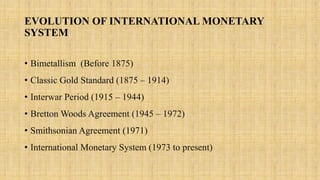

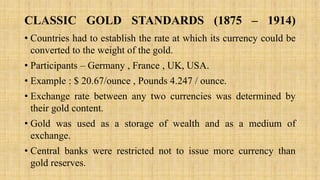

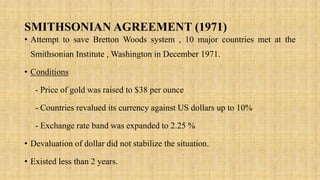

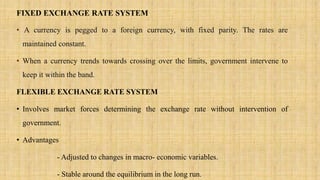

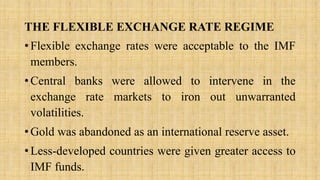

The international monetary system has evolved over time from bimetallism and the classic gold standard to the current floating exchange rate system. The Bretton Woods system established fixed exchange rates pegged to the US dollar, which was convertible to gold. It collapsed in the 1970s when the US suspended dollar convertibility. Currently, the flexible exchange rate regime categorizes systems as floating, pegging, or target zones. Floating rates are determined by market forces while pegging and target zones involve varying degrees of intervention to stabilize rates. The international monetary system facilitates global trade and investment by providing exchange rate stability and liquidity.