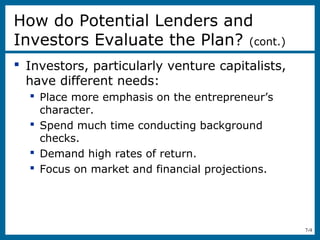

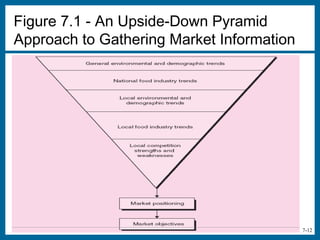

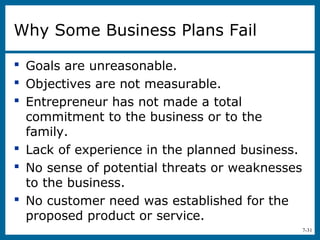

This document discusses the importance of creating a business plan when starting a new venture. It provides guidance on what should be included in each section of a business plan, such as the executive summary, marketing plan, financial plan, and appendices. The business plan is described as an important tool for entrepreneurs to assess the viability of their venture and obtain financing from lenders or investors. It also emphasizes the need to regularly update the business plan as the business and market conditions change.