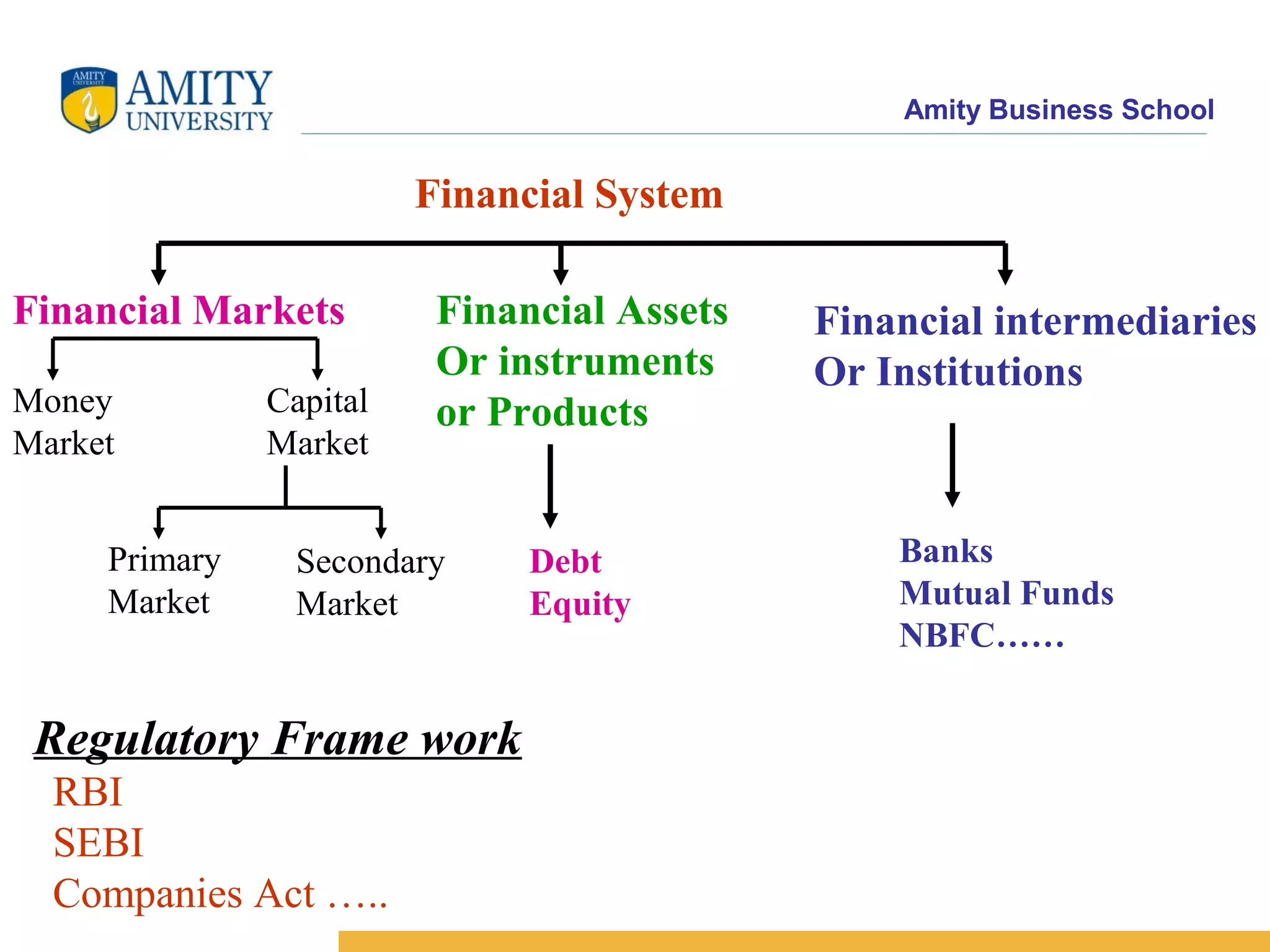

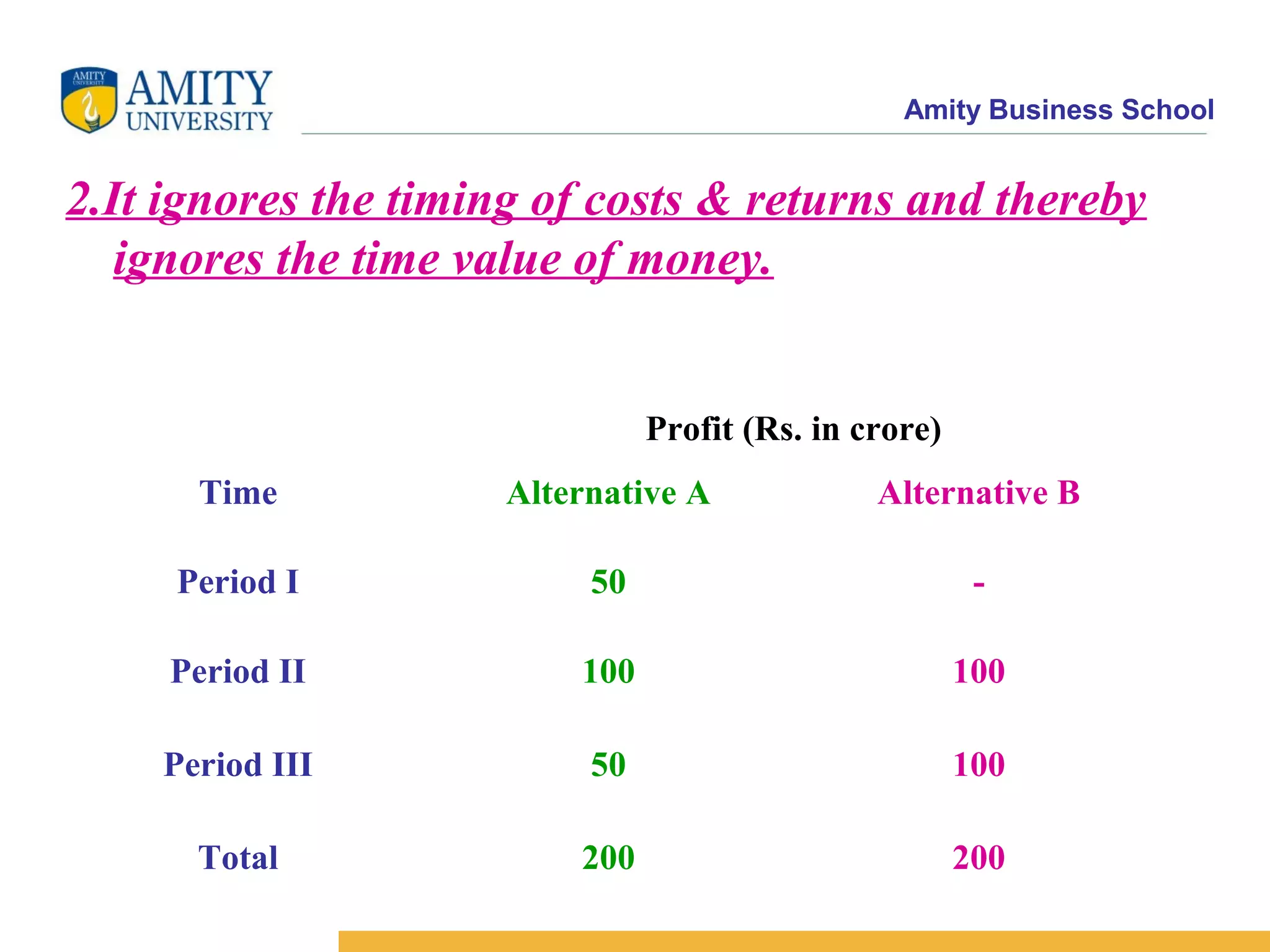

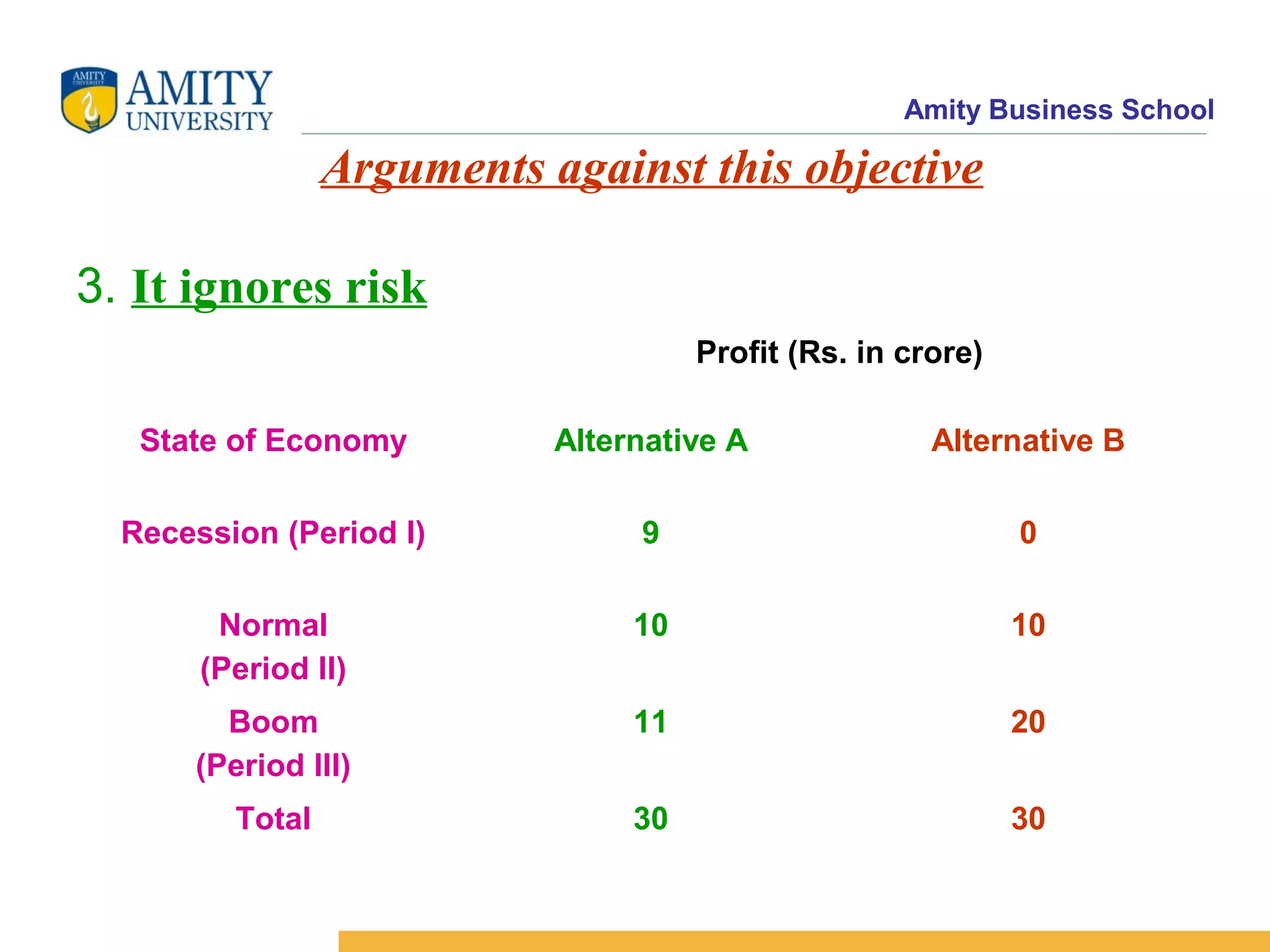

The document discusses financial management topics taught in an MBA program at Amity Business School. It defines the financial environment and system, including financial markets, instruments, intermediaries, and the regulatory framework. It then compares the objectives of profit maximization versus wealth maximization. Profit maximization is criticized for being vague, ignoring the time value of money and risk. Wealth maximization, also called value or net present worth maximization, is presented as a better objective as it focuses on maximizing shareholder value through appropriate financial decisions.