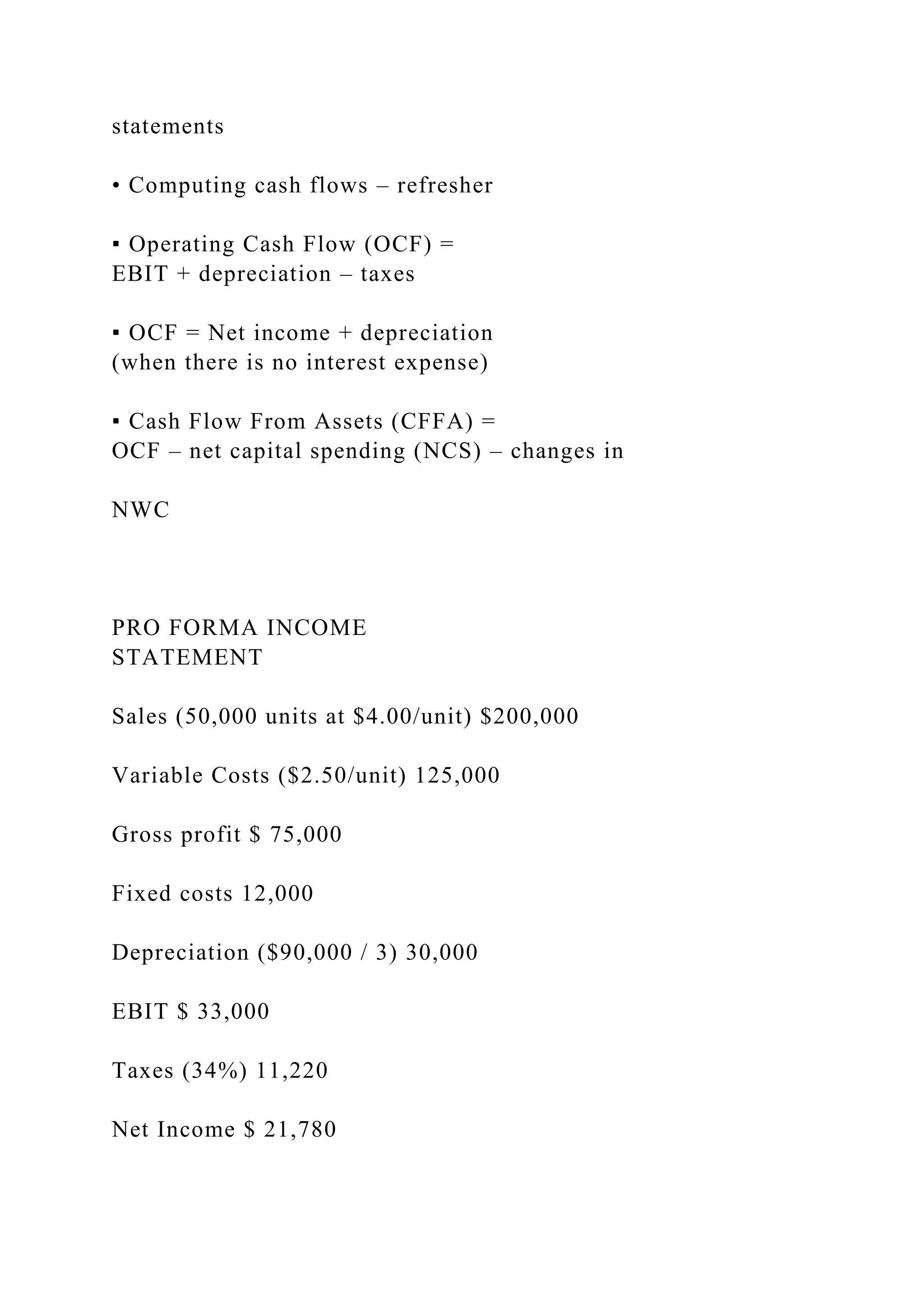

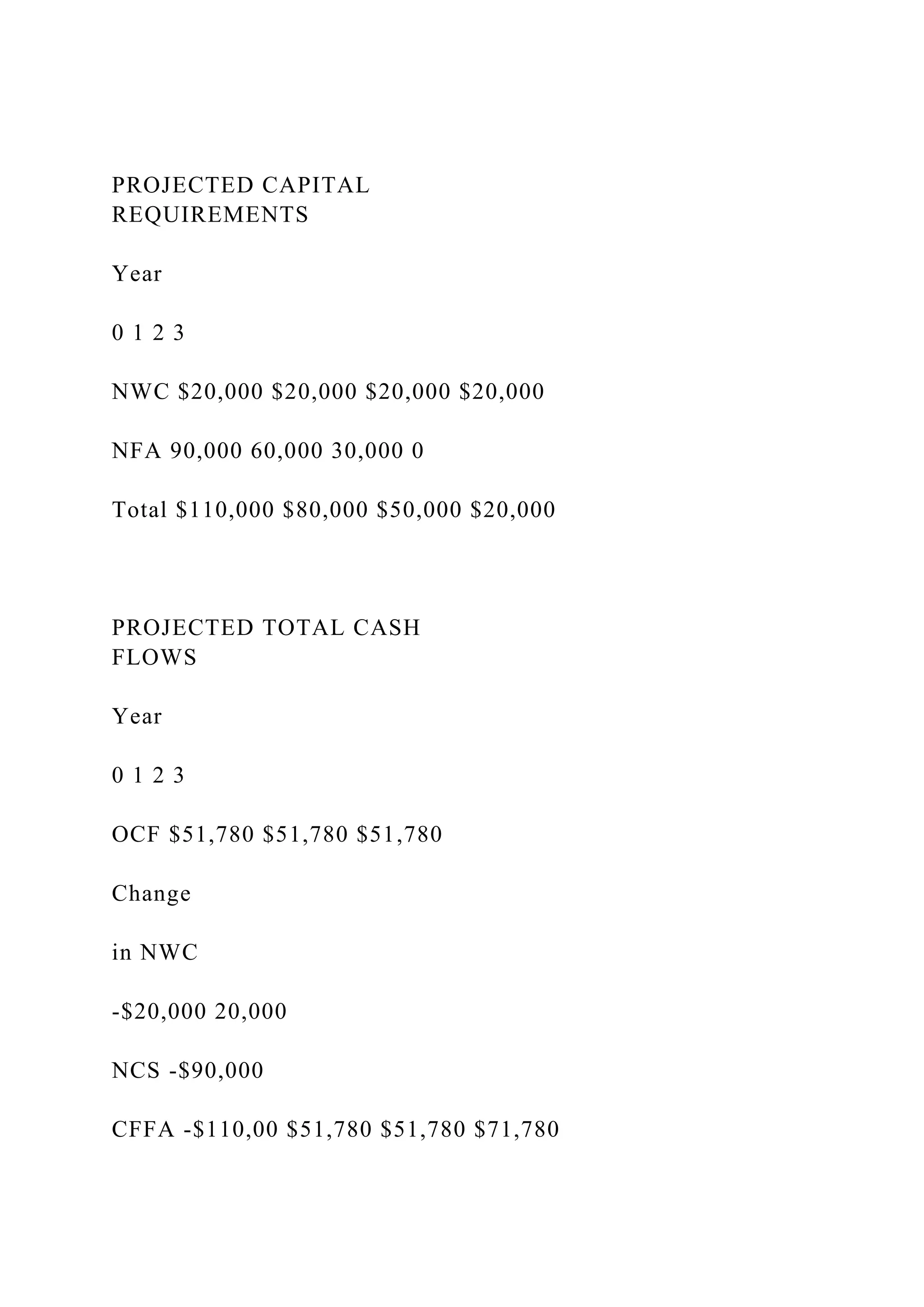

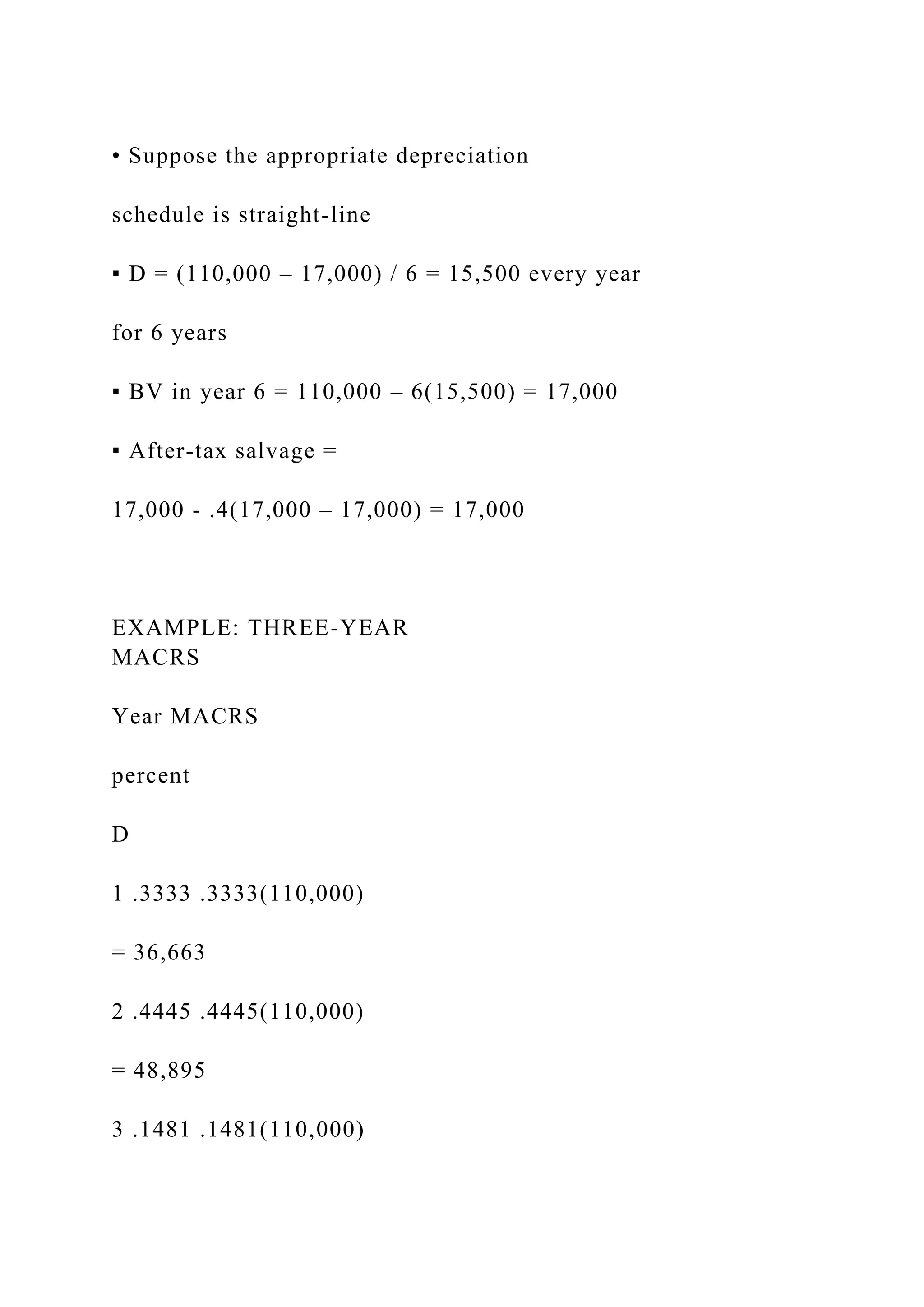

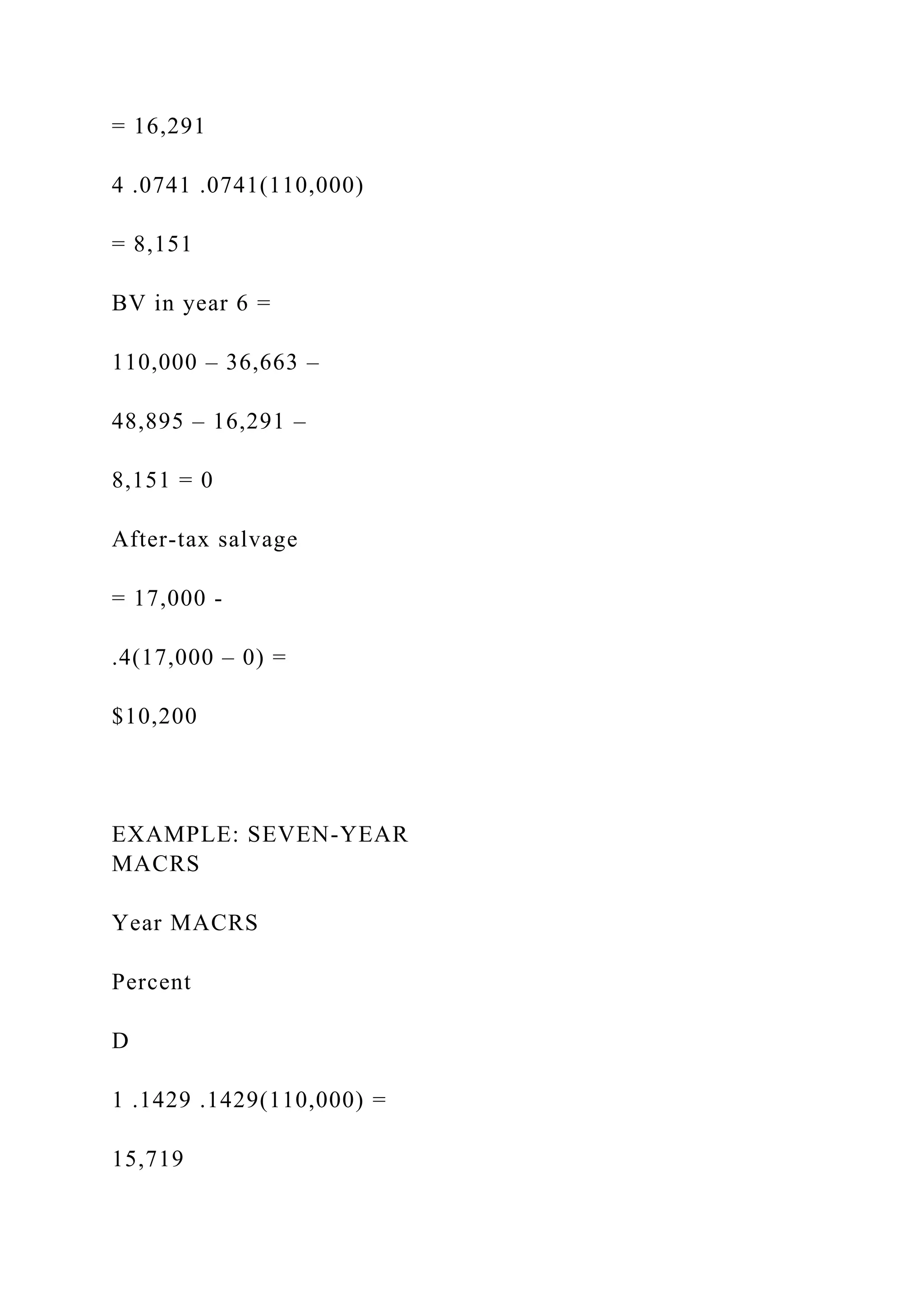

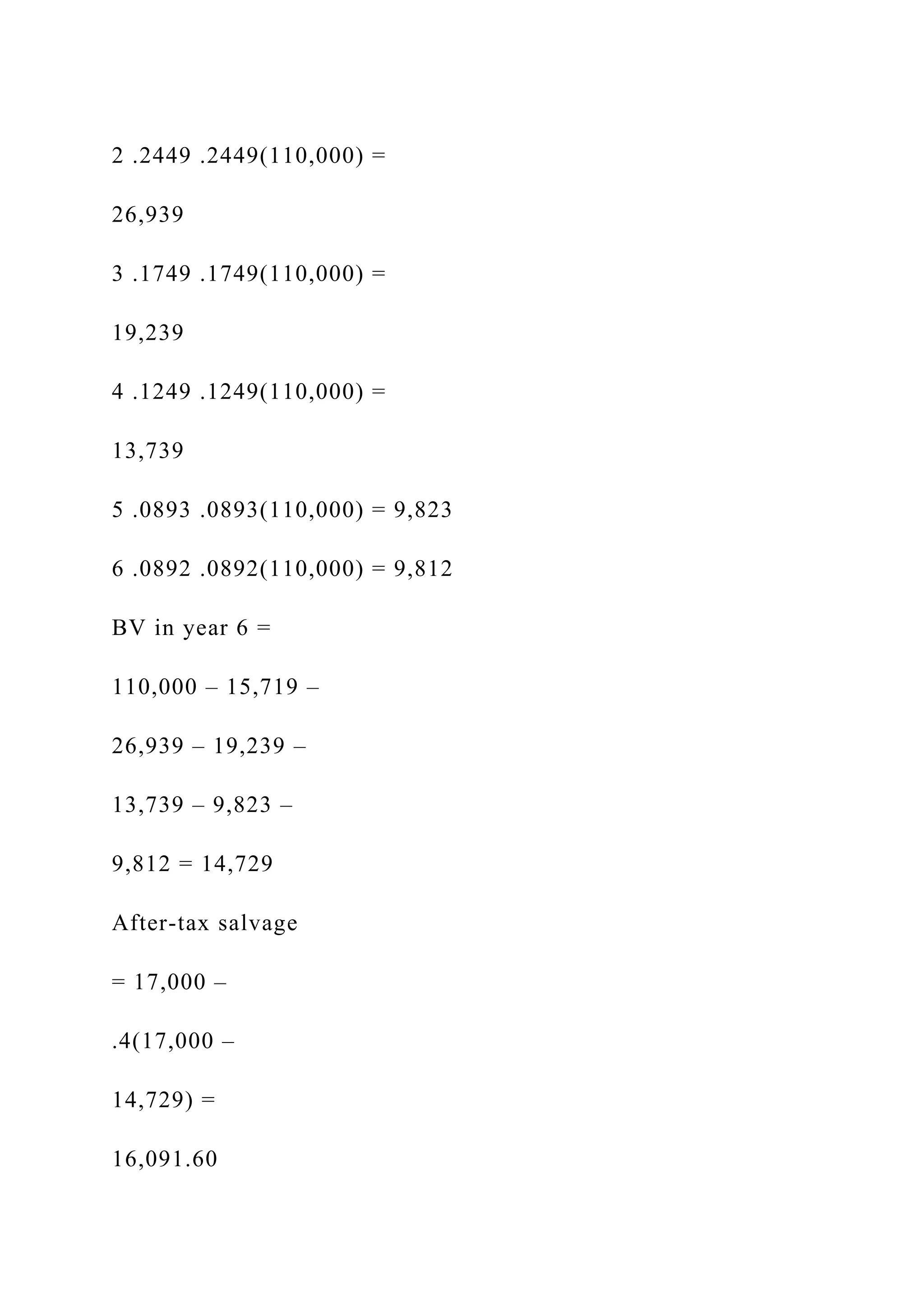

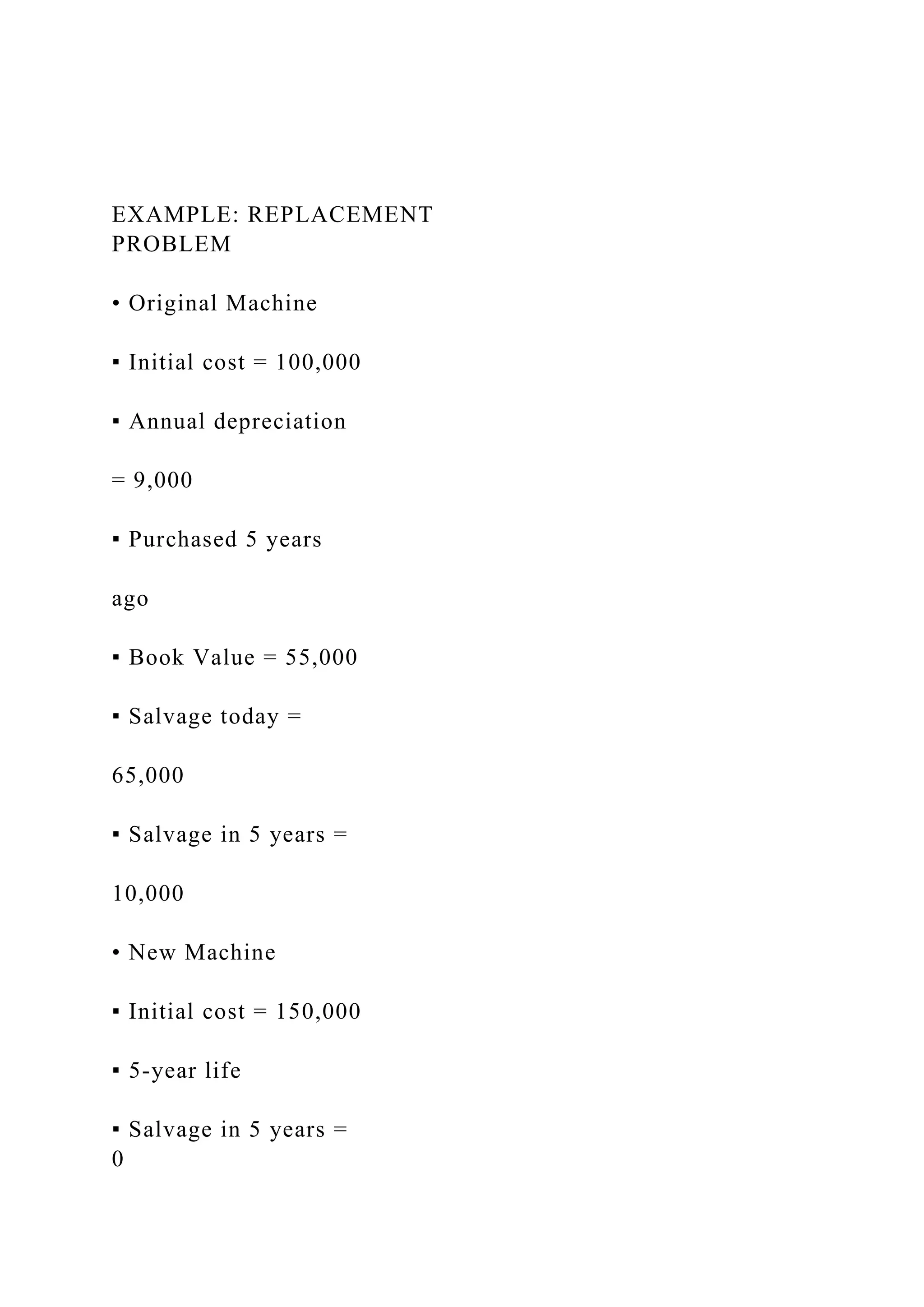

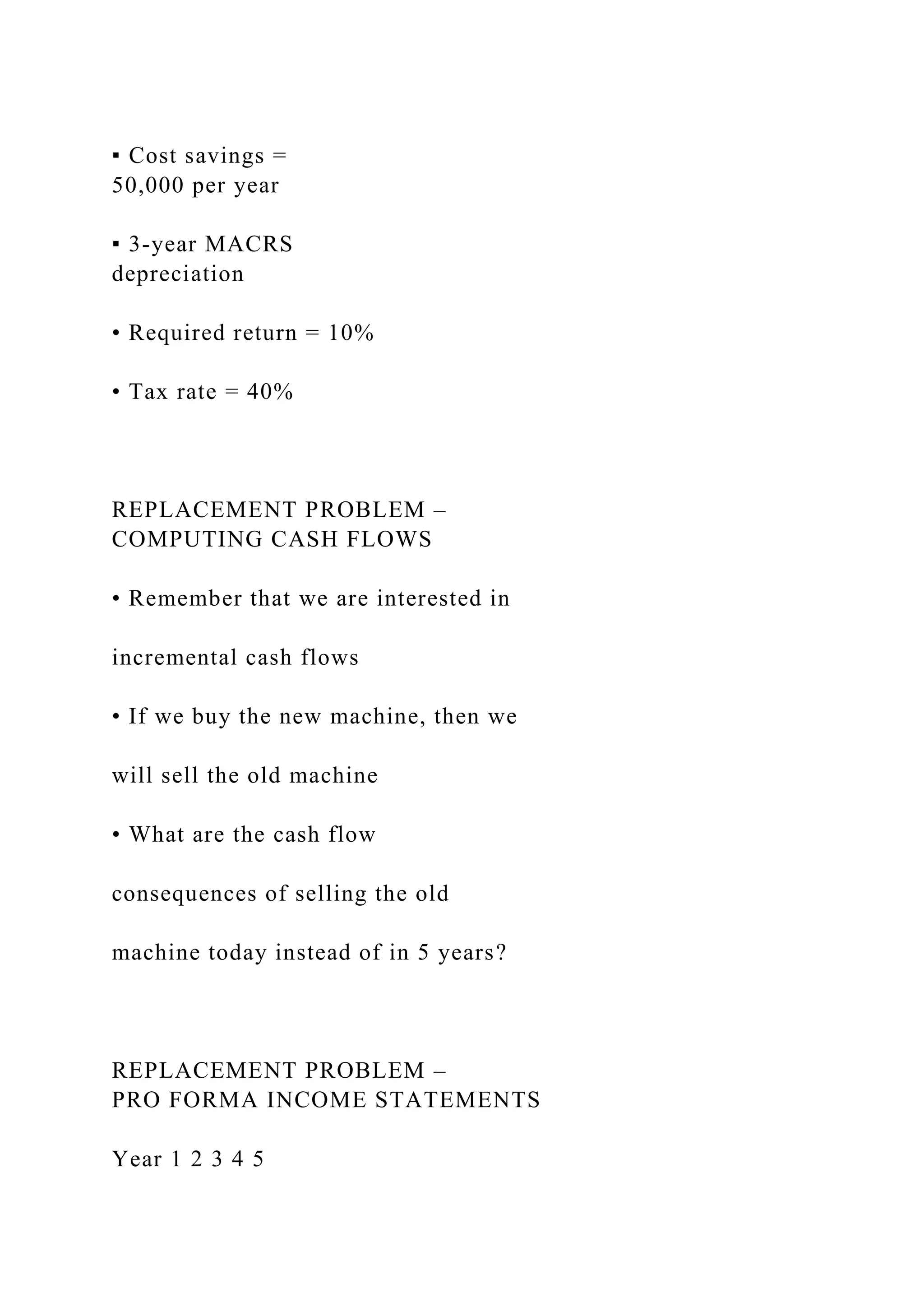

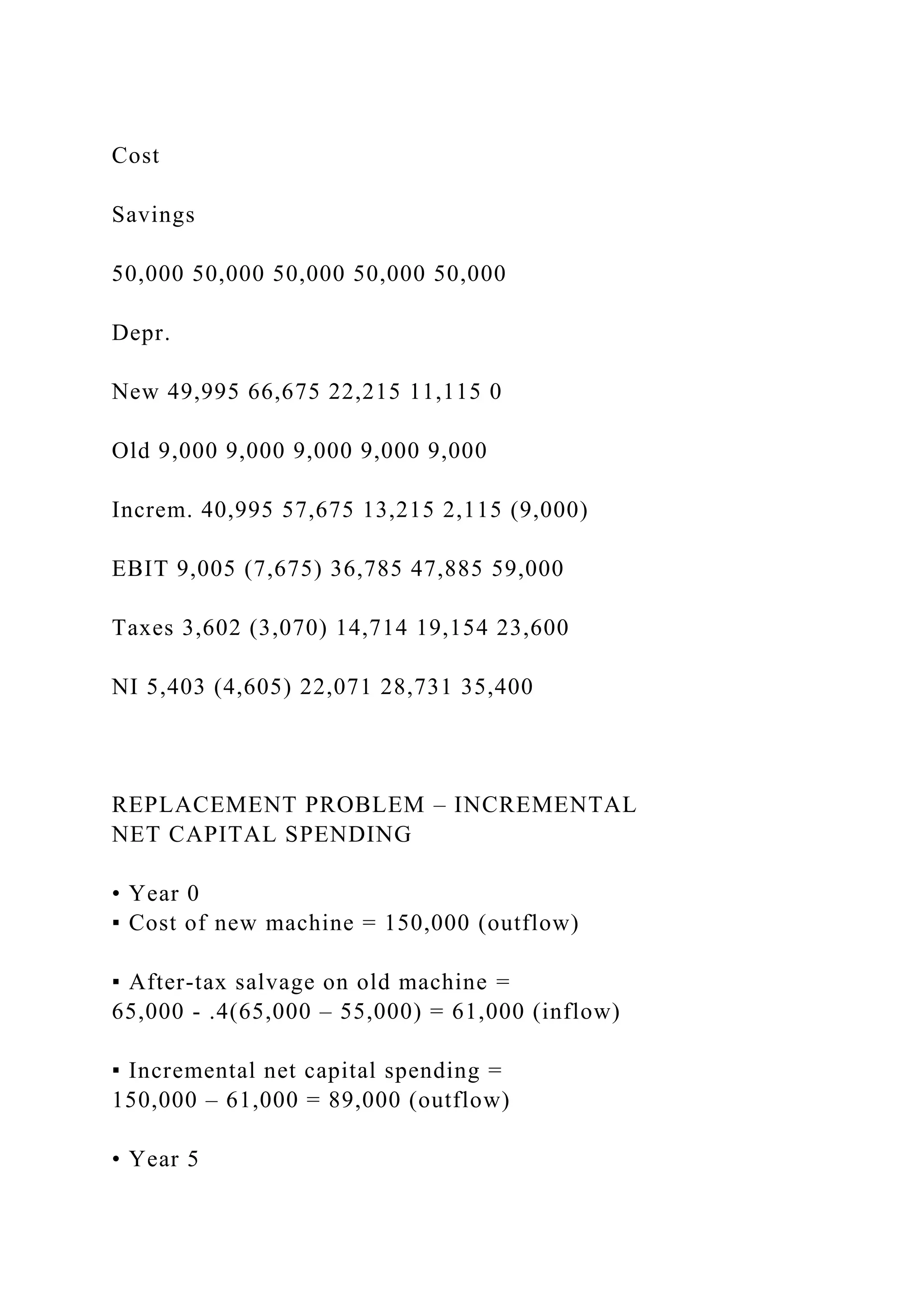

This document discusses capital budgeting decisions, emphasizing the importance of incremental cash flows that occur only if a project is accepted. It outlines common cash flow types, such as sunk costs and opportunity costs, and explains pro forma statements used in budgeting, including calculations for operating cash flow and depreciation. Additionally, the document provides examples of replacement problems and cash flow analysis, including methods for computing operating cash flow.