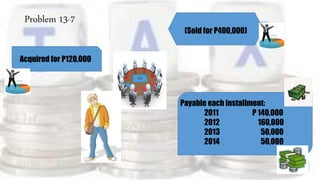

The document discusses the installment sales method for calculating taxes on property sold using a payment plan. It provides formulas for calculating selling price, contract price, initial payment, gross profit, income to report, and taxes due. Examples are given of applying the formulas to different property sale scenarios, such as residential property, inventory, and stock, to determine the taxable income and taxes owed each year based on payments received.