This document provides an overview of Special Drawing Rights (SDR) including:

1. SDRs were created by the IMF in 1969 as a supplemental international reserve asset to help address limitations of using gold and dollars.

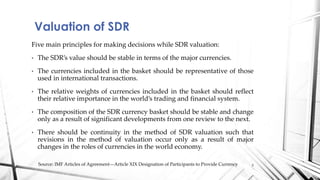

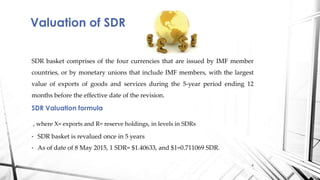

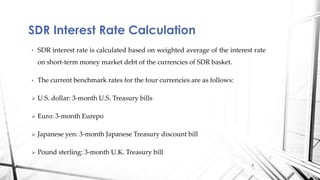

2. The value of an SDR is determined by a basket of 5 currencies - US dollar, Euro, Chinese yuan, Japanese yen, and British pound - and their relative weights are adjusted every 5 years based on trade and reserves.

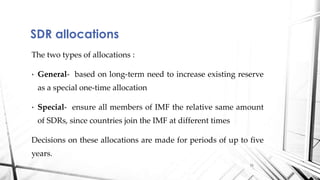

3. SDRs can be allocated to IMF member countries to supplement their official reserves, with the amount based on their IMF quota share. They can also be used in transactions with the IMF or to represent the value of international financial contracts.