The document provides an overview of key components of a business plan, including:

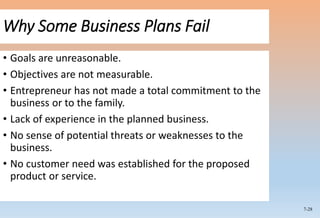

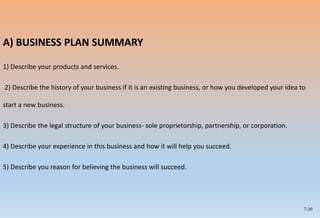

1) A business plan is a written document that describes all relevant internal and external elements of a new business venture, along with strategies for the first three years of operation.

2) An effective business plan considers the perspectives of the entrepreneur, potential investors, and marketing when determining its scope and level of detail.

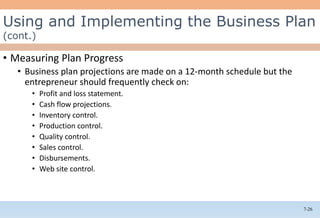

3) A well-written business plan helps determine a venture's viability, guides planning activities, and serves as an important tool for obtaining financing. Developing a business plan provides entrepreneurs a process of self-assessment.