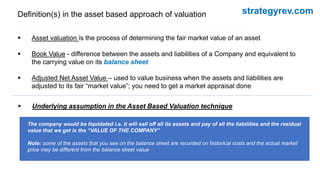

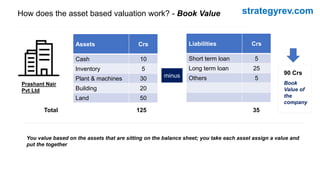

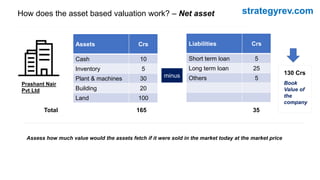

The document discusses three valuation methods: asset based, income based, and market based. The asset based approach values a company based on its assets and liabilities from the balance sheet. This can provide two potential values: book value, using carrying values, or adjusted net asset value, adjusting assets and liabilities to fair market values. The asset based approach assumes the company will liquidate and the residual value after selling assets and paying liabilities is the company's value.