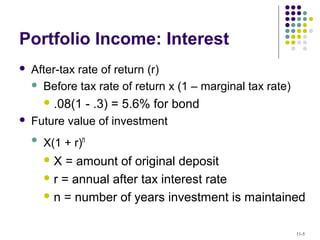

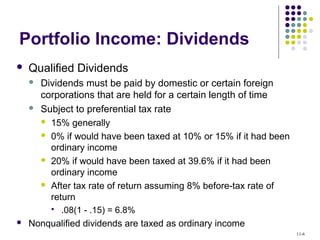

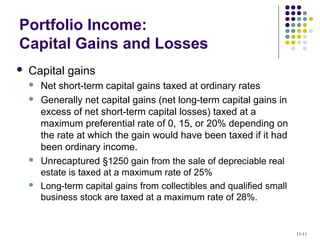

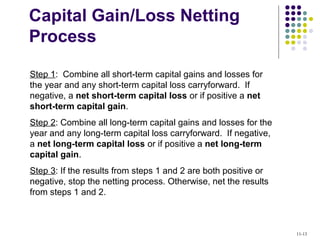

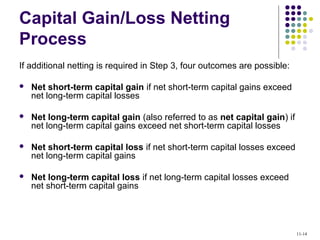

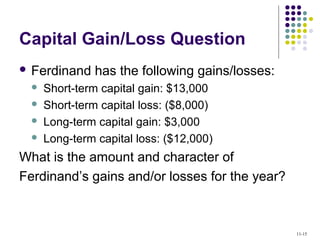

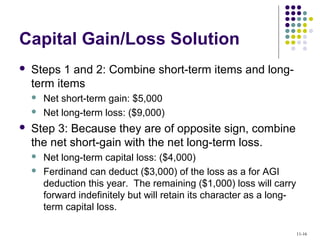

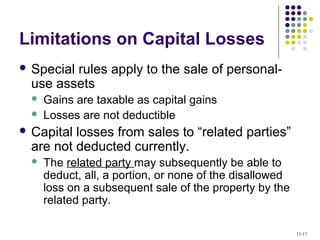

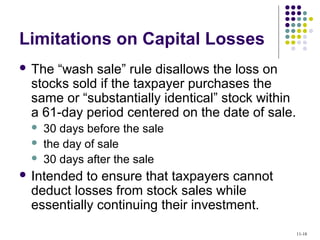

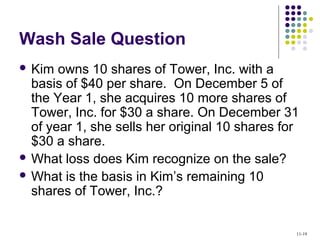

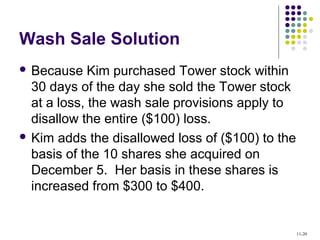

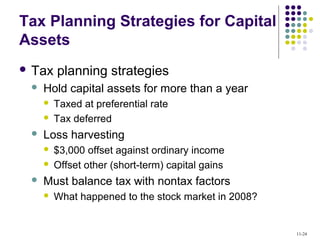

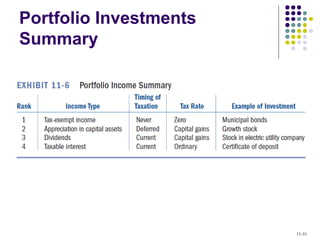

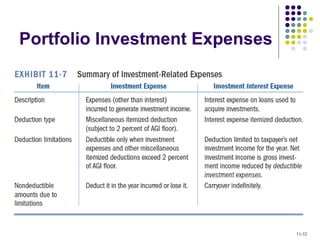

This chapter discusses taxation of investments including interest, dividends, capital gains and losses. Interest and dividends are generally taxed as ordinary income. Capital gains are taxed at preferential rates depending on the holding period. Losses can offset gains of the same character and up to $3,000 of ordinary income. Tax planning strategies include holding investments long-term to qualify for lower capital gains rates and loss harvesting. The chapter also covers tax-exempt investments like municipal bonds and life insurance.