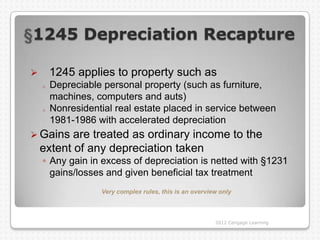

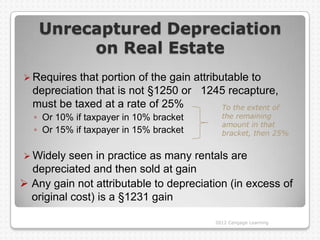

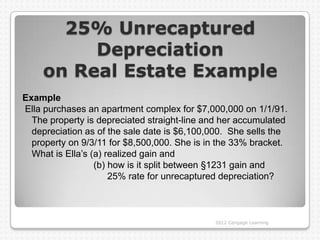

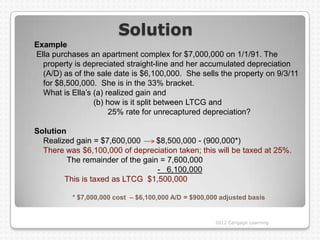

Ella purchased an apartment complex for $7 million in 1991. She accumulated $6.1 million in depreciation deductions by the time she sold it on 9/3/2011 for $8.5 million. Her realized gain is $1.4 million ($8.5 million sales price minus her $7 million original cost basis). This gain will be split between section 1231 gain and a 25% rate for the unrecaptured depreciation amount. The 25% rate applies to gains attributable to depreciation deductions taken in excess of what would have been allowed under the straight-line depreciation method.

![Solution

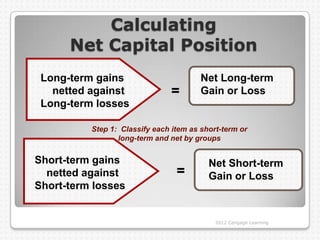

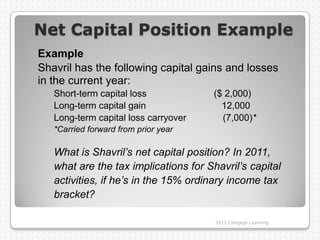

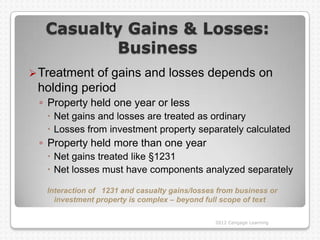

Short-term (Step 1 – net short-term activities)

Short-term capital gains $ 0

Short-term capital loss (2,000)

Net ST position $(2,000)

Long-term (Step 2 – net long-term activities)

Long-term capital gain $ 12,000

Long-term capital loss carryover ( 7,000)

Net LT position $ 5,000

(Step 3 –first two steps go in different directions, so net the results)

Net long-term capital gain [(2,000) + 5,000] $ 3,000

His $3,000 LTCG will be taxed at 0% because

he is in the 15% ordinary income tax bracket.

2012 Cengage Learning](https://image.slidesharecdn.com/itfippch082012final-120420003437-phpapp01/85/Itf-ipp-ch08_2012_final-20-320.jpg)

![Solution

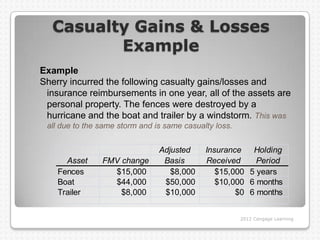

Example

Sherry incurred the following casualty gains/losses and insurance

reimbursements in one year, all personal. The fences were

destroyed by a hurricane & the boat and trailer by a windstorm. This

was all due to the same storm and is the same casualty loss.

Adjusted Insurance Holding

Asset FMV change Basis Received Period

Fences $15,000 $8,000 $15,000 5 years

Boat $44,000 $50,000 $10,000 6 months

Trailer $8,000 $10,000 $0 6 months

Solution

Hurricane results in a casualty gain = $ 7,000 $8,000 - 15,000

Windstorm results in a casualty loss = ($ 41,900) ($44,000 - $10,000) +

Net casualty loss = $ 34,900 ($8,000 - $0)] - $100 floor

The total net casualty loss of $34,900 is further reduced by 10% of AGI.

2012 Cengage Learning](https://image.slidesharecdn.com/itfippch082012final-120420003437-phpapp01/85/Itf-ipp-ch08_2012_final-38-320.jpg)