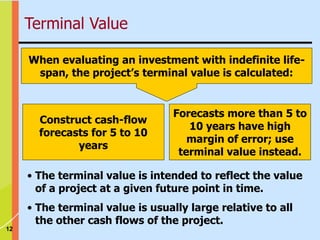

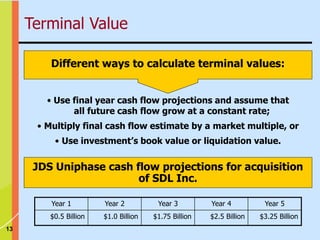

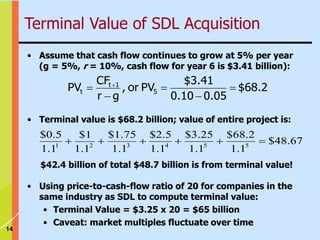

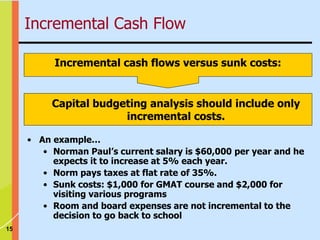

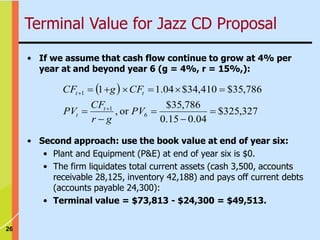

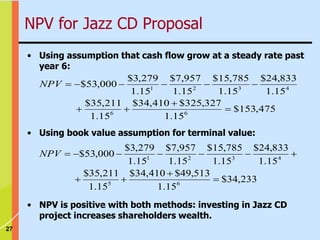

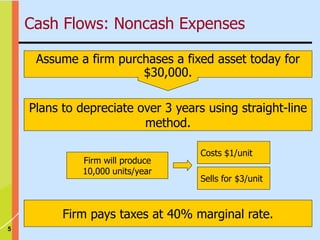

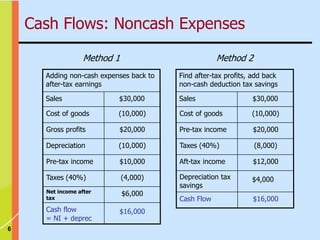

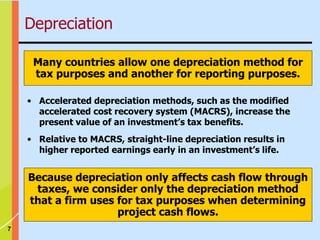

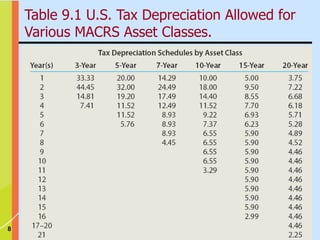

Capital budgeting focuses on cash flows rather than accounting profits. It is important to consider the timing and amounts of incremental cash inflows and outflows of a potential investment. Financing costs should be excluded from cash flow analyses. Non-cash expenses like depreciation affect cash flows through tax savings, so these tax impacts should be included. Terminal value calculations are also important to capture long-term value beyond the initial forecast period.

![11

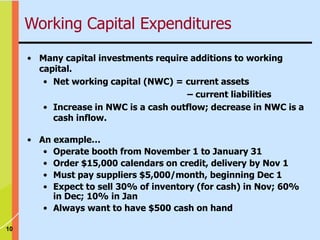

($5,000)

($5,000)

($5,000)

$0

Payments

($500)

Net cash flow

$1,500

[10%]

$9,000

[60%]

$4,500

[30%]

$0

Reduction in

inventory

Jan 1 to

Feb 1

Dec 1 to

Jan 1

Nov 1 to

Dec 1

Oct 1 to

Nov 1

Payments and

inventory

($500) +$4,000 ($3,000)

(4,000)

+500

+500

NA

Monthly in WC

(3,000)

1,000

500

0

Net WC

5,000

10,000

15,000

0

Accts payable

0

1,500

10,500

15,000

0

Inventory

$0

$500

$500

$500

$0

Cash

Feb 1

Jan 1

Dec 1

Nov 1

Oct 1

0

0

+3,000

Working Capital for Calendar Sales Booth](https://image.slidesharecdn.com/cashflows-221213075556-65989781/85/cash-flows-ppt-11-320.jpg)