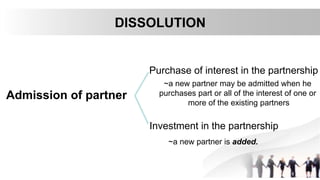

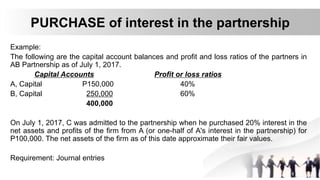

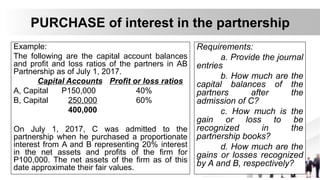

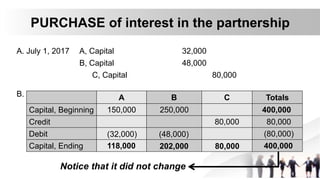

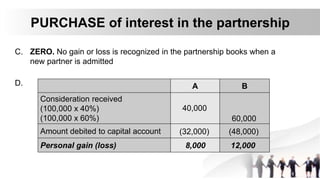

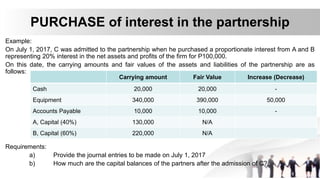

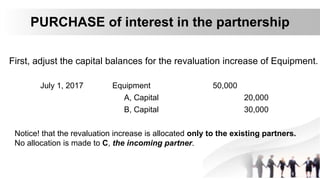

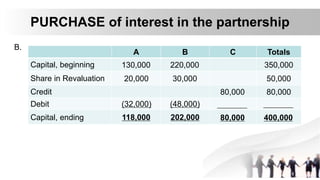

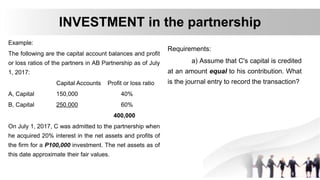

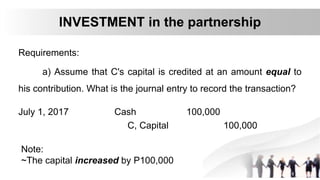

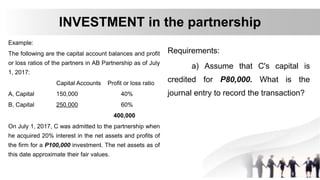

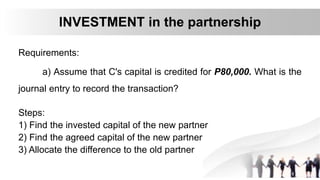

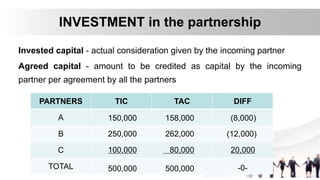

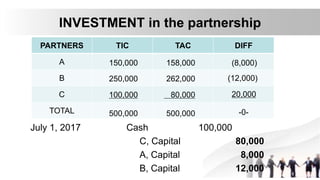

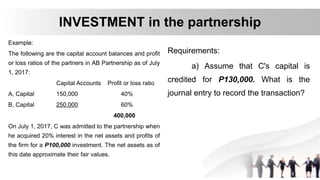

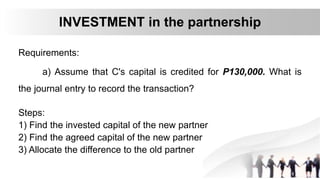

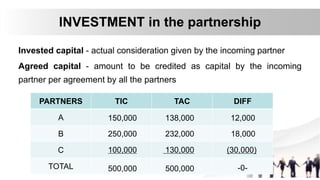

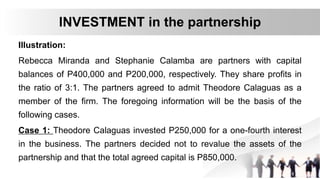

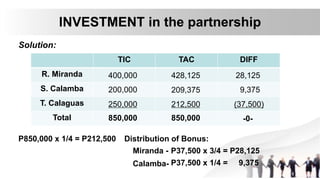

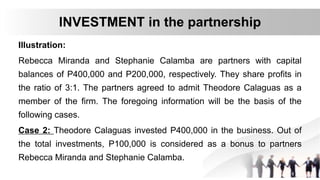

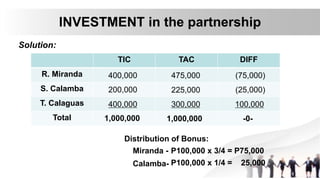

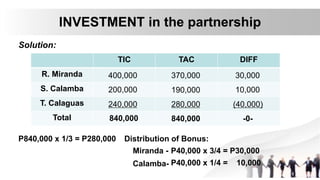

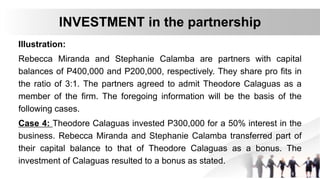

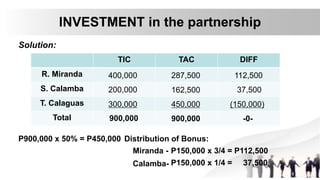

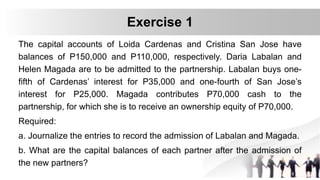

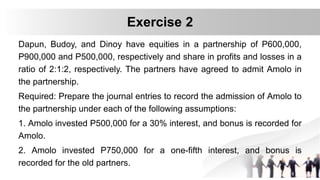

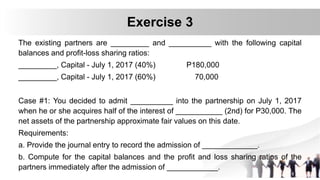

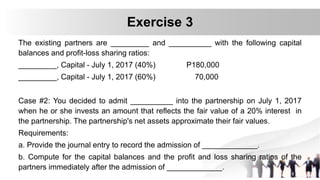

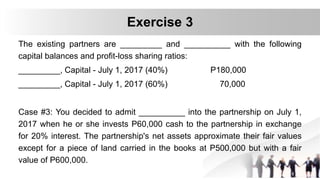

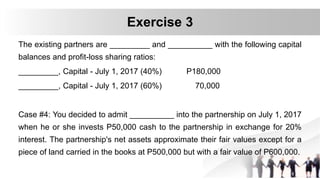

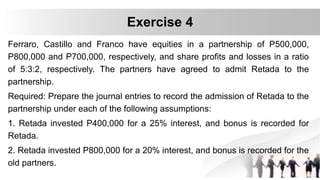

The document discusses partnership dissolution and the admission of new partners. It provides examples of admitting a new partner through the purchase of interest from existing partners or through direct investment in the partnership. When a partner purchases interest, journal entries debit the selling partners' capital accounts and credit the new partner's capital account. When a partner invests, their capital account is credited for the amount invested, with any difference allocated to existing partners. The document provides multiple examples and requirements to practice different partnership admission scenarios.