JP Associates - Result Update

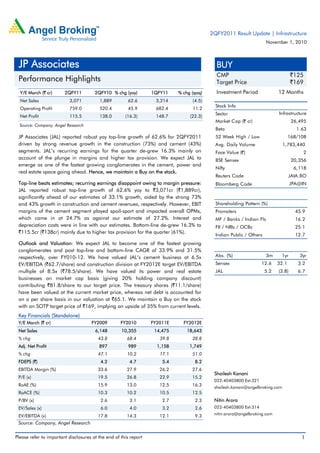

- 1. Please refer to important disclosures at the end of this report 1 Y/E March (` cr) 2QFY11 2QFY10 % chg (yoy) 1QFY11 % chg (qoq) Net Sales 3,071 1,889 62.6 3,214 (4.5) Operating Profit 759.0 520.4 45.9 682.4 11.2 Net Profit 115.5 138.0 (16.3) 148.7 (22.3) Source: Company, Angel Research JP Associates (JAL) reported robust yoy top-line growth of 62.6% for 2QFY2011 driven by strong revenue growth in the construction (73%) and cement (43%) segments. JAL’s recurring earnings for the quarter de-grew 16.3% mainly on account of the plunge in margins and higher tax provision. We expect JAL to emerge as one of the fastest growing conglomerates in the cement, power and real estate space going ahead. Hence, we maintain a Buy on the stock. Top-line beats estimates; recurring earnings disappoint owing to margin pressure: JAL reported robust top-line growth of 62.6% yoy to `3,071cr (`1,889cr), significantly ahead of our estimates of 33.1% growth, aided by the strong 73% and 43% growth in construction and cement revenues, respectively. However, EBIT margins of the cement segment played spoil-sport and impacted overall OPMs, which came in at 24.7% as against our estimate of 27.2%. Interest and depreciation costs were in line with our estimates. Bottom-line de-grew 16.3% to `115.5cr (`138cr) mainly due to higher tax provision for the quarter (61%). Outlook and Valuation: We expect JAL to become one of the fastest growing conglomerates and post top-line and bottom-line CAGR of 33.9% and 31.5% respectively, over FY010-12. We have valued JAL’s cement business at 6.5x EV/EBITDA (`62.7/share) and construction division at FY2012E target EV/EBITDA multiple of 8.5x (`78.5/share). We have valued its power and real estate businesses on market cap basis (giving 20% holding company discount) contributing `81.8/share to our target price. The treasury shares (`11.1/share) have been valued at the current market price, whereas net debt is accounted for on a per share basis in our valuation at `65.1. We maintain a Buy on the stock with an SOTP target price of `169, implying an upside of 35% from current levels. Key Financials (Standalone) Y/E March (` cr) FY2009 FY2010 FY2011E FY2012E Net Sales 6,148 10,355 14,475 18,643 % chg 43.8 68.4 39.8 28.8 Adj. Net Profit 897 989 1,158 1,749 % chg 47.1 10.2 17.1 51.0 FDEPS (`) 4.2 4.7 5.4 8.2 EBITDA Margin (%) 33.6 27.9 26.2 27.6 P/E (x) 19.5 26.8 22.9 15.2 RoAE (%) 15.9 13.0 12.5 16.3 RoACE (%) 10.3 10.2 10.5 12.5 P/BV (x) 2.6 3.1 2.7 2.3 EV/Sales (x) 6.0 4.0 3.2 2.6 EV/EBITDA (x) 17.8 14.3 12.1 9.3 Source: Company, Angel Research BUY CMP `125 Target Price `169 Investment Period 12 Months Stock Info Sector Bloomberg Code Shareholding Pattern (%) Promoters 45.9 MF / Banks / Indian Fls 16.2 FII / NRIs / OCBs 25.1 Indian Public / Others 12.7 Abs. (%) 3m 1yr 3yr Sensex 12.6 32.1 3.2 JAL 5.2 (3.8) 6.7 2 20,356 6,118 JAIA.BO JPA@IN 26,495 1.63 168/108 1,783,440 Infrastructure Avg. Daily Volume Market Cap (` cr) Beta 52 Week High / Low Face Value (`) BSE Sensex Nifty Reuters Code Shailesh Kanani 022-40403800 Ext:321 shailesh.kanani@angelbroking.com Nitin Arora 022-40403800 Ext:314 nitin.arora@angelbroking.com JP Associates Performance Highlights 2QFY2011 Result Update | Infrastructure November 1, 2010

- 2. JP Associates | 2QFY2011 Result Update November 1, 2010 2 Exhibit 1: 2QFY2011 Performance (Standalone) Y/E March (` cr) 2QFY11 2QFY10 % chg (yoy) 1QFY11 % chg (qoq) 1HFY11 1HFY10 % chg (yoy) Net Sales 3,071 1,889 62.6 3,214 (4.5) 6,286 4,006 56.9 Total Exp. 2,312 1,368 69.0 2,532 (8.7) 4,844 2,894 67.4 Op. Profit 759 520 45.9 682 11.2 1,441 1,112 29.6 OPM (%) 24.7 27.5 0.0 21.2 0.0 46 27.8 - Int. 323 259 25.0 328 (1.4) 651 481 35.5 Dep. 153 110 38.8 150 1.6 303 212 43.1 Non Op. Inc. 7 23 0.0 3 103.3 10 24 (57.6) Nonrecurring items - 732 (100.0) 367 (100.0) 367 997 - PBT 290 907 (68.1) 575 (49.6) 864 1,441 (40.0) Tax 174 37.0 371 59 196.4 233 79 193.9 Reported PAT 116 870 (86.7) 516 (77.6) 632 1,361 (53.6) PAT (%) 3.8 46.1 - 16.1 - 10.0 34.0 - Adj. PAT 116 138 (16.3) 149 (22.3) 264 364 (27.4) Adj.PAT (%) 3.8 7.3 - 4.6 - 4.2 9.1 - Adj. EPS (`) 0.5 0.6 (16.3) 0.7 (22.3) 1.2 1.7 (27.4) Source: Company, Angel Research Exhibit 2: 2QFY2011 Actual v/s Estimates (` cr) Estimates Actual Variation (%) Revenues 2,427.0 3,071.2 26.5 EBITDA Margin (%) 27.2 24.7 (248.6) PAT 118.0 115.5 (2.1) Source: Company, Angel Research

- 3. JP Associates | 2QFY2011 Result Update November 1, 2010 3 Exhibit 3: Segmental performance (standalone) Y/E March (` cr) 2QFY11 2QFY10 % chg 1HFY11 1HFY10 % chg Segment Revenue Cement & Cement Products 1,208 845 43.0 2,650 1,793 47.8 Construction 1,571 908 73.0 3,008 1,959 53.6 Power 12 14 (15.5) 23 26 (9.4) Hotel/Hospitality and Golf Course 37 29 30.6 74 62 19.3 Real Estate 323 88 265.5 689 184 275.4 Investment 4 24 0.0 7 24 0.0 Others 1 9 0.0 5 13 0.0 Unallocated 33 32 2.4 63 50 24.5 Less: Inter-Segmental Performance 115 37 212.7 227 82 178.3 Total Sales Income 3,075 1,913 60.8 6,293 4,029 56.2 Segment Results Cement & Cement Products 188 220 (14.5) 475 522 (9.1) Construction 328 180 82.6 433 363 19.2 Power 8 14 (41.4) 15 21 (28.1) Hotel/Hospitality and Golf Course (2) (6) (73.1) (3) (3) (18.5) Real Estate 133 29 356.0 289 74 291.1 Investment 4 24 0.0 7 24 (69.1) Others 1 4 0.0 2 2 0.0 Exceptional item : Profit on Sale of Shares - 942 513 1,316 Total PBIT 661 1,406 (53.0) 1,730 2,318 (25.4) Less: Interest Expense 323 259 25.0 651 481 35.5 Less: Exceptional Item - 0.0 - 102 0.0 Less: Unallocable Expense 48 31 55.3 70 78 (11.0) PBT 290 1,117 (74.1) 1,010 1,658 (39.1) PBIT Margin (%) bp chg. bp chg. Cement & Cement Products 15.6 26.1 (1,048) 17.9 29.1 (1,119) Construction 20.9 19.8 110 14.4 18.5 (414) Power 66.1 95.4 (2,925) 64.7 81.5 (1,681) Hotel/Hospitality and Golf Course (4.1) (19.7) 1,564 (3.7) (5.5) 173 Real Estate 41.2 33.0 817 41.9 40.2 169 Investment 100.0 100.0 - 100.0 100.0 - Others 62.4 42.7 31.0 16.9 Unallocated - 2,926.5 820.0 2,618.6 Capital Employed in Segment Cement & Cement Products 13,538 10,837 24.9 13,538 10,837 24.9 Construction 3,104 1,916 62.0 3,104 1,916 62.0 Power 854 253 237.4 854 253 237.4 Hotel/Hospitality and Golf Course 479 509 (5.9) 479 509 (5.9) Real Estate 2,188 806 171.6 2,188 806 171.6 Investment 5,652 4,770 18.5 5,652 4,770 18.5 Others 248 161 54.0 248 161 54.0 Unallocated 4,326 4,822 (10.3) 4,326 4,822 (10.3) Total 30,388 24,074 26.2 30,388 24,074 26.2 Source: Company, Angel Research

- 4. JP Associates | 2QFY2011 Result Update November 1, 2010 4 Segment-wise performance Cement division JAL’s cement division reported revenue growth of 43.0% yoy to `1,208cr (`845cr), 12.8% above our estimate of `1,071cr. The divisional EBIT margin came in at 15.6% (26.1%), which was mainly on account of higher input cost and decline in realisations. JAL currently has an installed cement capacity of ~24MTPA and 1HFY2011 dispatch volumes stood at ~7.3mtpa. We expect the company to achieve dispatch volumes of 14.6mtpa and top-line of `5,107cr for FY2011. This is assuming average realisation of `3,877/tonne (gross) for FY2011, which implies a 10% hike in the cement price in 2HFY2011 over 1HFY2011. For FY2012, we have factored in volume growth of 27% to 18.5mtpa and realisation of `4,071/tonne (gross) resulting in top-line of `6,803cr, a yoy jump of 33%. Construction division The construction division registered 73.0% yoy surge in revenues to `1,571cr (`908cr) as against our expectation of `1,100cr. Divisional EBIT margin came in at 20.9% (19.8%), which were in line with our estimates. We highlight that construction margins returned to normalised levels in 2QFY2011 after registering disappointing 7% margins in 1QFY2011. The construction division has posted volatile numbers over the last few quarters. For FY2011 and FY2012, we are penciling top-line of `7,815cr and `9,910cr, respectively. On the operating front, we are factoring in EBIT margin of 15.2% and 17.8% for FY2011 and FY2012, respectively. Real estate division The real estate division reported 265.5% yoy revenue growth to `323.cr (`88.4cr) in line with our expectation of `300.4cr. The divisional EBIT margin came in at 41.2% (33.0%), which were tad above our estimate of 40.1%. Exhibit 4: Quarterly revenue trend Source: Company, Angel Research Exhibit 5: Quarterly EBITDA trend Source: Company, Angel Research 38.3 48.3 62.9 63.0 58.4 113.8 60.5 70.2 62.6 - 20.0 40.0 60.0 80.0 100.0 120.0 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 Sales (Rs cr, LHS) Growth (yoy %, RHS) 34.0 25.8 37.0 25.9 28.5 23.6 25.5 21.2 24.7 - 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 0 100 200 300 400 500 600 700 800 900 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 EBITDA (Rs cr, LHS) EBITDAM (%, RHS)

- 5. JP Associates | 2QFY2011 Result Update November 1, 2010 5 Bottom-line weighed down by higher tax provision JAL reported PBT of `290cr, which surpassed our estimates mainly on account of robust top-line growth during the quarter. However, recurring earnings for the quarter de-grew 16.3% mainly on account of the plunge in margins and higher tax provision at 60.1% and was in line with our estimates. Exhibit 6: Quarterly net profit trend Source: Company, Angel Research 17.1 12.6 18.5 26.0 47.7 3.6 7.3 16.1 3.8 - 10.0 20.0 30.0 40.0 50.0 60.0 0 100 200 300 400 500 600 700 800 900 1,000 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 PAT (Rs cr, LHS) PATM (%, RHS)

- 6. JP Associates | 2QFY2011 Result Update November 1, 2010 6 Outlook and Valuation We expect JAL to become one of the fastest growing conglomerates and post top- line and bottom-line CAGR of 33.9% and 31.5% respectively, over FY010-12. We have valued JAL’s cement business at 6.5x EV/EBITDA (`62.7/share) and construction division at FY2012E target EV/EBITDA multiple of 8.5x (`78.5/share). We have valued its power and real estate businesses on market cap basis (giving 20% holding company discount) contributing `81.8/share to our target price. The treasury shares (`11.1/share) have been valued at the current market price, whereas net debt is accounted for on a per share basis in our valuation at `65.1. We maintain a Buy on the stock with an SOTP Target Price of `169, implying an upside of 35% from current levels. Exhibit 7: SOTP Valuation Business Segment Methodology ` cr `/share % to Target Price Cement EV/EBIDTA (x) 6.5x EV/EBITDA 13,335 62.7 37.0 Construction EV/EBIDTA (x) 8.5x EV/EBITDA 16,698 78.5 46.3 Power Mcap of JPVL @ 20% holding company discount 7,964 37.5 22.1 Real Estate NAV/Mcap Jayppe InfraTech + Jaypee Greens 9,416 44.3 26.2 Hotels - 8x FY2012E Net Profit 148 0.7 0.4 Treasury Stock At CMP 2,366 11.1 6.6 Net Debt - Net Debt for Cement, Construction and Real Estate Business (13,904) (65.4) (38.6) Total 36,025 169.4 100.0 Source: Company, Angel Research Exhibit 8: Key Assumptions FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Cement Capacity 7.0 9.0 14.7 19.1 24.9 29.3 Cement Production 6.7 6.8 7.6 10.5 16.7 21.2 Cement Sales 6.2 6.2 7.0 9.2 14.6 18.5 Realisations /Ton 3,316 3,602 3,634 4,308 3,877 4,071 Source: Company, Angel Research Exhibit 9: Angel EPS forecast v/s consensus Angel Forecast Bloomberg Consensus Variation FY2011E 5.4 5.6 3.7 FY2012E 8.2 6.9 (16.5) Source: Company, Angel Research

- 7. JP Associates | 2QFY2011 Result Update November 1, 2010 7 Investment Arguments On schedule cement capacity expansion instills confidence: JAL is on its way to become one of the leading players in the cement space following capacity expansion from 9.0mtpa in FY2008 to 29.3mtpa in FY2012E. The capacity expansion is on track and in line with management guidance. Cement contributed 44%, 35% and 38% to standalone top-line in FY2008, FY2009 and FY2010 respectively, and is expected to contribute 39.8% and 41.0% in FY2011 and FY2012, respectively. We believe that the cement capacity size that JAL proposes to set up would enable it to have substantial bargaining power, result in operating leverage benefits and catapult JAL into the league of cement majors. Exhibit 10: JAL's cement capacity vis-a-vis peers (mn/tonne) Source: Company, Angel Research Construction arm to log 33.2% CAGR over FY2010-12E: JAL is developing the 160km, 6-lane (extendable to 8 lanes) access controlled Yamuna expressway between Noida and Agra. The Yamuna Expressway (YE) project also involves real estate development to the tune of 530mn.sq.ft. The cost of YE is `9,739cr and has a concession period of 36 years. Financial closure of the YE is done with 69% of the TPC already put in (equity component of `1,250cr, IPO proceeds of `1,500cr and debt of `4,477cr). Moreover, Jaypee Infratech is in possession of 96.5% of the land required for construction of the highway, and work is on schedule. Thus, JAL’s strong execution track record backed by in-place funding and acquired land renders strong visibility to its construction arm. Diversified play: JAL is a unique play on the ongoing infrastructure theme with a bouquet of offerings in construction, cement, power and real-estate. Moreover, not only does the company have a diversified set of offerings, but also enjoys scale benefits in each of them. We believe that the company stands to benefit as the infrastructure theme pans out going ahead. 48.9 27 30.4 15.8 14.0 5.4 29.3 - 10.0 20.0 30.0 40.0 50.0 60.0 Grasim(Incl. Ultratech) Ambuja ACC IndiaCements MadrasCem JKLakshmiCem JPAssociates FY09 FY10 FY11E FY12E

- 8. JP Associates | 2QFY2011 Result Update November 1, 2010 8 Exhibit 11: Recommendation Summary Company CMP TP Rating Top-line (` cr) EPS (`) *Adj. P/E OB/ FY10 FY11E FY12E CAGR (%) FY10 FY11E FY12E CAGR (%) FY10 FY11E FY12E Sales(x) CCCL 78 - Neutral 1,976 2,397 2,891 21.0 5.0 5.0 6.7 16.2 15.8 15.7 11.7 1.9 Gammon India 201 - Neutral 4,489 5,575 6,607 21.3 8.4 10.0 12.1 20.0 11.5 9.7 8.0 2.9 HCC 62 - Neutral 3,629 4,146 4,900 16.2 1.3 1.6 1.9 19.0 17.9 15.2 12.7 4.8 IRB Infra 259 - Neutral 1,705 2,675 3,672 46.8 11.6 13.0 15.7 16.4 8.4 7.5 6.2 - IVRCL 149 216 Buy 5,492 6,493 8,071 21.2 7.8 8.8 10.9 18.2 11.0 9.8 7.9 3.9 JP Assoc. 125 169 Buy 10,355 14,475 18,643 34.2 4.7 4.5 7.6 27.8 26.8 27.7 16.4 - Punj Lloyd 123 156 Buy 10,448 9,756 12,402 9.0 (10.9) 5.6 11.2 - - 21.9 10.9 2.4 NCC 152 201 Buy 4,778 5,738 6,588 17.4 7.8 8.6 9.8 12.1 14.5 13.2 11.6 3.4 Sadbhav 1,449 1,702 Buy 1,257 1,621 1,986 25.7 43.0 77.4 89.8 44.4 14.1 7.9 6.8 5.3 Simplex In. 480 573 Buy 4,564 5,460 6,543 19.7 25.6 33.0 40.9 26.4 18.8 14.5 11.7 2.5 Patel Engg 370 565 Buy 3,191 3,693 4,297 16.0 28.4 30.8 32.7 7.3 9.2 8.5 8.0 2.5 Madhucon 143 173 Buy 1,388 1,737 2,164 24.9 6.2 7.3 9.1 21.6 10.6 9.0 7.2 2.6 L&T 2,081 - Neutral 37,035 44,047 55,519 22.4 47.4 54.9 68.7 20.4 33.7 29.1 23.3 2.8 ITNL 319 358 Accu. 2,403 3,480 6,071 59.0 17.7 21.8 25.9 20.8 18.0 14.6 12.3 6.7 Source: Company, Angel Research Exhibit 12: SOTP break up Company Core Const. Real Estate Road BOT Invst. In Subsidiaries Others Total ` % to TP ` % to TP ` % to TP ` % to TP ` % to TP ` CCCL 80 100 0 0 0 0 0 0 0 0 80 Gammon India 121 54 0 0 0 0 0 0 104 46 225 HCC 26 41 29 46 8 13 0 0 0 0 63 IRB Infra 118 43 0 0 150 55 5 2 0 0 273 IVRCL 162 75 0 0 0 0 54 25 0 0 216 JP Assoc. 79 46 44 26 0 0 0 0 47 28 169 Punj Lloyd 156 100 0 0 0 0 0 0 0 0 156 NCC 138 69 7 3 32 16 0 0 24 12 201 Sadbhav 862 51 0 0 840 49 0 0 0 0 1702 Simplex In. 573 100 0 0 0 0 0 0 0 0 573 Patel Engg 458 81 56 10 16 3 0 0 36 6 565 Madhucon 92 53 4 2 52 30 0 0 25 15 173 L&T 1542 76 0 0 0 0 482 24 0 0 2024 ITNL 159 44 0 0 151 42 0 0 48 13 358 Source: Company, Angel Research

- 9. JP Associates | 2QFY2011 Result Update November 1, 2010 9 Profit & Loss Statement (Standalone) Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Net Sales 3,578 4,274 6,148 10,355 14,475 18,643 % chg 7.6 19.4 43.8 68.4 39.8 28.8 Total Expenditure 2,538 2,888 4,084 7,465 10,687 13,493 Net Raw Materials 1,179 1,374 2,153 4,290 6,152 7,830 Other Mfg costs 580 575 843 1,497 2,176 2,746 Personnel 161 255 331 453 637 802 Other 618 683 757 1,225 1,834 2,216 EBITDA 1,040 1,386 2,064 2,891 3,788 5,150 % chg 33.2 48.9 40.1 31.0 36.0 (% of Net Sales) 29.1 32.4 33.6 27.9 26.2 27.6 Depreciation& Amortisation 163 203 309 456 641 773 EBIT 877 1,183 1,755 2,435 3,147 4,376 % chg 34.8 48.4 38.7 29.2 39.1 (% of Net Sales) 24.5 27.7 28.5 23.5 21.7 23.5 Interest & other Charges 257 339 504 1,056 1,272 1,878 Other Income - - - - - - (% of PBT) Share in profit of Associates - - - - - - Recurring PBT 620 844 1,251 1,379 1,874 2,498 % chg 36.0 48.3 10.2 35.9 33.3 Extraordinary Expense/(Inc.) - - - 719.5 513.2 - PBT (reported) 620 844 1,251 2,098 2,388 2,498 Tax 205 234 354 390 716 750 (% of PBT) 33.1 27.7 28.3 18.6 30.0 30.0 PAT (reported) 415 610 897 1,708 1,671 1,749 PAT after MI (reported) 415 610 897 1,708 1,671 1,749 ADJ. PAT 415 610 897 989 1,158 1,749 % chg (45.7) 46.9 47.1 10.2 17.1 51.0 (% of Net Sales) 11.6 14.3 14.6 9.5 8.0 9.4 Basic EPS (`) 3.8 5.2 6.4 4.7 5.4 8.2 Fully Diluted EPS (`) 2.0 2.9 4.2 4.7 5.4 8.2 % chg 46.9 47.1 10.2 17.1 51.0

- 10. JP Associates | 2QFY2011 Result Update November 1, 2010 10 Balance Sheet (Standalone) Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 219 234 280 425 425 425 Preference Capital - - - - - - Reserves& Surplus 2,654 4,364 6,418 8,076 9,535 11,061 Shareholder’s Funds 2,873 4,598 6,698 8,501 9,960 11,486 Minority Interest - - - - - - Total Loans 5,516 8,306 13,106 17,909 21,563 25,040 Deferred Tax Liability 499 571 720 956 956 956 Total Liabilities 8,889 13,475 20,524 27,366 32,479 37,482 APPLICATION OF FUNDS Gross Block 4,202 5,166 8,619 12,847 15,260 17,183 Less: Acc. Depreciation 1,280 1,455 1,801 2,228 2,869 3,643 Net Block 2,922 3,712 6,818 10,619 12,391 13,540 Capital Work-in-Progress 2,228 4,219 5,082 3,892 4,160 4,373 Deferred Tax Asset 9.3 11.5 30.4 32.8 32.8 32.8 Investments 1,779 3,225 4,465 5,576 6,112 6,463 Current Assets Cash 1,430 1,815 2,909 3,054 2,262 3,482 Loans & Advances 1,099 2,222 3,308 3,995 7,527 9,694 Other 1,729 1,926 2,946 6,049 7,727 9,924 Current liabilities 2,308 3,655 5,037 5,853 7,733 10,028 Net Current Assets 1,950 2,308 4,126 7,245 9,783 13,071 Misc. Exp. not written off 0 0 1 1 1 1 Total Assets 8,888 13,475 20,524 27,366 32,479 37,482

- 11. JP Associates | 2QFY2011 Result Update November 1, 2010 11 Cash Flow Statement (Standalone) Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Profit before tax 620 844 1,251 1,065 2,388 2,498 Depreciation 163 203 309 456 641 773 Change in Working Capital (294) (28) 1,709 2,725 3,330 2,069 Direct taxes paid 205 234 316 271 716 750 Cash Flow from Operations 872 841 (465) (1,474) (1,018) 453 Inc./ (Dec.) in Fixed Assets 1,890 2,955 3,324 3,077 2,681 2,136 Inc./ (Dec.) in Investments 222 1,446 891 (214) 536 351 Cash Flow from Investing 2,112 4,401 4,215 2,863 3,217 2,487 Issue of Equity 99 1,250 426 87 0 - Inc./(Dec.) in loans 1,296 2,790 4,379 4,803 3,655 3,477 Dividend Paid (Incl. Tax) 91 134 81 176 212 223 Others 304 (40) (1,049) 231 - - Cash Flow from Financing 1,000 3,946 5,772 4,482 3,443 3,254 Inc./(Dec.) in Cash (240) 386 1,093 145 (792) 1,220 Opening Cash balances 1,670 1,430 1,815 2,909 3,054 2,262 Closing Cash balances 1,430 1,815 2,909 3,054 2,262 3,482

- 12. JP Associates | 2QFY2011 Result Update November 1, 2010 12 Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 32.9 23.9 19.5 26.8 22.9 15.2 P/CEPS 23.6 17.9 14.5 12.2 11.5 10.5 P/BV 4.8 3.2 2.6 3.1 2.7 2.3 Dividend yield (%) 0.6 0.8 0.8 0.9 0.8 0.8 EV/Sales 8.5 7.7 6.0 4.0 3.2 2.6 EV/EBITDA 29.4 23.8 17.8 14.3 12.1 9.3 EV / Total Assets 3.4 2.4 1.8 1.5 1.4 1.3 Per Share Data (`) EPS (Basic) 3.8 5.2 6.4 4.7 5.4 8.2 EPS (fully diluted) 2.0 2.9 4.2 4.7 5.5 8.2 Cash EPS 5.3 6.9 8.6 10.2 10.9 11.9 DPS 0.7 1.0 1.0 1.1 1.0 1.0 Book Value 26.2 39.2 47.8 40.0 46.8 54.0 DuPont Analysis EBIT margin 24.5 27.7 28.5 23.5 21.7 23.5 Tax retention ratio 66.9 72.3 71.7 81.4 70.0 70.0 Asset turnover (x) 0.5 0.4 0.4 0.5 0.5 0.6 ROIC (Post-tax) 7.9 8.9 8.6 9.5 8.1 9.5 Cost of Debt (Post Tax) 3.1 3.5 3.4 5.5 4.5 5.6 Leverage (x) 1.4 1.4 1.5 1.6 1.8 1.9 Operating ROE 14.6 16.6 16.3 15.9 14.7 17.0 Returns (%) ROCE (Pre-tax) 9.9 10.6 10.3 10.2 10.5 12.5 Angel ROIC (Pre-tax) 16.8 18.7 17.6 14.8 13.5 15.7 ROE 14.4 16.3 15.9 13.0 12.5 16.3 Turnover ratios (x) Asset Turnover (Gross Block) 0.9 0.9 0.9 1.0 1.0 1.1 Inventory / Sales (days) 73 76 66 64 70 73 Receivables (days) 45 44 48 58 69 72 Payables (days) 255 338 353 239 206 214 W.cap cycle (ex-cash) (days) 68 43 51 95 148 168 Solvency ratios (x) Net debt to equity 1.4 1.4 1.5 1.7 1.9 1.9 Net debt to EBITDA 3.9 4.7 4.9 5.1 5.1 4.2 Interest Coverage 3.4 3.5 3.5 2.3 2.5 2.3

- 13. JP Associates | 2QFY2011 Result Update November 1, 2010 13 Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Jaiprakash Associates 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors. Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%)