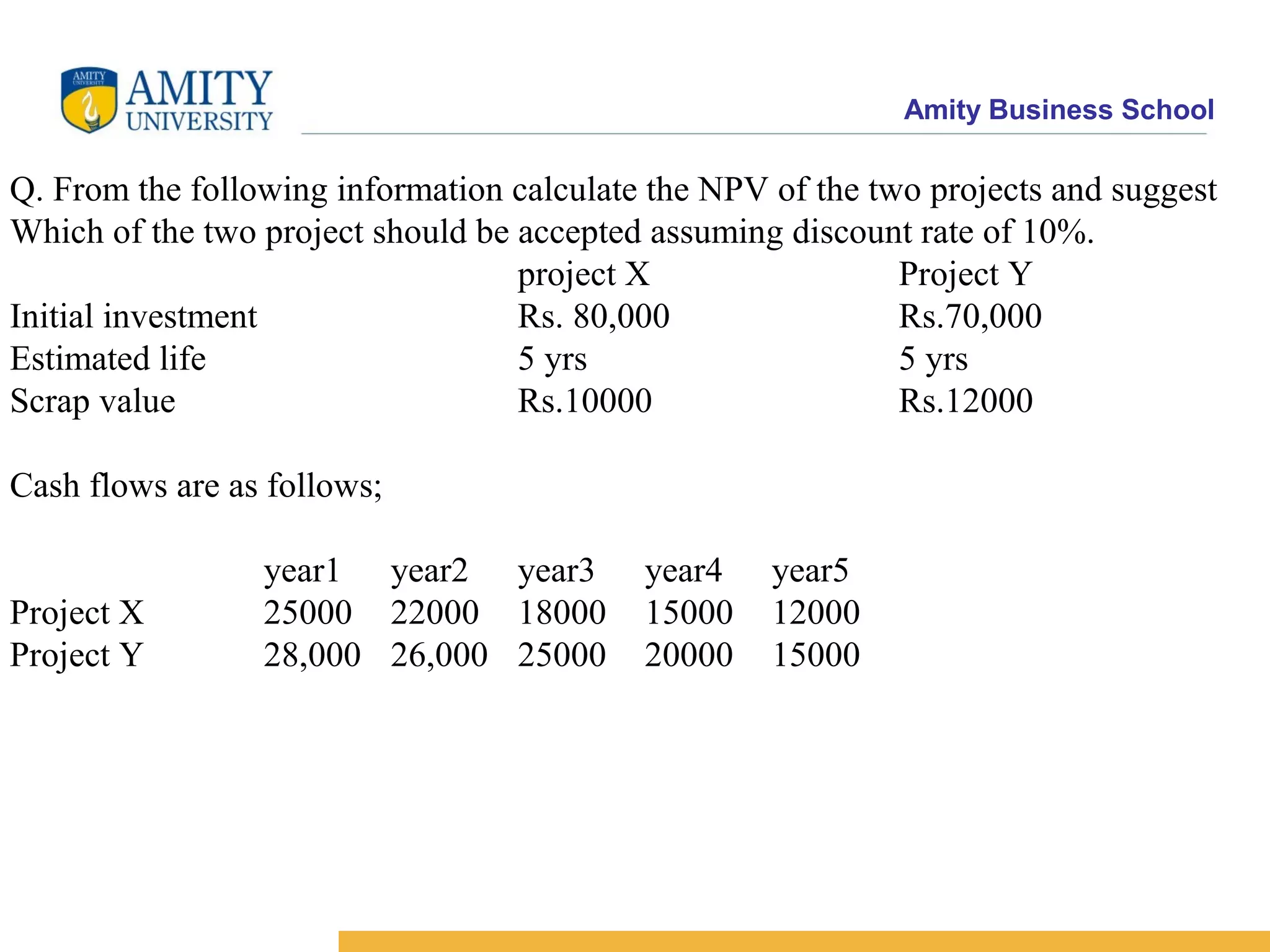

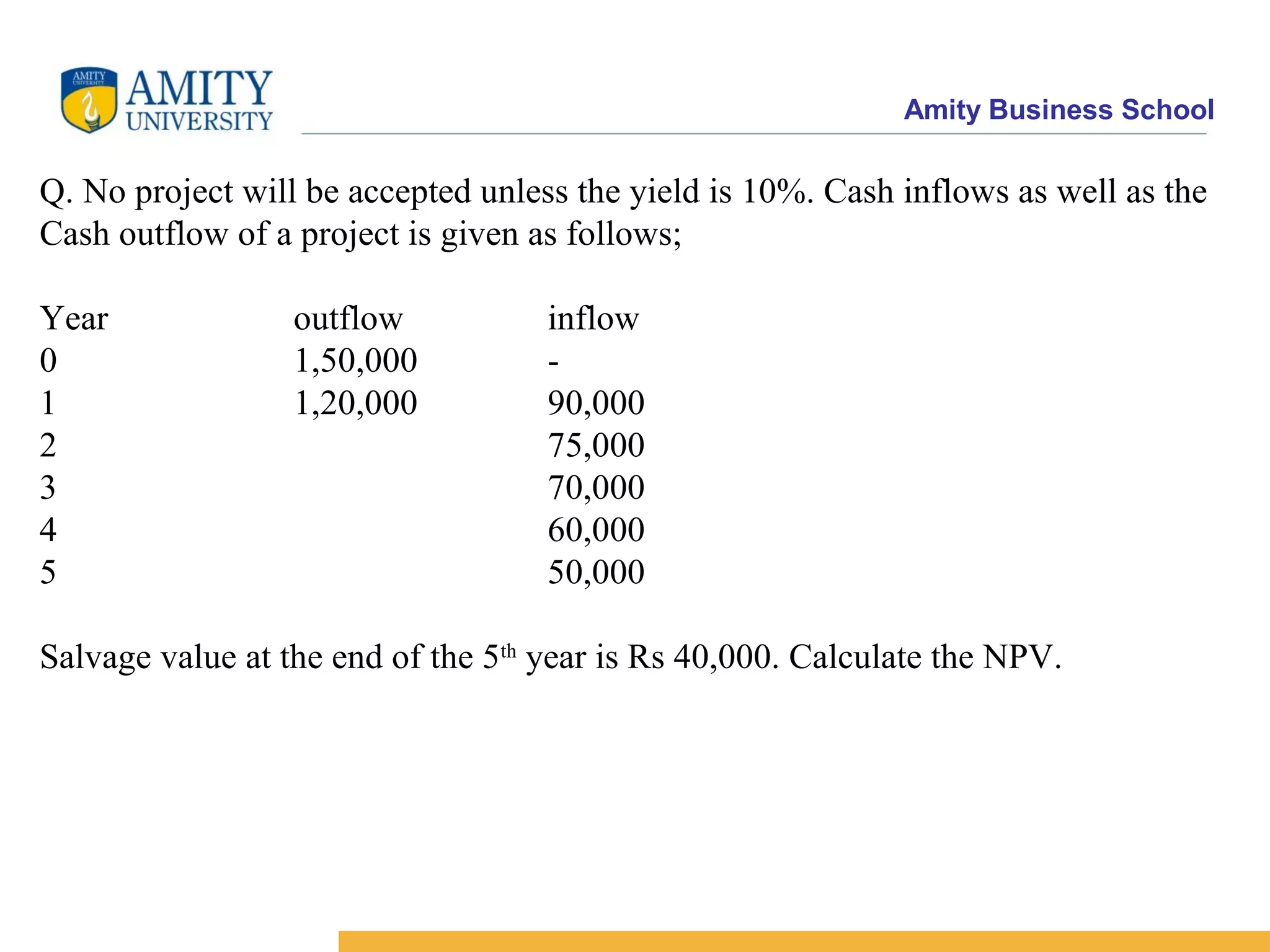

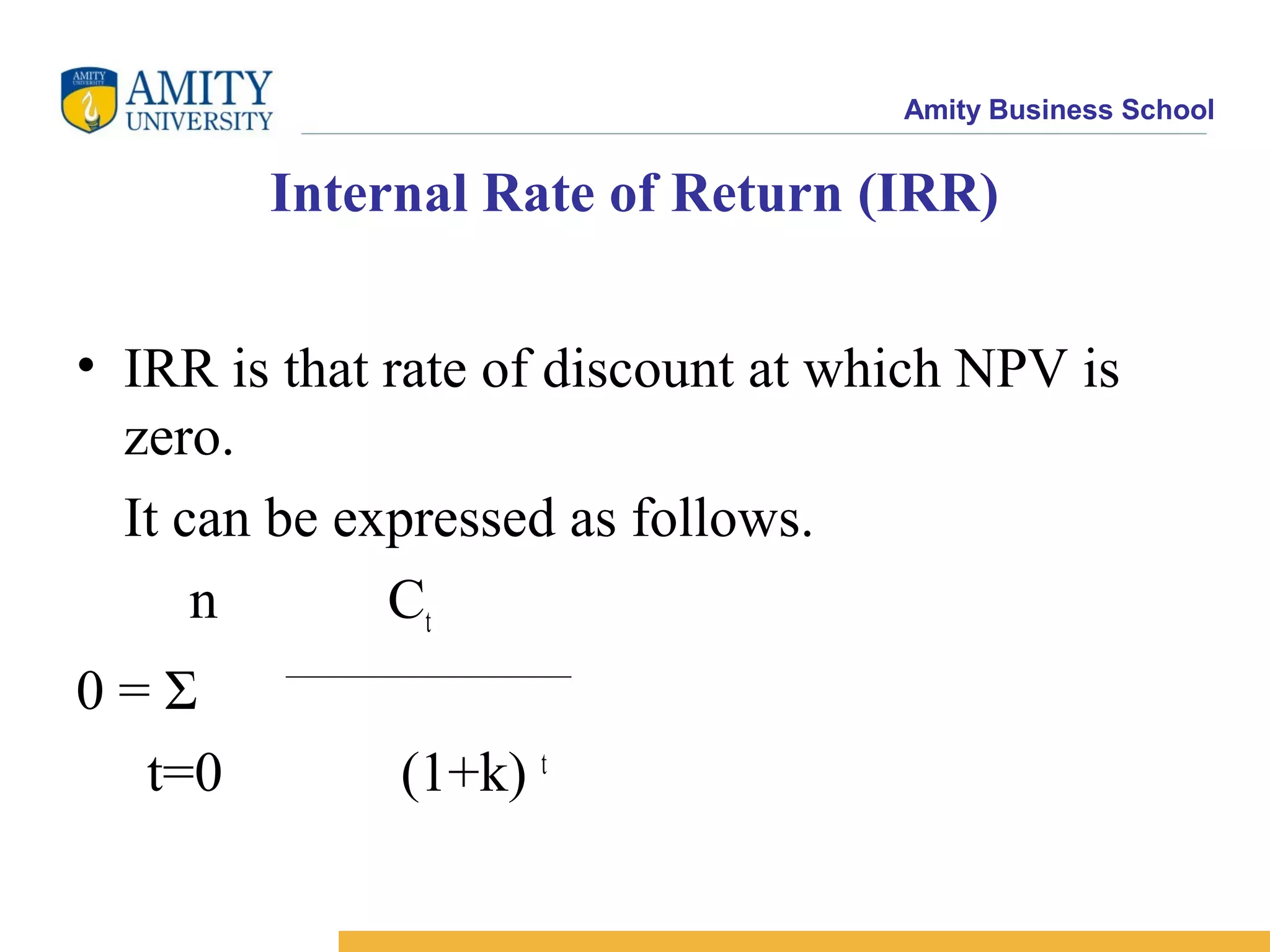

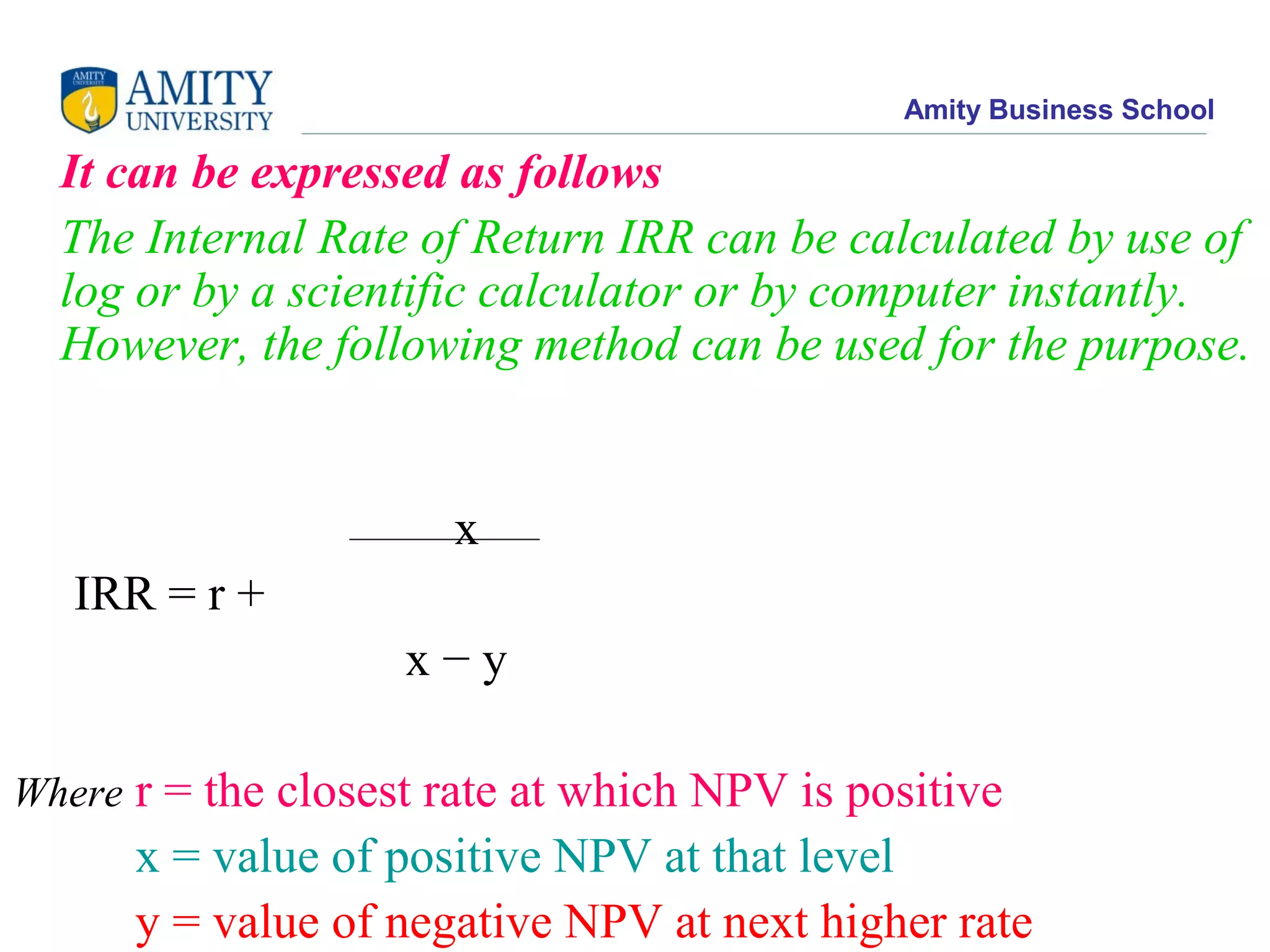

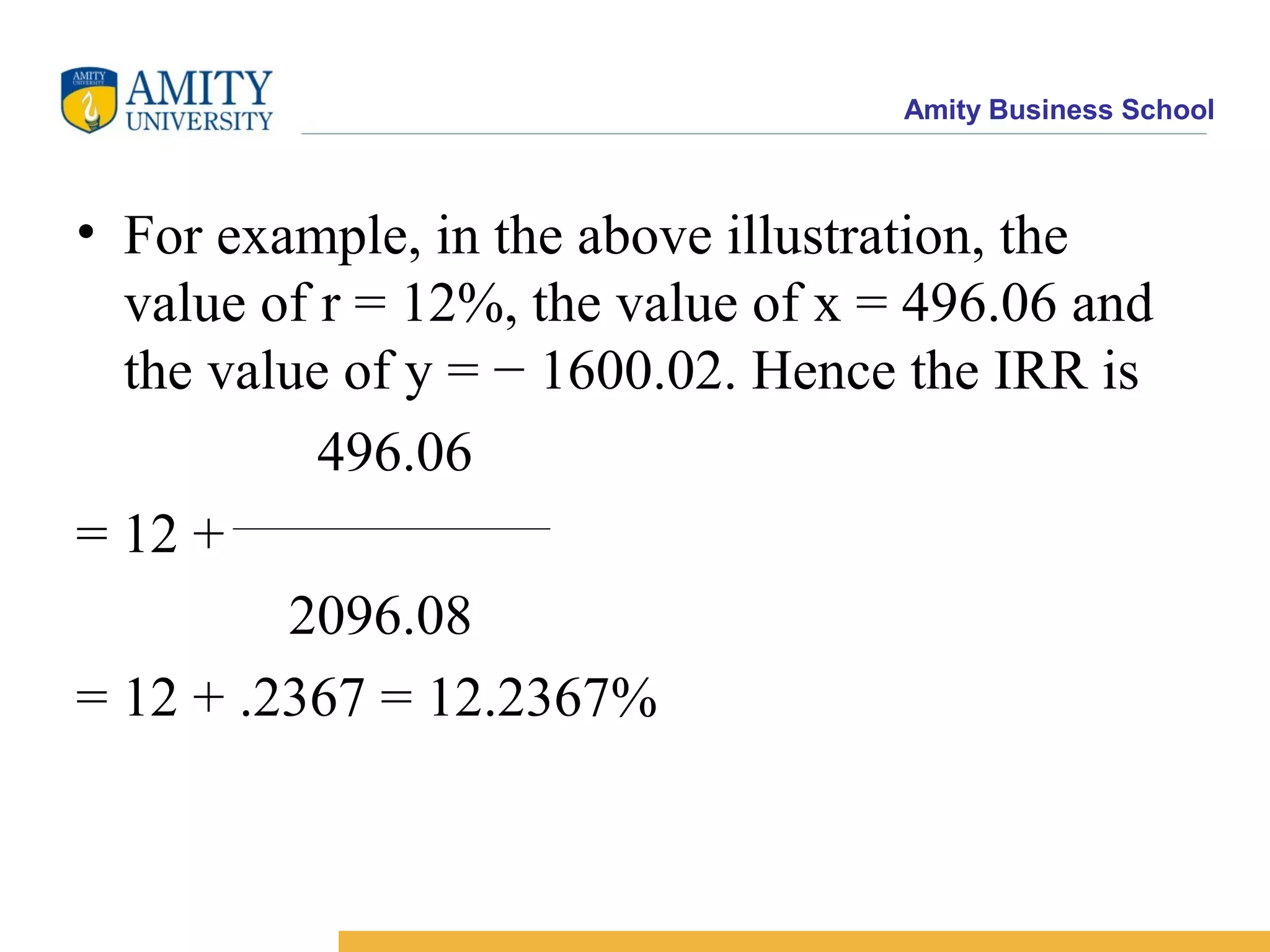

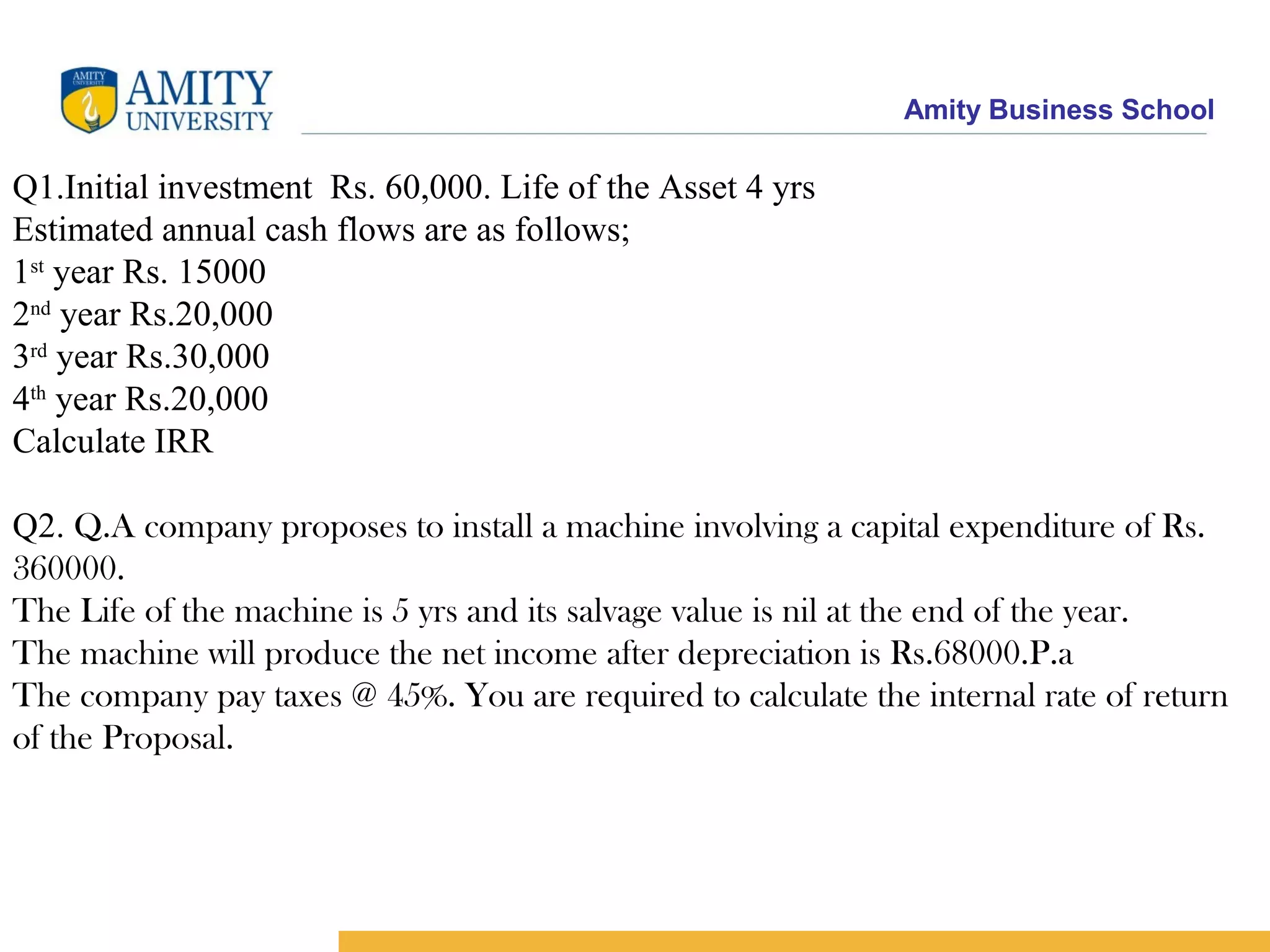

The document discusses various capital budgeting techniques used to evaluate investment projects, including payback period and net present value (NPV). It provides examples of how to calculate payback period for projects with both uniform and non-uniform cash flows. It also discusses the limitations of payback period as a capital budgeting method. The document then introduces NPV as a discounted cash flow technique and provides the formula for calculating NPV. It states that projects with positive NPV should be accepted while projects with negative NPV should be rejected.