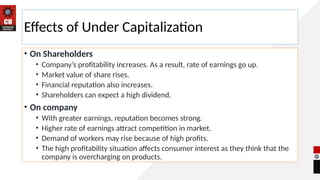

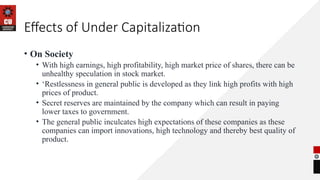

The document discusses financial management, encompassing its definitions, objectives, functions, and the significance of financial planning within a business. Key areas are outlined, including investment, financial, dividend, liquidity, and capital structure decisions, each impacting the enterprise's financial health and growth strategies. Additionally, concepts of overcapitalization and undercapitalization are explained, highlighting their effects on shareholders and the company at large.