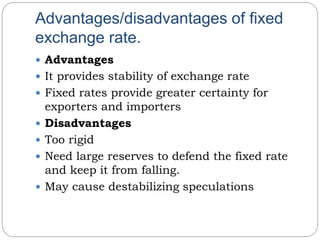

Foreign exchange involves the conversion of one country's currency into another's. It occurs in foreign exchange markets where currencies are bought and sold. The exchange rate is the rate at which one currency can be exchanged for another. There are three main types of exchange rate systems: fixed rates which maintain stability but lack flexibility, floating rates which are determined by market forces, and managed rates which permit some government influence. The purchasing power parity theory holds that exchange rates will adjust over the long run to equalize the purchasing power of currencies, while the balance of payments theory cites a country's trade flows and financial account as determining exchange rate supply and demand.