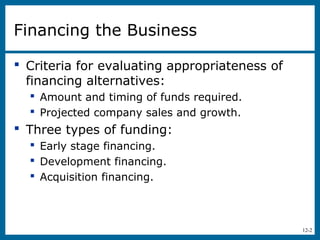

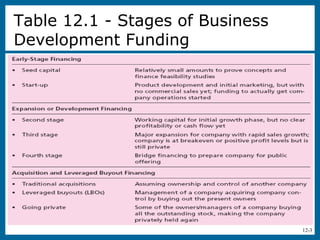

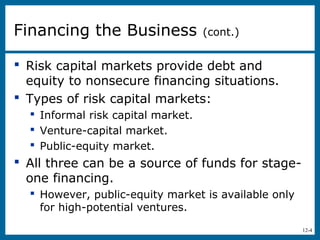

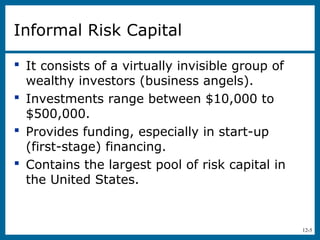

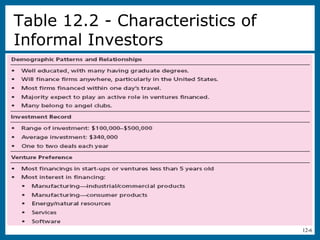

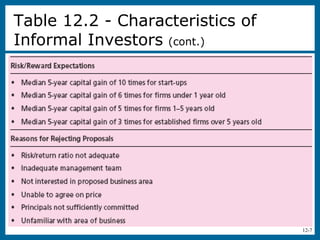

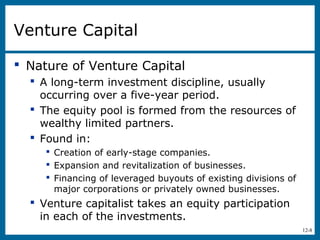

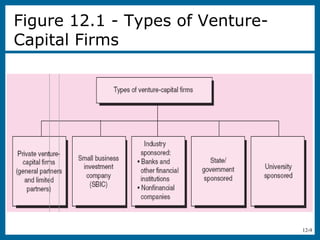

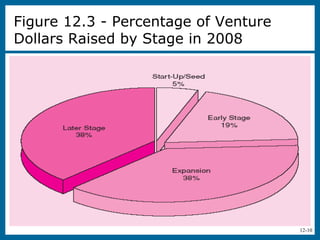

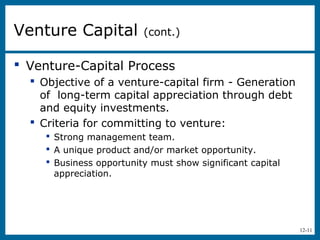

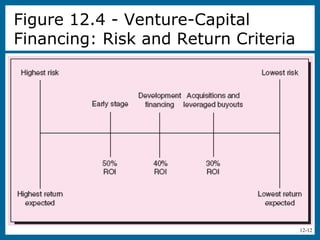

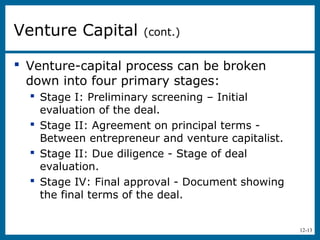

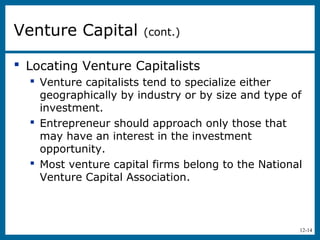

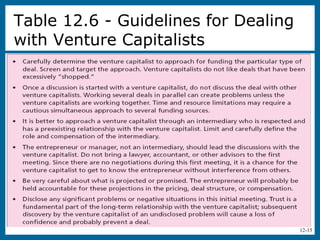

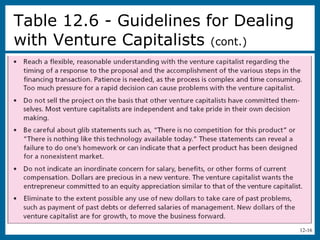

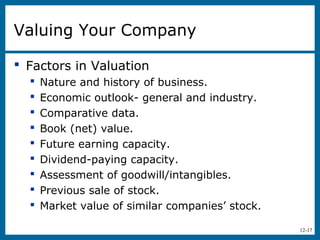

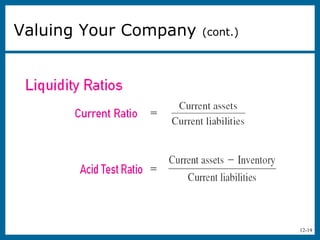

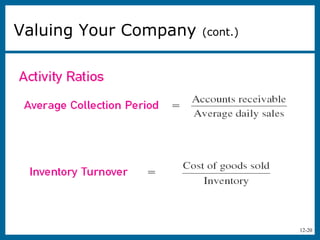

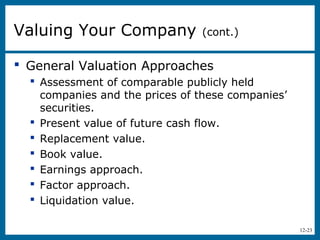

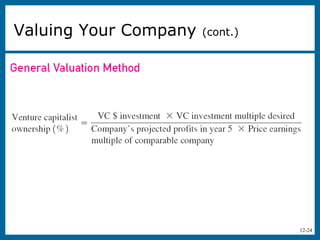

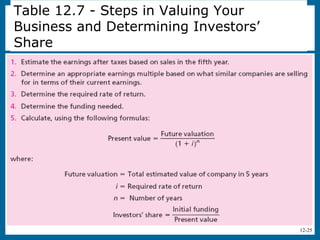

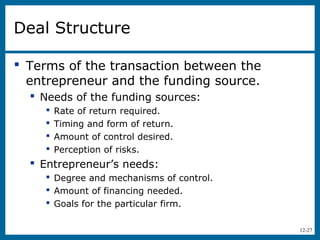

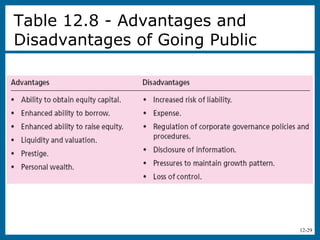

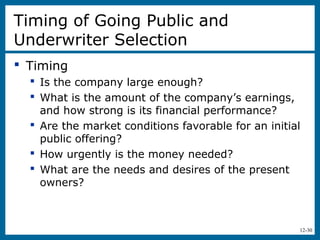

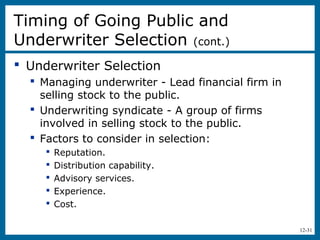

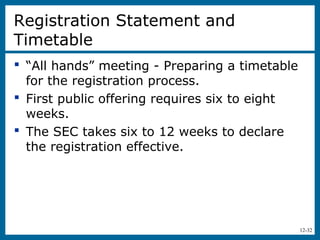

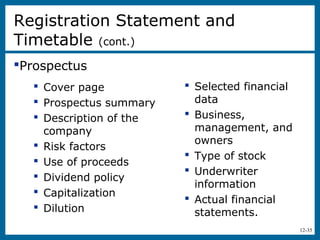

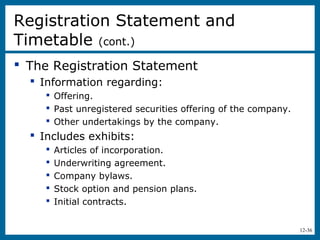

This document provides an overview of different financing options for businesses at various stages, including informal risk capital (investments from business angels), venture capital, and going public. It discusses the criteria for different financing alternatives, characteristics of informal investors and venture capital firms, the venture capital process, valuing a company, and the registration process and requirements for going public.