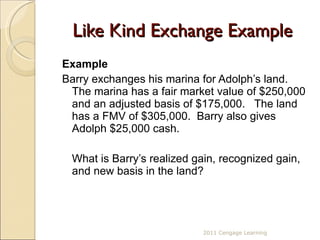

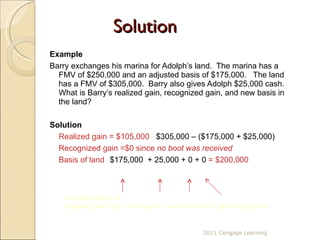

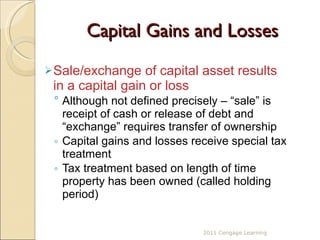

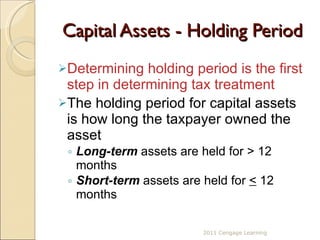

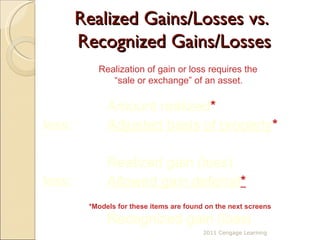

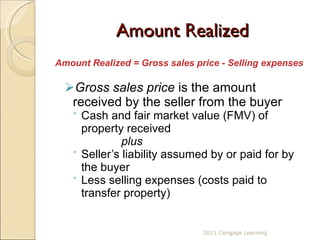

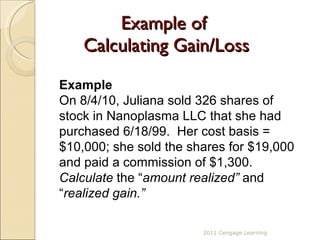

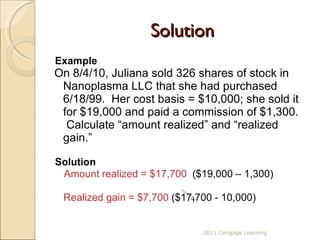

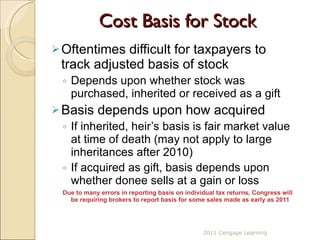

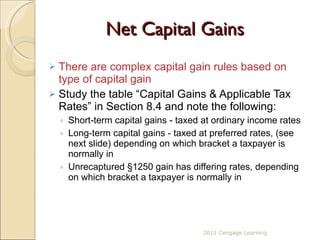

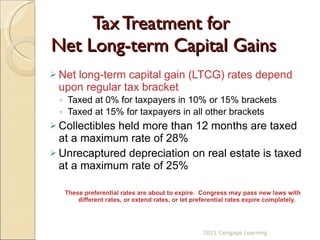

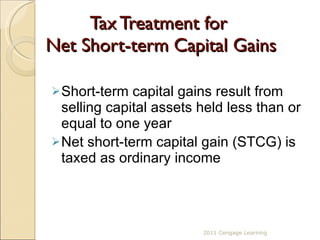

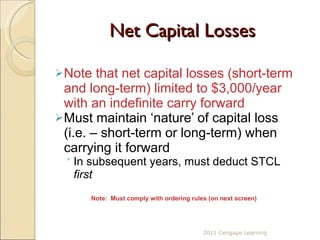

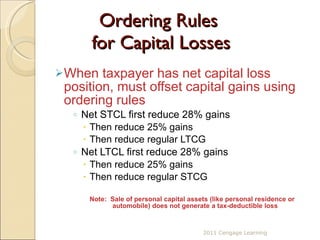

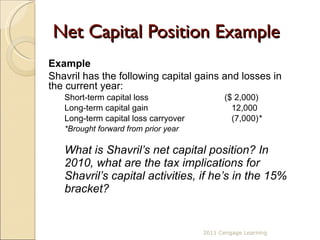

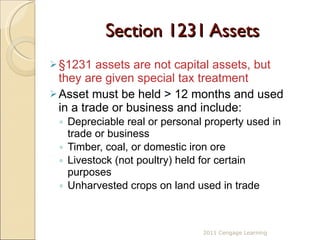

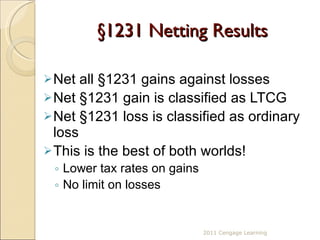

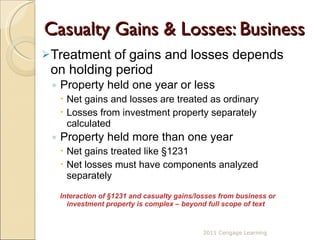

The document discusses capital gains and losses for tax purposes. It defines key terms like capital assets and holding periods, and how to calculate realized and recognized gains and losses. It also covers the tax treatment of long-term and short-term capital gains, including preferential rates for long-term capital gains. Net capital gains and losses are calculated by netting short-term and long-term transactions separately.

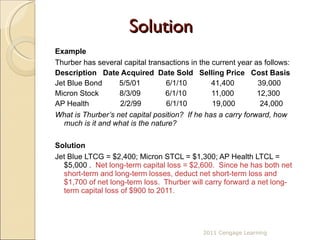

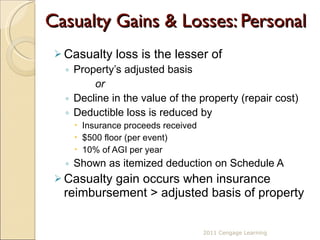

![Solution Short-term (Step 1 – net short-term activities) Short-term capital gains $ 0 Short-term capital loss (2,000) Net ST position $(2,000) Long-term (Step 2 – net long-term activities) Long-term capital gain $ 12,000 Long-term capital loss carryover ( 7,000) Net LT position $ 5,000 (Step 3 –first two steps go in different directions, so net ) Net long-term capital gain [(2,000) + 5,000] $ 3,000 His $3,000 LTCG will be taxed at 0% because he is in the 15% ordinary income tax bracket. 2011 Cengage Learning](https://image.slidesharecdn.com/chapter8-110510194453-phpapp02/85/Chapter-8-20-320.jpg)

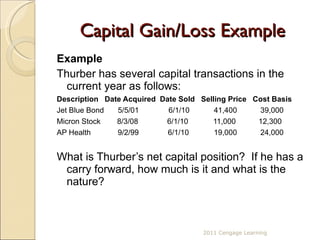

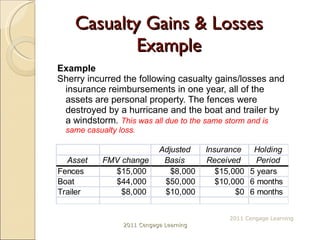

![Solution Example Sherry incurred the following casualty gains/losses and insurance reimbursements in one year, all personal. The fences were destroyed by a hurricane & the boat and trailer by a windstorm . This was all due to the same storm and is same casualty loss. Solution Hurricane results in a casualty gain = $ 7,000 $8,000 - 15,000. Windstorm results in a casualty loss = $41,500 ($44,000 - $10,000) + ($8,000 - $0)] - $500 floor Net casualty loss = $34,900 The total net casualty loss of $34,900 is further reduced by 10% of AGI. 2011 Cengage Learning](https://image.slidesharecdn.com/chapter8-110510194453-phpapp02/85/Chapter-8-38-320.jpg)