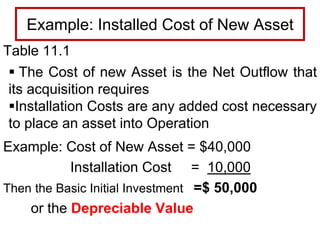

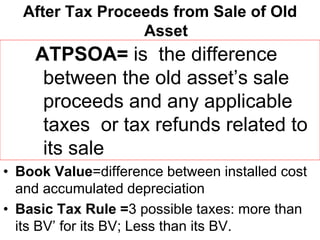

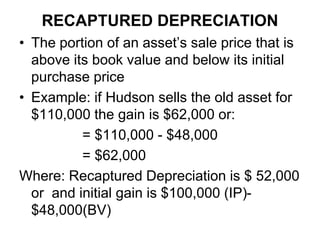

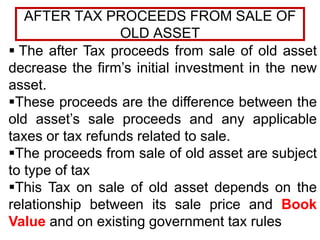

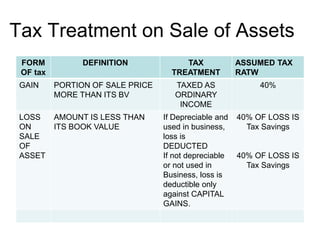

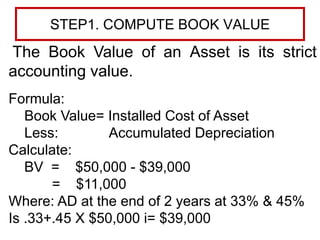

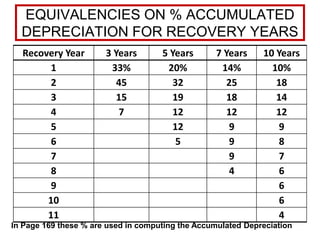

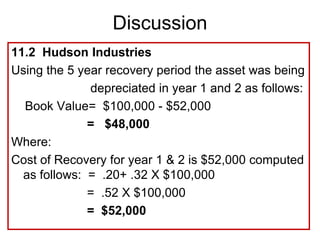

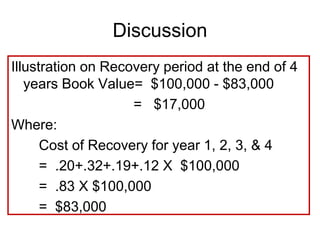

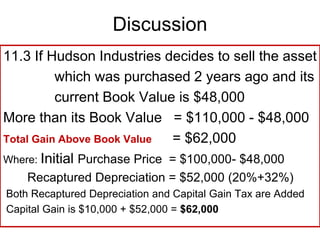

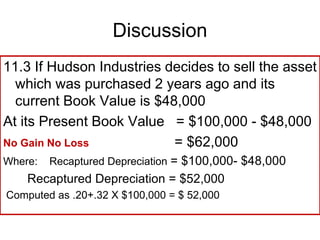

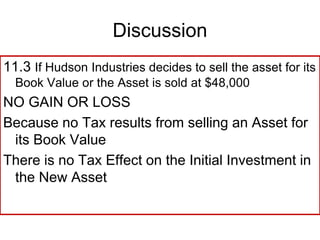

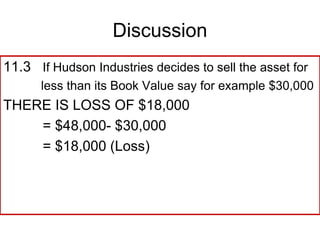

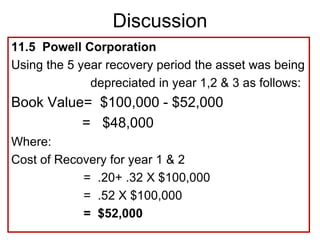

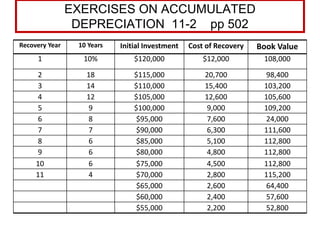

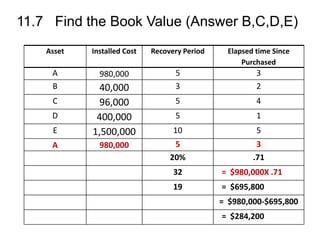

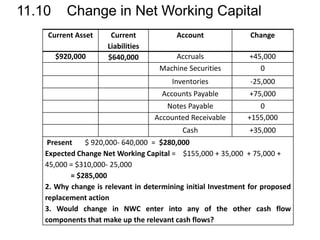

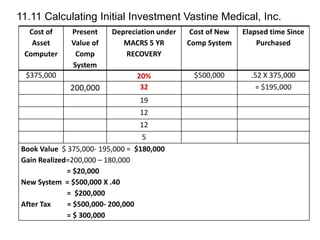

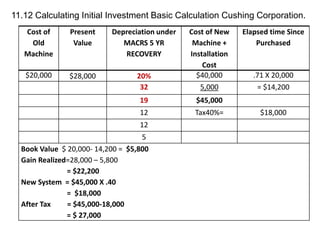

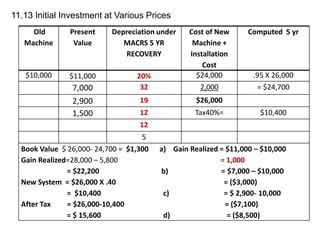

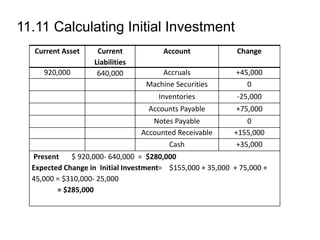

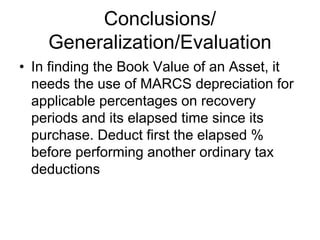

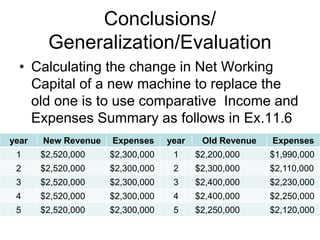

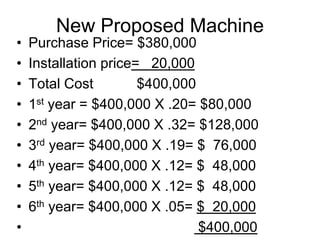

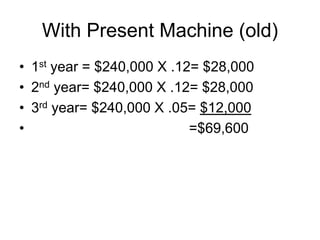

The document discusses the concept of initial investment in capital expenditures, detailing the necessary cash outflows such as the installed cost of new assets, after-tax proceeds from the sale of old assets, and changes in net working capital. It elaborates on calculating the book value and taxation rules related to asset sales, including tax implications for gains, losses, and recaptured depreciation. Additionally, it presents examples of depreciation calculations, net working capital changes, and overall investment evaluations for asset replacement.