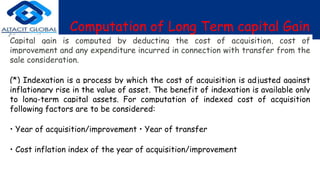

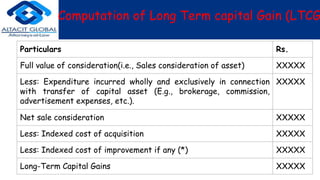

Capital gain is the increase in value of a capital asset when it is sold for a higher price than was paid to acquire it. A capital gain is only realized when the asset is sold. Capital gains are classified as either short-term or long-term depending on how long the asset was held. Long-term capital gains are subject to lower tax rates than short-term gains. Some capital gains, such as from the sale of a primary residence up to $500,000 for married couples, are exempt from capital gains tax if certain conditions are met. Capital losses can offset capital gains to reduce tax liability.