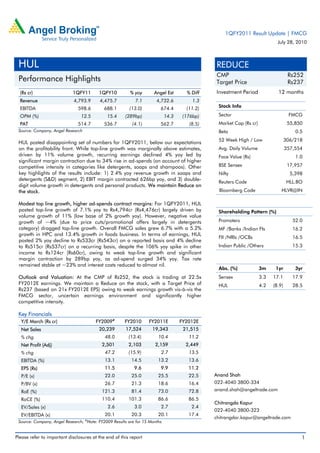

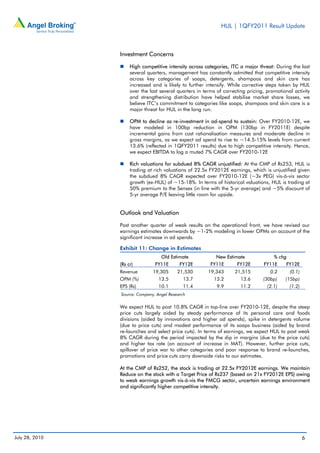

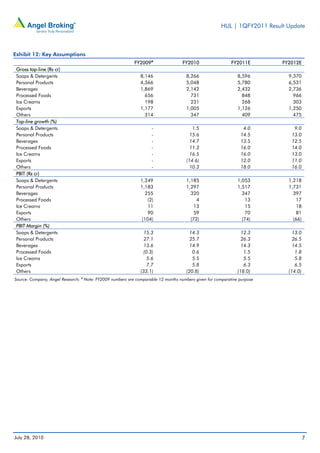

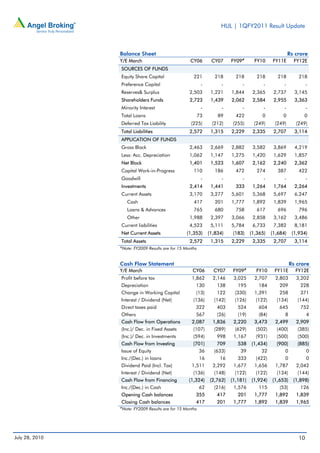

HUL reported disappointing 1QFY2011 results, with profits declining 4% due to a 34% rise in advertising spending. While revenue grew 7% driven by 11% volume growth, operating margins contracted significantly by 289 basis points. Higher competitive intensity in categories like detergents and soaps drove the increase in advertising. Weak profit growth and uncertain earnings outlook despite modest revenue growth lead us to maintain a reduce rating on the stock.