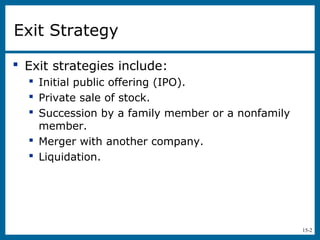

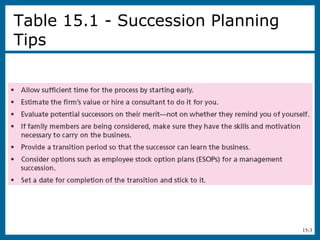

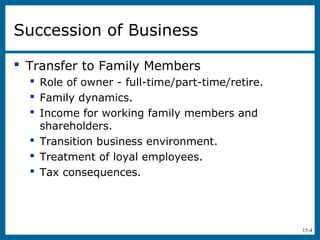

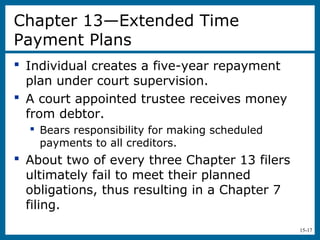

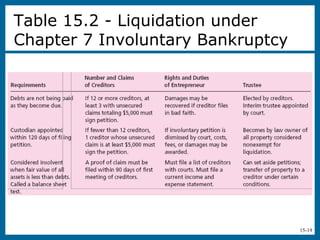

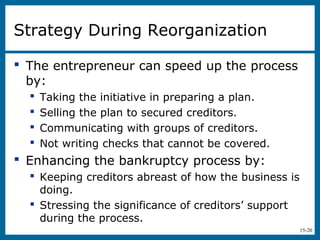

This document discusses strategies for exiting a business venture, including succession planning, selling the business, and bankruptcy options. It provides details on transferring ownership to family or non-family members, directly selling the business, using an employee stock ownership plan, or pursuing a management buyout. The different types of bankruptcy are explained, including Chapter 7 liquidation, Chapter 11 reorganization, and Chapter 13 extended payment plans. Key considerations for surviving or recovering from bankruptcy are also outlined.