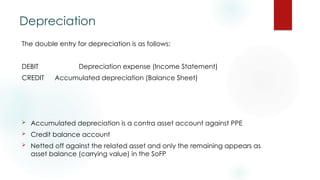

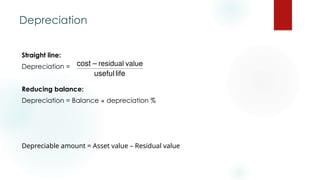

The document discusses tangible non-current assets, focusing on asset and revenue expenditures, property, plant, and equipment, and their accounting treatment under various frameworks like IFRS and US GAAP. It explains key concepts such as depreciation methods, asset revaluations, and the distinction between capital and revenue expenditures. Additionally, it covers subsequent expenditures, disposals, and the implications of various depreciation methods on financial statements.