CFM Full Notes (BCU)

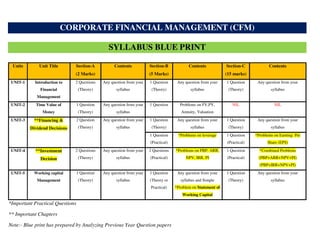

- 1. CORPORATE FINANCIAL MANAGEMENT (CFM) SYLLABUS BLUE PRINT Units Unit Title Section-A (2 Marks) Contents Section-B (5 Marks) Contents Section-C (15 marks) Contents UNIT-1 Introduction to Financial Management 2 Questions (Theory) Any question from your syllabus 1 Question (Theory) Any question from your syllabus 1 Question (Theory) Any question from your syllabus UNIT-2 Time Value of Money 1 Question (Theory) Any question from your syllabus 1 Question Problems on FV,PV, Annuity, Valuation NIL NIL UNIT-3 **Financing & Dividend Decisions 2 Question (Theory) Any question from your syllabus 1 Question (Theory) Any question from your syllabus 1 Question (Theory) Any question from your syllabus 1 Question (Practical) *Problems on leverage 1 Question (Practical) *Problems on Earning Per Share (EPS) UNIT-4 **Investment Decision 2 Questions (Theory) Any question from your syllabus 2 Questions (Practical) *Problems on PBP, ARR, NPV, IRR, PI 1 Question (Practical) *Combined Problems (PBP+ARR+NPV+PI) (PBP+IRR+NPV+PI) UNIT-5 Working capital Management 1 Question (Theory) Any question from your syllabus 1 Question (Theory or Practical) Any question from your syllabus and Simple *Problem on Statement of Working Capital 1 Question (Theory) Any question from your syllabus *Important Practical Questions ** Important Chapters Note:- Blue print has prepared by Analyzing Previous Year Question papers

- 3. CORPORATE FINANCIAL MANAGEMENT SYLLABUS

- 4. BBA CFM QUESTION PAPER PATTERN Section-A 5 X 2 = 10 (5 Questions out of 7 Questions) Section-B 3 X 6 = 18 (3 Questions out of 5 Questions) Section-C 3 X 14 = 42 (3 Questions out of 5 Questions)

- 5. Unit-1 Introduction to Financial Introduction to Financial Management

- 18. The Finance Function is a part of financial management. Financial Management is the activity concerned with the control and planning of financial concerned with the control and planning of financial resources. In business, the finance function involves the acquiring and utilization of funds necessary for efficient operations.

- 19. Investment Decisions Financing Decisions Dividend Decisions Liquidity Decisions The purpose of the finance function Objectives of Finance Functions The purpose of the finance function There are two main purposes of the finance function: To provide the financial information that other business functions require to operate effectively and efficiently To support business planning and decision-making

- 37. Favour

- 55. 1. Nature of Business. 2. Size of Business. 3. Production Techniques. 4. Purchase of old equipments. 5. Reputation of the Business. 1. Shifts in Consumer. 2. Competitive Factors. 3. Shifts in Technology. 4. Government reputations of Control.

- 57. Mr.Chethan.S Asst. Professor, Department of Management 1 UNIT-2 TIME VALUE OF MONEY (TVM) INTRODUCTION:- “A bird in the hand is worth two in the bush” is a proverb that means the things we currently have are worth a lot more than the things we have a chance of getting. A bird in the hand is worth two in the bush is often used as advice or a warning for a person who is making risky decisions or is about to risk a lot over an unknown outcome. The proverb says that the things you already own are far more valuable to you than things you hope to get because you may never actually get them. This applies to financial transactions too. Say, someone borrowed a certain amount from you and it is due. Just as you are expecting the money to be credited to your account, you get a call from the borrower saying that he will pay you after 3 months. You are not happy about this. This is because you are aware of time value of money or TVM.

- 58. Mr.Chethan.S Asst. Professor, Department of Management 2 There is no reason for any rational person to delay taking an amount owed to him or her. More than financial principles, this is basic instinct. The money you have in hand at the moment is worth more than the same amount you ‘may’ get in future. One reason for this is inflation and another is possible earning capacity. The fundamental code of finance maintains that, given money can generate interest; the value of a certain sum is more if you receive it sooner. This is why it is called as the present value. Basically, the time value of money validates that it is more beneficial to have cash now than later. Say, if you invest a Rs. 100 today – the returns will be more compared to the same investment made 2 months from now. Moreover, there is always a risk that the borrower might delay even more or not pay at all in the future. CONCEPT OF TIME VALUE OF MONEY:

- 59. Mr.Chethan.S Asst. Professor, Department of Management 3 MEANING OF TVM:- The term “Time Value of Money” refers to the Money’s worth varies according to the time period in which it is received. REASONS FOR THE TIME PREFERENCE FOR MONEY:- 1. Uncertainty and loss. 2. To satisfy present needs. 3. Investment opportunities. 4. Inflation. 5. Consumption. NEED/ APPLICATION/ IMPORTANCE OF TVM:- 1. In Investment Decision. 2. In Capital Budgeting Decision. 3. It helps in personal decisions like savings for children, buying a house etc., 4. It helps in accepting or rejecting project proposal. 5. Assessment of credit policies. 6. Determining the magnitude of risk & Uncertainty. TECHNIQUES OF TIME VALUE OF MONEY:- Techniques of TVM Compounding Technique *Future value of Single cash flow *Future Value of even cash flow *Future Value of Uneven cash flow *Future value of Annuity Discounting Technique *Present value of Single cash flow *Present Value of even cash flow *Present Value of Uneven cash flow *Present value of Annuity

- 60. Mr.Chethan.S Asst. Professor, Department of Management 4 MEANING OF PRESENT VALUE:- It refers to the current worth of a future sum of money or stream of cash flows given a specified rate of return. MEANING OF FUTURE VALUE:- It refers to the value of an asset or cash at a specified date in the future that is equivalent in value to a specified sum today. MEANING OF ANNUITY:- It is a sum of money or an investment that is paid at regular intervals. A. COMPOUNDING TECHNIQUE. i) Future value of Single cash flow FVn = PV (1+r) n Where, FVn = Future value PV = Present value r = rate of Interest n = No. of years Problem- 01 Calculate the future value of a sum of Rs.1000 if it is invested at 8% interest for a period of 1 year. Solution:-

- 61. Mr.Chethan.S Asst. Professor, Department of Management 5 Problem- 02 Calculate the future value of a sum of Rs. 5000 if it is invested at 12% interest for a period of 3 years. Solution:- Problem- 03 Mr. X invests Rs.1000 for a period of 5 years in a Bank. The rate of interest is 10%. Find the Future value. Solution:-

- 62. Mr.Chethan.S Asst. Professor, Department of Management 6 Multiple Compounding Periods If a sum of Money is compounded for 1 year at a particular rate of interest then above illustration help us to find the future Value. But if the compounding period differs, interest earned will also differ if the interest is compounded Semi annually, Quarterly or monthly; such future value is calculated by using the following formula: FV = PV [1 + r/m]mn Where, FV = Future Value PV = Present Value i.e., cash flow r = Rate of Interest n = Total no. of years m = No. of times interest is compounded in a year Problem-04 Calculate the future value of a sum of Rs.1000 if it is invested for a year with an interest compound period of Semi-annually, Quarterly and Monthly at 10%. Solution:-

- 63. Mr.Chethan.S Asst. Professor, Department of Management 7

- 64. Mr.Chethan.S Asst. Professor, Department of Management 8 Problem-05 Calculate the future value of a sum of Rs.5000 if it is invested for 2 years with an interest compounding Semi-annually, Quarterly and Monthly at 12%. Solution:-

- 65. Mr.Chethan.S Asst. Professor, Department of Management 9 ii) Future Value of even cash flow FVn = PV (1+r) n-1 + PV (1+r) n-2 + PV (1+r) n-3 + PV (1+r) n-4 ………+ PV Or FVA = PCF (1+r) n – 1 r Problem-06 Mr. Ajay deposits Rs. 6,000 at the end of each year for 5 years in his saving account. Paying 9% interest compounded annually. He wants to determine how much sum of money he will have at the end of 5th year.

- 66. Mr.Chethan.S Asst. Professor, Department of Management 10 Problem-07 Compute the Future value for the following payments made over a period of 5 years at 12% rate of interest. Year 1 2 3 4 5 Payments 3000 3000 3000 3000 3000

- 67. Mr.Chethan.S Asst. Professor, Department of Management 11 PROBLEM-08 Mr. Sushanth deposits Rs.12, 000 at the end of each year for 6 years and deposits earns compound interest at 12% p.a. Determine how much sum of money he will have at the end of 6 years.

- 68. Mr.Chethan.S Asst. Professor, Department of Management 12 iii) Future Value of Uneven cash flow FVUECF = R1 (1+r) n-1 + R2 (1+r) n-2 + R3 (1+r) n-3 + R4 (1+r) n-4 …… Where, FVUECF = Future value of Uneven cash flow R1, R2 ,R3 = Uneven cash flow r = rate of Interest n = No. of years PROBLEM-09 Calculate the Future value at the end of 5 year of the following series of payment at 9% rate of interest, Rs.2000 at the end of 1st year, Rs.4000 at the end of 2nd year, Rs.6000 at the end of 3rd year, Rs.8000 at the end of 4th year, Rs.10000 at the end of 5th year.

- 69. Mr.Chethan.S Asst. Professor, Department of Management 13 PROBLEM-10 Calculate the Future value of the following cash flow if it is invested at 8% interest p.a. At the end of the year Amount Deposited 1 1000 2 2000 3 3000 4 4000

- 70. Mr.Chethan.S Asst. Professor, Department of Management 14 iv) Future value of Annuity PROBLEM-11 Mr. Naveen deposited Rs.1000 annually in a bank for 5 years at 10% interest compounded. Calculate future value at the end of 5 years. PROBLEM-12 Mr. Anand deposited Rs.5000 annually in a bank for 5 years at 10% interest compounded. Calculate future value at the end of 4 years.

- 71. Mr.Chethan.S Asst. Professor, Department of Management 15 B. DISCOUNTING TECHNIQUES. i) Present value of Single cash flow PV = __FV____ (1+r) n Where, PV = Present value FV = Future Value r = Rate of Interest / Discounting rate n = No. of years PROBLEM-13 Mr. Mohan receive Rs.30, 000 after 5 years from now his time preference for money is 10% p.a. Find Present value. PROBLEM-14 Calculate the present value of sum of Rs.25, 000 received after 2 years if the discount rate is 8% p.a.

- 72. Mr.Chethan.S Asst. Professor, Department of Management 16 PROBLEM-15 Calculate present value of Rs.5000 received at the end of a year if the discount rate is 9% p.a. ii) Present Value of even cash flow PV = F1____ + F2____ + F3____ + F4____ + - - - - - - - - + F____ (1+r) 1 (1+r) 2 (1+r) 3 (1+r) 4 (1+r) n Where, F = Future cash flow PV = Present Value r = Rate of Interest / Discounting rate n = No. of years

- 73. Mr.Chethan.S Asst. Professor, Department of Management 17 PROBLEM-16 Find out the present value of Annuity receipt of Rs.8, 000 received for 5 years at the rate of 8% discount. PROBLEM-17 What is the present value of Annuity of Rs.9, 000 received at the end of 5th year. If it is invested at 10%.

- 74. Mr.Chethan.S Asst. Professor, Department of Management 18 iii) Present Value of Uneven cash flow PV = F1____ + F2____ + F3____ + F4____ + - - - - - - - - + F____ (1+r) 1 (1+r) 2 (1+r) 3 (1+r) 4 (1+r) n Where, F = Future cash flow PV = Present Value r = Rate of Interest / Discounting rate n = No. of years PROBLEM-18 Calculate the Present value of the following series of payments made at the end of each year for the period of 5 years at 8% interest rate. Rs. 8, 000 at the end of 1st year Rs.10, 000 at the end of 2nd year Rs.12, 000 at the end of 3rd year Rs.14, 000 at the end of 4th year Rs.16, 000 at the end of 5th year

- 75. Mr.Chethan.S Asst. Professor, Department of Management 19 PROBLEM-19 Compute the present value of cash inflows at 10% discount rate using formula method as well as table method. Year 1 2 3 4 5 Expected cash Flow 1000 2000 3000 4000 5000

- 76. Mr.Chethan.S Asst. Professor, Department of Management 20 iv) Present value of Annuity PROBLEM-20 Mr. Arun receives Rs. 1000 dividend annually for 3 years. Calculate present value of this stream of dividend at a discount of 10%?

- 77. Mr.Chethan.S Asst. Professor, Department of Management 21 PROBLEM-21 Mr. Darshan receives Rs. 3000 dividend annually for 3 years. Calculate present value at a discount of 10%?

- 78. Mr.Chethan.S Asst. Professor, Department of Management 22 DOUBLING PERIOD It refers to the method in which a particular sum of money is double in a definite period of time at a specified rate of interest. This is calculated by using the formula:- 1. Rule 72 = Doubling Period = 72 Rate of Interest 2. Rule 69 = Doubling Period = 0.35 + 69 Rate of Interest PROBLEM-22 Calculate the doubling period for a sum of Rs.8, 000 at 6% rate of Interest per annum. PROBLEM-23 Calculate the doubling period if an investor invests his deposit at 12% interest by using rule 69 and 72.

- 79. Mr.Chethan.S Asst. Professor, Department of Management 23 VALUATION Valuation is the process of estimating the worth of something having economic or monetary value. It is usually expressed as a price/ earnings ratio. METHODS OF VALUATION: 1. Book Value 2. Market Value 3. Liquidation Value 4. Replacement Value 5. Going concern Value A. VALUATION OF BOND/ DEBENTURE: 1. Redeemable Bond/ Debenture PV of Debenture = I1____ + I2____ + I3____ + M3____ (1+r) 1 (1+r) 2 (1+r) 3 (1+r) 3 Where, PVB = Present Value of Bond I = Interest amount received r = Discounting rate/ Capitalization rate M = Maturity value PROBLEM-24 A Debenture is available for Rs.1000. It has interest amount of Rs.80 per year for a period of 5 years with the capitalization rate of 12%. The bond has the maturity value of Rs.1140. Advice the investor in his buying decision.

- 80. Mr.Chethan.S Asst. Professor, Department of Management 24

- 81. Mr.Chethan.S Asst. Professor, Department of Management 25 PROBLEM-25 A Debenture is available in the market for Rs.1000 with Rs.80 as interest for a year for a period of 4 years with the maturity value of Rs.1120. The debentures capitalization rate is 10%. Advice Mr.Pavan in his buying decision of this debenture. -

- 82. Mr.Chethan.S Asst. Professor, Department of Management 26 2. Irredeemable Bond/ Debenture PV of Debenture = I____ r Where, PVB = Present Value of Bond I = Interest amount received r = Discounting rate/ Capitalization rate PROBLEM-26 What is the value of Irredeemable debentures which as Rs.60 as the interest for infinite period with the discount rate at 9%. PROBLEM-27 How much an investor has to pay for the following debt instrument whose interest per year is Rs.70. Its capitalization rate is 11%.

- 83. Mr.Chethan.S Asst. Professor, Department of Management 27 B. VALUATION OF PREFERENCE SHARE: 1. Redeemable Preference share PV of Preference share = D1____ + D2____ + D3____ + M3____ (1+r) 1 (1+r) 2 (1+r) 3 (1+r) 3 Where, PVPS = Present Value Redeemable Preference share D = Dividend of the year r = Discounting rate/ Capitalization rate M = Maturity value PROBLEM-28 How much an investor has to pay for the redeemable preference shares which has dividend of Rs.70 per year for next 4 year with maturity value of Rs.1150. The capitalization rate is 8%.

- 84. Mr.Chethan.S Asst. Professor, Department of Management 28 PROBLEM-29 A preference share is available in the stock market with the following information: a. Maturity value of preference share Rs.1120. b. Dividend amount of Rs.50 per year. c. Maturity period is 4 years. d. Discount rate is 8%.

- 85. Mr.Chethan.S Asst. Professor, Department of Management 29 2. Irredeemable Preference share PVIPS = D____ r Where, PVIPS = Present Value Irredeemable Preference share D = Dividend of the year r = Discounting rate/ Capitalization rate PROBLEM-30 A company issued 8% irredeemable preference share of Rs.100 each. The capitalization rate is 6%. Compute present value of preference shares. PROBLEM-31 Compute the present value of 7% Irredeemable preference shares of Rs.100 each. If the capitalization rate is 11%.

- 86. Mr.Chethan.S Asst. Professor, Department of Management 30 C. VALUATION OF EQUITY SHARE: 1. Dividend Capitalization Model a. Single Period Valuation Model PVES = D1____ + P1____ (1+r) 1 (1+r) 1 Where, PVES = Present Value Equity share D1 = Dividend paid in the 1st year P1 = Sale price of equity share at the end of the year r = Discounting rate/ Capitalization rate PROBLEM-32 Mr. Raghu holds an equity share which has the features of getting Rs.20 as dividend for the First year. He aspects to sell the same share for Rs.190 at the end of the year. What is the value today if the capitalization rate is 11%.

- 87. Mr.Chethan.S Asst. Professor, Department of Management 31 PROBLEM-33 Mr. Anand is planning to buy an equity share hold it for 1 year and then sells it. The expected dividend at the end of the year is Rs.8 and expected rates is Rs.220 at the final year. Determine the value of equity share if the capitalization rate is 14%. b. Two period Valuation Model PVES = D1____ + D2____ + P1____ (1+r) 1 (1+r) 2 (1+r) 2 Where, PVES = Present Value Equity share D1 & D2 = Dividend paid in the 1st & 2nd year P1 = Sale price of equity share at the end of 2nd year r = Discounting rate/ Capitalization rate

- 88. Mr.Chethan.S Asst. Professor, Department of Management 32 PROBLEM-34 Mr. Raj is holding the equity share of a company which has the following features. The dividend of 1st and 2nd year is Rs.8 and Rs.10. The discount rate is 9%. The sale price of equity share at the end of 2nd year is Rs.160. Calculate the present value of equity share.

- 89. Mr.Chethan.S Asst. Professor, Department of Management 33 PROBLEM-35 Mr. Ashok is planning to buy an equity share hold it for two years then sale it. The expected dividend at the end of 1st year and 2nd year is Rs.10 and Rs.12. expected selling price of share at the end of 2nd year is Rs.280. Discount rate is 16%.

- 90. Mr.Chethan.S Asst. Professor, Department of Management 34 c. When dividend rate is constant PVES = D1____ r Where, PVES = Present Value Equity share D1 = Dividend r = Discounting rate/ Capitalization rate PROBLEM-36 XYZ Co., ltd currently paying a dividend of Rs.30 per share. It is expected that the company will pay the same dividend in the future. The current capitalization rate is 16%. What is the present value of equity share. PROBLEM-37 Calculate the present value of equity share. If the dividend is Rs.20 per share for an infinite period with the capitalization rate is 16%.

- 91. Mr.Chethan.S Asst. Professor, Department of Management 35 d. When the dividend is growing at constant rate PVES = D1____ r - g Where, PVES = Present Value Equity share D1 = Dividend r = Discounting rate/ Capitalization rate g = Growth rate PROBLEM-38 A Company is expected to pay dividend of Rs.8 per share by next year. The dividends are expected to grow continuously at the rate of 10%. What is the value of equity share, if the required rate of return is 12%. PROBLEM-39 An investor is planning to purchase a equity share which has the following features: The current dividend is Rs.30. The discount rate is 16%. The growth rate is 8%.

- 92. Mr.Chethan.S Asst. Professor, Department of Management 36 e. When the dividend rate is growing at variable rate Procedure: Step 1: Calculate the present value of Dividend Step 2: Find out the present value of equity share at the end of year with constant growth in dividend. Step 3: Find out present value of equity share today PROBLEM-40 A Company is expected to pay a dividend of Rs.5 per share. After a year its dividends are expected to grow 14% for next 5 years and then at the rate of 7% indefinitely. Find out the PVES if the capitalization rate is 11%.

- 93. Mr.Chethan.S Asst. Professor, Department of Management 37

- 94. Mr.Chethan.S Asst. Professor, Department of Management 38 PROBLEM-41 A Company is currently paying a dividend of Rs.4 per share. The dividend is expected to grow at 16% for next 5 years and at 11% forever. What is the present value of the share? If the capitalization rate is 14%.

- 95. Mr.Chethan.S Asst. Professor, Department of Management 39

- 96. Mr.Chethan.S Asst. Professor, Department of Management 40 2. Earning Capitalization Model PVES = E___ r Where, PVES = Present Value Equity share E = Earning per share r = Discounting rate/ Capitalization rate PROBLEM-42 Calculate the present value of equity share of a company which earns Rs.1, 00,000 which is to be distributed among 10,000 shareholders with the capitalization rate is 12%. PROBLEM-43 Calculate the price of equity share according to earning capitalization model. When earning per share is Rs.22 with the capitalization rate is 13%. e capitalization rate is 13%.

- 97. Chethan. S Asst Prof., Department of Management 1 CORPORATE FINANCIAL MANAGEMENT III SEMESTER BBA UNIT-3 FINANCING DECISION AND DIVIDEND DECISION A. FINANCING DECISION FINANCING DECISION: Financing decision involves determining different sources of finance from which funds may be raised and proportion of each source finance. Financial manager can raise funds from both debt and equity sources of finance keeping in mind the cost, control and risk of each source of finance. However, he has to ensure the best debt-equity mix to maximize the wealth of the shareholders. The mix of debt and equity is known as capital structure. CAPITALISATION Capitalization means all the money received by that business in exchange for long - term debt and equity Capitalization is the total value of a company’s outstanding shares. It is calculated by multiplying the number of shares by their current price. The market capitalization formula is: MC = N x P Where MC stands for market capitalization N stands for the number of outstanding shares P is the closing price per share Depending on their size, companies are generally classified as large-cap (typically $10 billion+), mid-cap ($2 billion to $10 billion) or small-cap (typically $300 million to $2 billion).

- 98. Chethan. S Asst Prof., Department of Management 2 MEANING OF CAPITAL STRUCTURE OR FINANCING DECISION Capital Structure is the mix of different sources of long-term funds such as equity shares, preference shares, long-term loans or debts like debentures or bonds, retained earnings etc., in the total capitalization of the company. In simple words, capital structure refers to the mix of debt and equity. For example, if company has equity shares of Rs.1,00,000, debentures of Rs.1,00,000, preference shares of Rs.1,00,000 and retained earnings of Rs.50,000. The capital structure of the firm is said to be Rs.3,50,000. CAPITAL STRUCTURE AND FINANCIAL STRUCTURE The term capital structure differs from financial structure. Capital structure refers to the mix of different sources of long-term funds only whereas financial structure refers to the mix of both long-term funds as well as short-term funds. Thus, a company’s capital structure is only a part of its financial structure. Patterns of Capital Structure In case of a new company the capital structure may be of any of the following four patterns. i) Capital structure with equity shares only. ii) Capital structure with both equity and preference shares. iii) Capital structure with equity shares and debentures. iv) Capital structure with equity shares, preference shares and debentures.

- 99. Chethan. S Asst Prof., Department of Management 3 The choice of an appropriate capital structure depends on a number of factors such as the nature of the company’s business, regularity of earnings, conditions of the money market, attitude of the investors, etc. Since the capital structure is the mix of debt and equity, it is better to understand the basic difference between these two: Debt is a liability on which interest has to be paid irrespective of the company’s profits, while equity consists of shareholders’ or owners’ funds on which payment of dividend depends upon the company’s profits. A high proportion of the debt content in the capital structure increases the risk and may lead to financial insolvency of the company in adverse times. However, raising funds through debt is cheaper as compared to raising funds through shares. This is because of two reasons: i) Interest payable on debt is allowed as an expense for tax purpose whereas dividend is considered to be an appropriation of profits hence payment of dividend does not result in any tax benefit to the company. (ii) Cost of debt is less than cost of equity. For example, if a company is in 50% tax bracket, pays interest at 12% on its debentures, the effective to it comes only to 6%. While if the amount is raised by issue of 12% preference shares, the cost of raising the amount would be 12%. Thus, raising funds by debt is cheaper resulting in higher availability of profits for shareholders. This increases the earnings per equity share of the company which is the basic objective of a finance manager.

- 100. Chethan. S Asst Prof., Department of Management 4 OPTIMAL CAPITAL STRUCTURE The optimum capital structure may be defined as the relationship of debt and equity securities, which minimizes the firm’s cost of capital and thereby maximizes the value of the firm. The optimum capital structure is the combination of debt and equity which maximizes the value of the firm. Optimum capital structure maximizes the value of the company and hence the wealth of its owners and minimizes the company’s cost of capital. Thus, the optimum capital structure is obtained when the market value per equity share is the maximum. Thus, the objective of the firm should, therefore, be to select debt-equity mix which leads to maximum value of the firm. Principles of Capital structure decisions:- a) Cost Principle Cost Principle: this principle deals with the ideal capital structure which should minimize cost of financing and maximize the earnings per share. The cheaper form of capital structure is debt capital. b) Risk Principle Risk Principle: this principle deals with the capital structure which should not accept high risk. If company issue large amount of preference shares out of the earnings of the company then less amount will be left out for equity shareholders as dividend is paid after the preference shares. c) Control Principle Control Principle: this principle deals with the capital structure which is keeping the controlling position of owners. Preference shareholders possesses no voting rights and don't disturb positions. d) Flexibility Principle Flexibility Principle: this principle deals with capital structure which can have additional requirements of funds in future. e) Timing Principle Timing Principle: this principle deals with capital structure which should be able to have market opportunities and which should be able to minimize cost of raising funds and obtain the savings.

- 101. Chethan. S Asst Prof., Department of Management 5 FEATURES OF CAPITAL STRUCTURE 1. Profitability. 2. Solvency. 3. Flexibility. 4. Control. 5. Simplicity. 6. Liquidity. FACTORS DETERMINING THE CAPITAL STRUCTURE 1. Trading on Equity or Financial Leverage: The use of long-term fixed interest bearing debt and preference share capital along with equity share capital is called financial leverage or trading on equity. The use of long-term debt increases magnifies the earnings per share if the firm yields a return higher than the cost of debt. The earnings per share also increase with the use of preference share capital but due to the fact that interest is allowed to be deducted while computing tax, the leverage impact of debt is much more. 2. Growth and stability of sales: The capital structure of a firm is highly influenced by the growth and stability of its sales. If the sales of a firm are expected to remain fairly stable, it can raise a higher level of debt. Stability of sales ensures that the firm will not face any difficulty in meeting its fixed commitments of interest payment and repayments of debt. Similarly, the rate of growth in sales also affects the capital structure decision. 3. Cash flow ability to service debt: A firm which shall be able to generate larger and stable cash inflows can employ more debt in its capital structure as compared to the one which has unstable and lesser ability to generate cash inflows. Debt financing implies burden of fixed charge sue to the fixed payment of interest and the principal. 4. Nature and size of the firm Nature and size of a firm also influences its capital structure. A public utility concern has different capital structure as compared to other manufacturing concern. Public utility concerns may employ more of debt because of stability and regularity of their earnings. On the other hand, a concern which cannot provide stable earnings due to the nature of its business will have to rely mainly on equity capital. 5. Control Whenever additional funds are required by a firm, the management of the firm wants to raise the funds without any loss of control over the firm. In case the funds are raised through the issue of equity shares, the control of the existing shareholders is diluted.

- 102. Chethan. S Asst Prof., Department of Management 6 Hence, they might raise the additional funds by way of fixed interest bearing debt and preference share capital. Preference shareholders and debenture holders do not have the voting right. Hence, from the point of view of control, debt financing is recommended. 6. Cost of Capital: Every rupee invested in a firm has a cost. Cost of capital refers to the minimum return expected by its suppliers. The capital structure should provide for the minimum cost of capital. The main sources of finance for a firm are equity, preference share capital and debt capital. The return expected by the suppliers of capital depends upon the risk they have to undertake. Usually, debt is a cheaper source of finance compared to preference and equity capital due to (i) fixed rate of interest of debt; (ii) legal obligation to pay interest; (iii) repayment of loan and priority in payment at the time of winding up of the company. 7. Flexibility: Capital structure of a firm should be flexible, i.e., it should be such as to be capable of being adjusted according to the needs of the changing conditions. It should be possible to raise additional funds, whenever the need be, without much of difficulty and delay. A firm should arrange its capital structure in such a manner that it can substitute one form of financing by another. Redeemable preference shares and convertible debentures may be preferred on account of flexibility. Preference shares and debentures which can be redeemed at the discretion of the firm offer the highest flexibility in the capital structure. 8. Requirements of investors: The requirements of investors are another factor that influences the capital structure of a firm. It is necessary to meet the requirements of both institutional as well as private investors when debt financing is used. Investors are generally classified under three kinds, i.e. bold investors, cautious investors and less cautious investors. Bold investors are willing to take all types of risk, are enterprising in nature, and prefer capital gains and control and hence equity share capital is best suited to them. 9. Capital Market Conditions: Capital market conditions do not remain the same for ever. Sometimes there may be depression while at other times there may be boom in the market. The choice of the securities is also influenced by the market conditions. If the share market is depressed and there are pessimistic business conditions, the company should not issue equity shares as investors would prefer safety. But in case there is boom period, it would be advisable to issue equity shares. 10. Assets structure: The liquidity and the composition of assets should also be kept in mind while selecting the capital structure. If fixed assets constitute a major portion of the total assets of the company, it may be possible for the company to raise more of long term debts. 11. Purpose of financing: If funds are required for a productive purpose, debt financing is suitable and the company should issue debentures as interest can be paid out of the profits generated from the investments. However, if the funds are required for unproductive purpose or general development on permanent basis, we should prefer equity capital. 12. Period of Finance: The period for which the finances are required is also an important factor to be kept in mind while selecting an appropriate capital mix. If the finances are required for a limited period of, say, seven years, debentures should be preferred to shares. Redeemable preference shares may also be used for a limited period finance, if found suitable otherwise. However, in case funds are needed on permanent basis, equity share capital is more appropriate.

- 103. Chethan. S Asst Prof., Department of Management 7 13. Costs of floatation: Although not very significant, yet costs of floatation of various kinds of securities should also be considered while raising funds. The cost of floating a debt is generally less than the cost of floating equity and hence it may persuade the management to raise debt financing. The costs of floating as a percentage of total funds decrease with the increase in size of the issue. 14. Personal considerations: The personal considerations and abilities of the management will have the final say on the capital structure of a firm. Managements which are experienced and are very enterprising do not hesitate to use more of debt in their financing as compared to the less experienced and conservative management. 15. Corporate tax rate: High rate of corporate taxes on profits compel the companies to prefer debt financing, because interest is allowed to be deducted while computing taxable profits. On the other hand, dividend on shares is not an allowable expense for that purpose. 16. Legal requirements: The government has also issued certain guidelines for the issue of shares and debentures. The legal restrictions are very significant as these lay down a framework within which capital structure decision has to be made. For example, the controller of capital issues, now SEBI grants his consent for capital issue when (i) the debt- equity ratio does not exceed 2:1 (ii) the ratio of preference capital to equity does not exceed 1:3 and (iii) promoters hold at least 25% of the equity capital. EPS (Earning Per Share) Earnings per share can be defined as that share of a company’s profit that is distributed to each share of stocks. Further, it is considered to be a significant financial parameter as it helps to gauge a company’s financial health. To elaborate, higher EPS reflects greater profitability from the company and its overall ventures. A company with a steadily increasing EPS is often considered to be a reliable investment option. Generally, EPS is divided into 3 broad categories, namely – Trailing EPS: It is entirely based on the previous year’s figures. Current EPS: Mostly based on the current projections and available figures. Forward EPS: Depends on anticipated future projections and estimated figures.

- 104. Chethan. S Asst Prof., Department of Management 8 Calculation of Earnings per Share EPS = Net Profit available to Equity shareholder No. of equity share Preparation of Income Statement / Income Table/ Profitability Statement Particulars Amount Net Sales XXXX ( - ) Variable Cost XXX Contribution XXXX ( - ) Fixed Cost XXX Earning Before Interest & Tax (EBIT) XXXX ( - ) Interest on Debenture XXX Earning Before Tax (EBT) XXXX ( - ) Corporate Tax XXX Earning After Tax (EAT) XXXX ( - ) Preference Dividend XXX Net Profit available to Equity shareholder XXXX

- 105. Chethan. S Asst Prof., Department of Management 9 PROBLEMS ON EPS (Earning Per Share) PROBLEM 01 A Company has equity share capital of ₹5, 00,000 divided into share of ₹100 each. Company wishes to raise ₹3, 00,000 for Expansion and Modernization purpose. The company has following alternatives. i) All are equity shares (common stock). ii) ₹1, 00,000 in equity share and ₹2, 00,000 in Debentures at 10% Interest. iii) All are debentures at 10% Interest. iv) ₹1, 00,000 in equity share and ₹2, 00,000 in preference share capital at 8% Dividend rate. The corporate tax is 50% The company EBIT is ₹1, 50,000 Calculate EPS for each case and comment which capital structure the company has to choose. Solution:-

- 106. Chethan. S Asst Prof., Department of Management 10

- 107. Chethan. S Asst Prof., Department of Management 11 PROBLEM 02 PENTA FOUR Ltd. has currently an all equity structure consisting of 15,000 equity shares of Rs.100 each. The management is planning to raise another Rs. 25 lakhs to finance a major programme of expansion and is considering three alternative methods of financing: i) To issue 25,000 equity shares of Rs.100 each. ii) To issue 25,000, 8% debentures of Rs.100 each. iii) To issue 25,000, 8% preference shares of Rs.100 each. The company’s expected earnings before interest and taxes will be Rs.8 lakhs. Assuming a corporate tax rate of 46%, determine the earnings per share (EPS), in each alternative and comment which alternative is best and why? Solution:-

- 108. Chethan. S Asst Prof., Department of Management 12

- 109. Chethan. S Asst Prof., Department of Management 13 PROBLEM 03 AB Ltd., is capitalized with Rs.10,00,000 divided into shares of Rs.100 each. It plans to raise further Rs.5,00,000 for expansion plans. The company plans the following schemes: a) All equity shares. b) Rs.2,00,000 in equity shares and Rs.3,00,000 in debentures at 10%. c) All debentures at 10%. The company has estimated its EBIT at Rs.3,00,000. Tax rate is 50%. Suggest which scheme is to be selected. Solution:-

- 110. Chethan. S Asst Prof., Department of Management 14

- 111. Chethan. S Asst Prof., Department of Management 15 PROBLEM 04 ABC Ltd., has a share capital of Rs.1,00,000 divided into shares of Rs.10 each. It has a major expansion programme requiring an investment of another Rs.50,000. The management is considering the following three alternatives: i) Issue 5,000 shares of Rs.10 each ii) Issue 5,000, 12% preference shares of Rs.10 each. iii) Issue of 10% debentures of Rs.50,000 The company’s present EBIT is Rs.30,000 p.a. Calculate the EPS for the above three alternatives presuming, a) EBIT continues to be the same. b) EBIT increases by Rs.10,000 Assume the tax rate at 50%. Solution:-

- 112. Chethan. S Asst Prof., Department of Management 16

- 113. Chethan. S Asst Prof., Department of Management 17

- 114. Chethan. S Asst Prof., Department of Management 18 PROBLEM 05 A company needs Rs.12,00,000 for the installation of a new factory which would yield an annual EBIT of Rs.2,40,000. The company has the objective of maximizing the EPS. It is considering the possibility of issuing equity shares of Rs.10 each plus raising a debt of Rs.2,00,000, Rs.6,00,000, or Rs.10,00,000. The current market price per share is Rs.40 which is expected to drop to Rs.25 per share of the market borrowings were to exceed Rs.7,50,000. Cost of borrowings is as follows: • Upto Rs.2,50,000 at 10% p.a. • Between Rs.2,50,000 and Rs.6,50,000 at 14% p.a. • Between Rs.6,50,000 and Rs.10,00,000 at 16% p.a. Assume tax rate of 50%, calculate the EPS and the scheme which would meet the objective of the management. Solution:-

- 115. Chethan. S Asst Prof., Department of Management 19

- 116. Chethan. S Asst Prof., Department of Management 20

- 117. Chethan. S Asst Prof., Department of Management 21 PROBLEM 06 2019 QP Question A Company has EBIT of Rs.4,80,000 and its capital structure consist of the following Securities. Particulars Amount Equity share Capital (10 Each) 4,00,000 12% Preference shares 6,00,000 14.5% Debentures 10,00,000 The Company is facing fluctuations in its sales what would be the change in EPS. a) If the EBIT of the Company Increased by 25%. b) If the EBIT of the Company Decreased by 25%. The corporate Tax is 35%. Solution:-

- 118. Chethan. S Asst Prof., Department of Management 22 PROBLEM 07 2018 QP Question Sun Limited and Moon Limited are identical except that former is not Levered while the latter it has levered. The particulars are as follows: Particulars Sun Limited Moon Limited Equity Share Capital (Rs.10 each) 10,00,000 5,00,000 8% debt Capital - 5,00,000 Assets 10,00,000 10,00,000 Return on Assets 20% 20% Calculate the EPS assuming the tax rate of 30% and would it be advantageous to the moon limited to raise the level of debt to 70%? Solution:-

- 119. Chethan. S Asst Prof., Department of Management 23

- 120. Chethan. S Asst Prof., Department of Management 24 PROBLEM 08 KR Limited is capitalized with Rs.5,00,000 divided into 50,000 equity shares of Rs.10 each. The management desires to raise another Rs.5,00,000 to finance some expansion programme. There are four possible financing plans: i) All equity Shares. ii) Rs.2,50,000 in equity and the balance in debentures carrying 10% Interest. iii) Rs.2,50,000 in Equity and Rs.2,50,000 in preference shares carrying 10% Dividend. iv) All debentures carrying 10% Interest. The existing EBIT amounts to Rs.60,000 p.a. Calculate EPS in all the above four plans. Solution:- Particulars Plan I Plan II Plan III Plan IV EBIT 60,000 60,000 60,000 60,000 Less: Interest on debentures @ 10 % Nil 25,000 nil 50,000 Earnings Before Tax (EBT) 60,000 35,000 60,000 10000 Less: Tax @ 50% 30,000 17,500 30,000 5,000 Earnings After Tax (EAT) 30,000 17,500 30,000 5,000 Less: Preference Dividend nil nil 25000 nil Earnings Available to equity shares 30,000 17,500 5,000 5,000 No. of Equity shares 100,000 75,000 75,000 50,000 EPS 0.3 0.23 0.06 0.1 (Note:- If tax information is not given in the problem we should assume 30% or 50% and we should give Note below the Solution)

- 121. Practice Questions Year - 2016 Solution:- a. When the EBIT is 80,000 CALCULATION OF EPS Particulars EBIT/operating profit Less: Interest on Debt. @10 % Earnings Before Tax (EBT) Less: Tax @ 50 % Earnings After Tax (EAT) Less: Dividend on Pref. Share Earnings Available to equity shares No. of Equity shares EPS Asst Prof., Department of Management Practice Questions a. When the EBIT is 80,000 CALCULATION OF EPS Equity Pref+Deb Debenture Plan I Plan II Plan III 80000 80000 80000 @10 % nil 5,000 10,000 (EBT) 80000 75000 70000 40,000 37,500 35,000 40,000 37,500 35,000 Share @10% nil 5000 nil Earnings Available to equity shares 40,000 32,500 35,000 20,000 10,000 10,000 2 3.25 3.5 Chethan. S Asst Prof., Department of Management 25 Debenture Plan III 80000 10,000 70000 35,000 35,000 nil 35,000 10,000 3.5

- 122. b. When the EBIT is increased to 1,00,000 Particulars EBIT/operating profit Less: Interest on debentures @10 % Earnings Before Tax (EBT) Less: Tax @ 50 % Earnings After Tax (EAT) Less: Dividend on Preference capital @10% Earnings Available to equity shares No. of Equity shares EPS Year - 2015 Asst Prof., Department of Management b. When the EBIT is increased to 1,00,000 Equity Pref+Deb Debenture Plan I Plan II Plan III 100000 100000 100000 Interest on debentures @10 % nil 5,000 10,000 (EBT) 100000 95000 90000 50,000 47,500 45,000 50,000 47,500 45,000 Dividend on Preference capital nil 5000 nil Earnings Available to equity shares 50,000 42,500 45,000 20,000 10,000 10,000 2.5 4.25 4.5 Chethan. S Asst Prof., Department of Management 26 Debenture Plan III 100000 10,000 90000 45,000 45,000 nil 45,000 10,000 4.5

- 123. Chethan. S Asst Prof., Department of Management 27 Solution:- A. The Company may issue 50,000 equity shares of Rs.100 per share. Particulars EBIT - I EBIT - II EBIT - III EBIT 1,00,000 2,00,000 4,00,000 Less: Interest on Debt. Nil Nil Nil Earnings Before Tax (EBT) 1,00,000 2,00,000 4,00,000 Less: Tax @ 50% 50,000 1,00,000 2,00,000 Earnings After Tax (EAT) 50,000 1,00,000 2,00,000 Less: Preference Dividend Nil Nil Nil Earnings Available to equity shares 50,000 1,00,000 2,00,000 No. of Equity shares 50,000 50,000 50,000 EPS Rs.1 Rs.2 Rs.4 B. The Company issue 50,000 equity shares of Rs.100 each and 25,000 debentures of Rs.100each at 8% Interest. Particulars EBIT - I EBIT - II EBIT - III EBIT 1,00,000 2,00,000 4,00,000 Less: Interest on Debt. 2,00,000 2,00,000 2,00,000 Earnings Before Tax -1,00,000 0 2,00,000 Less: Tax @ 50% -50,000 0 1,00,000 Earnings After Tax (EAT) -1,50,000 0 1,00,000 Less: Preference Dividend Nil Nil Nil Earnings Available to equity shares -1,50,000 0 1,00,000 No. of Equity shares 25,000 25,000 25,000 EPS Rs.-6 Rs.0 Rs.4

- 124. C. The Company issue 50,000 equity shares of 25,000 preference share of Rs.100each at 8% Dividend. Particulars EBIT Less: Interest on Debt. Earnings Before Tax Less: Tax @ 50% Earnings After Tax (EAT) Less: Preference Dividend Earnings Available to equity shares No. of Equity shares EPS Year - 2014 Asst Prof., Department of Management C. The Company issue 50,000 equity shares of Rs.100 each and 25,000 preference share of Rs.100each at 8% Dividend. EBIT - I EBIT - II EBIT 1,00,000 2,00,000 4,0 Nil Nil Nil 1,00,000 2,00,000 4,0 50,000 1,00,000 2,0 (EAT) 50,000 1,00,000 2,0 Preference Dividend 2,00,000 2,00,000 2,0 -1,50,000 -1,00,000 0 25,000 25,000 25 Rs.-6 Rs.-4 Rs.0 Chethan. S Asst Prof., Department of Management 28 Rs.100 each and EBIT - III 4,00,000 Nil 4,00,000 2,00,000 2,00,000 2,00,000 25,000 Rs.0

- 125. LEVERAGE Leverage is an investment strategy of using borrowed money various financial instruments or investment. Leverage can also refer to the amount of Companies use leverage to finance their assets companies can use debt to invest in business operations in an attempt to increase shareholder value. An automaker, for example, could borrow money to build a new factory. The new factory would enable the automaker to increase the number of cars it produces and increase Concept: To gain Higher Financial Benefits compared to the fixed charges Types of leverages There are three types of leverages: i) Operating leverage ii) Financial leverage and iii) Combined leverage i) Operating leverage Operating leverage refers to the extent to which the firm has fixed operating costs. If firm has high degree of operating leverage, it will have relatively high fixed costs in comparison with a firm with low operating leverage. Operating leverage can be calculated by the following formula: Asst Prof., Department of Management LEVERAGES Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an Leverage can also refer to the amount of debt a firm uses to finance assets. Companies use leverage to finance their assets—instead of issuing stock to raise capital, companies can use debt to invest in business operations in an attempt to increase shareholder could borrow money to build a new factory. The new factory would enable the automaker to increase the number of cars it produces and increase Concept: - “How to do more with less” To gain Higher Financial Benefits compared to the fixed charges Payable There are three types of leverages: Operating leverage refers to the extent to which the firm has fixed operating costs. If firm has high degree of operating leverage, it will have relatively high fixed costs in comparison with a firm with low operating leverage. Operating leverage can be calculated by the Chethan. S Asst Prof., Department of Management 29 specifically, the use of to increase the potential return of an a firm uses to finance assets. instead of issuing stock to raise capital, companies can use debt to invest in business operations in an attempt to increase shareholder could borrow money to build a new factory. The new factory would enable the automaker to increase the number of cars it produces and increase profits. Payable Operating leverage refers to the extent to which the firm has fixed operating costs. If firm has high degree of operating leverage, it will have relatively high fixed costs in comparison with a firm with low operating leverage. Operating leverage can be calculated by the

- 126. Chethan. S Asst Prof., Department of Management 30 Contribution Operating leverage = ---------------- EBIT Degree of operating leverage % of change in EBIT DOL = --------------------------- % of change in Sales ii) Financial leverage Financial leverage refers to the extent to which the firm has fixed financing costs arising from the use of debt capital. If firm has high financial leverage, it will have relatively high fixed financing costs compared to the firm with low financial leverage. Financial leverage can be calculated by the following formula: EBIT Financial leverage = ---------- EBT Note: If dividend payable on preference shares available in the problem the formula for Financial Leverage is: EBIT Financial leverage = ---------- EBT – Dp ------- 1-T Where; Dp = Dividend on preference shares. Degree of financial leverage % of change in EPS DFL = --------------------------- % of change in EBIT iii) Combined leverage or Total leverage Combined leverage refers to the extent to which a firm has fixed operating costs as well as financing costs. Combined leverage can be calculated by the following formula: Contribution Combined leverage = --------------- EBT Or =Operating Leverage x Financial Leverage

- 127. Chethan. S Asst Prof., Department of Management 31 Note: If dividend payable on preference shares available in the problem the formula for Combined Leverage is : Contribution Combined leverage = ------------------- EBT – Dp ------- 1-T Where; Dp = Dividend on preference shares. Degree of combined leverage % of change in EPS DCL = ------------------------ % of change in Sales Combinations of Operating and Financial leverage Operating Leverage Financial Leverage Combined effect High Low Low High High Low High Low It is very dangerous policy which should be avoided it is called as risky situation.(Very risky) It is very cautious policy and not assumed any risk.( Conservative) This is an ideal policy. The company can follow aggressive debt policy which is known as ideal situation.(Moderate) Adverse effects of operating leverage were taken care of by having low financial leverage. (Moderate)

- 128. PROFORMA OF INCOME STATEMENT Particulars Net Sales Less: Variable Cost Contribution Less: Fixed Cost EBIT/operating profit Less: Interest on debentures Earnings Before Tax (EBT) Less: Tax Earnings After Tax (EAT) Less: Dividend on Preference capital Earnings Available to equity shares No. of Equity shares EPS DIFFERENCE BETWEEN OPERATING AND FINANCIAL LEVERAGE Asst Prof., Department of Management PROFORMA OF INCOME STATEMENT Amount (₹) XXXX XXX XXXX XXX XXXX Interest on debentures XXX (EBT) XXXX XXX XXXX Dividend on Preference capital XXX Earnings Available to equity shares XXXX XXX XX DIFFERENCE BETWEEN OPERATING AND FINANCIAL LEVERAGE Operating Leverage Financial Leverage Chethan. S Asst Prof., Department of Management 32 DIFFERENCE BETWEEN OPERATING AND FINANCIAL LEVERAGE Combined Leverage

- 129. Chethan. S Asst Prof., Department of Management 33 PROBLEM 09 Calculate operating leverage: Interest Rs.5, 000; Sales Rs.50, 000; Variable cost Rs.25, 000 and Fixed cost Rs.15, 000 Solution:-

- 130. Chethan. S Asst Prof., Department of Management 34 PROBLEM 10 Calculate operating, financial, combined leverages from Interest Rs.5, 000; Sales Rs.50, 000; Variable cost Rs.25, 000; Fixed cost Rs.15,000. Solution:-

- 131. Chethan. S Asst Prof., Department of Management 35 PROBLEM 11 A firm has sales of Rs.5, 00,000, variable cost Rs. 3, 50,000 and fixed cost Rs.1, 00,000 and debt of Rs.2,50,000 at 10 per cent interest. Calculate the operating, financial and combined leverage. Solution:-

- 132. Chethan. S Asst Prof., Department of Management 36 PROBLEM 12 XYZ Ltd., has an average selling price of Rs.10 per unit. Its variable unit cost is Rs.7 and fixed costs amount to Rs.1,70,000. it pays 50% tax on its income. It finances all its assets by equity capital. ABC Ltd., is identical to XYZ Ltd., except in respect of the pattern of financing. ABC Ltd., finances its assets by equity for 50% and by debt for 50%, the interest on which amounts to Rs.20,000. Determine operating and financial leverages at sales level of Rs.7,00,000 for both companies and interpret the results. Solution:-

- 133. Chethan. S Asst Prof., Department of Management 37 Interpretation A company should try to have a balance of the two leverages because they have got tremendous effect on EBIT and EPS. It may be noted that a right combination of these leverages is a very big challenge for the management. A proper combination of both operating and financial leverage is a blessing for the firm’s growth while an improper combination may prove to be a curse.

- 134. Chethan. S Asst Prof., Department of Management 38 PROBLEM 13 2019 QP Question (6 Marks) A firm has sales of Rs.10,00,000, variable cost of Rs.5,00,000, fixed cost of Rs.2,00,000 and debt of Rs.5,00,000 at 10% interest. Calculate operating, financial and combined leverage. Solution:-

- 135. Chethan. S Asst Prof., Department of Management 39 PROBLEM 14 2018 QP Question (6 Marks) A firm has sales of Rs.20,00,000, variable cost of Rs.14,00,000, fixed cost of Rs.4,00,000 and debt of Rs.10,00,000 at 10% interest. Calculate operating, financial and combined leverage. Solution:-

- 136. Chethan. S Asst Prof., Department of Management 40 PROBLEM 15 2017 QP Question (6 Marks) Determine the three types of leverages from the following information:- Selling price per unit Rs.10 Variable cost per unit Rs.5 Fixed Cost Rs.1,20,000 10% debt capital Rs.3,00,000 Number of units sold 90,000 Solution:-

- 137. Chethan. S Asst Prof., Department of Management 41 PROBLEM 16 2016 QP Question (6 Marks) Determine the three types of leverages from the following information:- FIRM - A FIRM - B Sales Rs.20,00,000 Rs.30,00,000 Variable Cost 40% of Sales 30% of Sales Fixed Cost Rs.5,00,000 Rs.7,00,000 Interest Rs.1,00,000 Rs.1,25,000 Interpret the Results of the firm. Solution:-

- 138. Chethan. S Asst Prof., Department of Management 42

- 139. Practice Questions Year - 2015 Year - 2014 Asst Prof., Department of Management Practice Questions Chethan. S Asst Prof., Department of Management 43

- 140. B. DIVIDEND DECISION MEANING OF DIVIDEND: Dividend is a after tax profit which is distributed to the shareholders. The term dividend refers to that part of the profits of a company which is distributed amongst its shareholders. DEFINITION: Dividend refers to a reward, cash or otherwise, that a company gives to its shareholders. Dividends can be issued in various forms, such as cash payment, stocks or any other form. A company’s dividend is decided by its board of directors and it requires the shareholders’ approval. However, it is not obligatory for a company to pay dividend. Dividend is usually a part of the profit that the company shares with its shareholders. DIVIDEND PROCESS Asst Prof., Department of Management DIVIDEND DECISION MEANING OF DIVIDEND:- after tax profit which is distributed to the shareholders. The term dividend refers to that part of the profits of a company which is distributed amongst its shareholders. Dividend refers to a reward, cash or otherwise, that a company to its shareholders. Dividends can be issued in various forms, such as cash payment, stocks or any other form. A company’s dividend is decided by its board of directors and it requires the shareholders’ approval. However, it is not to pay dividend. Dividend is usually a part of the profit that the company shares with its shareholders. DIVIDEND PROCESS Chethan. S Asst Prof., Department of Management 44 after tax profit which is distributed to the shareholders. The term dividend refers to that part of the profits of a company which is Dividend refers to a reward, cash or otherwise, that a company to its shareholders. Dividends can be issued in various forms, such as cash payment, stocks or any other form. A company’s dividend is decided by its board of directors and it requires the shareholders’ approval. However, it is not to pay dividend. Dividend is usually a part of the

- 141. Chethan. S Asst Prof., Department of Management 45 DIVIDEND POLICY The term dividend policy refers to the policy concerning how much profits to be distributed as dividend and how much to be retained in the business. TYPES OF DIVIDEND POLICY 1. Stable dividend policy 2. Regular dividend policy 3. Irregular Dividend Policy 4. No dividend Policy 1. Stable dividend policy The term ‘stability of dividend’ means consistency or lack of variability in the stream of dividend payment. In more precise terms, it means payment of certain minimum amount of dividend regularly. A stable dividend policy may be established in any of the following forms: a. Constant dividend per share: Some companies follow a policy of paying fixed dividend per share irrespective of the level of earnings year after year. Such firms, usually, create a ‘Dividend Equalization Reserve’ to enable them pay the fixed dividend even in the year when the earnings are not sufficient or when there are losses. A policy of constant dividend per share is most suitable to concerns whose earnings are expected to remain stable over a number of years. b. Constant payout ratio: It means payment of a fixed percentage of net earnings as dividends every year. The amount of dividend in such a policy fluctuates in direct proportion to the earnings of the company. This type of policy is suitable to concerns whose profits are expected to increase over a number of years. c. Stable rupee dividend plus extra dividend: Some companies follow a policy of paying constant low dividend per share plus an extra dividend in the years of high profits. Such a policy is most suitable to the firms having fluctuating earnings from year to year.

- 142. Chethan. S Asst Prof., Department of Management 46 2. Regular dividend policy • Payment of dividend at the usual rate is termed as regular dividend. The investors such as retired persons, widows and other economically weaker persons prefer to get regular dividends. A regular dividend policy offers the following advantages: • It establishes a profitable record of the company. • It created confidence amongst the shareholders. • It aids in long-term financing and renders financing easier. • It stabilizes the market value of shares. • The shareholders view dividends as a source of funds to meet their day-to- day living expenses. 3. Irregular Dividend Policy • Some companies follow irregular dividend payments on account of the following: • Uncertainty of earnings. • Unsuccessful business operations. • Lack of liquid resources. • Fear of adverse effects of regular dividends on the financial standing of the company. 4. No dividend Policy A company may follow a policy of paying no dividends presently because of its un favorable working capital position or on account of requirements of funds for future expansion and growth. FORMS OF DIVIDEND • Cash dividend • Property dividend • Stock dividend or Bonus shares • Scrip or Bond dividend Dividends can be classified in various forms. They are:

- 143. Chethan. S Asst Prof., Department of Management 47 • Cash dividend: A cash dividend is a usual method of paying dividend. Payment of dividends in cash results in outflow of funds from the firm. The firm should, therefore, have adequate cash resources at it disposal so that its liquidity position is not adversely affected due to cash dividend. • Scrip or Bond dividend: In case the company does not have sufficient cash to pay dividend it may issue bonds for the amount due to the shareholders by way of dividends. The purpose of bond dividend is to postpone the payment of immediate dividend in cash. The bond holders get regular interest on their bonds besides payment of the bond money on the due date. Bond dividend is not popular in India. • Property dividend: In case of property dividend the company pay dividend in the form of assets which are not required by the company or in the form of company’s products. This type of dividend is also not popular in India. • Stock dividend or Bonus shares: In case of this dividend, the company issues its own shares to the existing shareholders in lieu or in addition to cash dividend. Payment of stock dividend is popularly termed as “issue of bonus shares” in India. FACTORS AFFECTING DIVIDEND POLICY External factors 1. General state of economy 2. State of capital market 3. Legal restrictions 4. Contractual restrictions 5. Tax policy

- 144. Chethan. S Asst Prof., Department of Management 48 Internal factors 1. Desire of the shareholders 2. Financial needs of the company 3. Nature of earnings 4. Desire of control 5. Liquidity position The factors affecting the dividend policy are classified into external and internal: External factors Following are the external factors which affect the dividend policy of a firm: 1. General state of economy: The general state of economy affects to a great extent the management’s decision to retain or distribute earnings of the firm. In case of uncertain economic and business conditions - the management may like to retain the whole or a part of the firm’s earnings to build up reserves to absorb shock in the future. In periods of depression - the management may also like to retain a large part of its earnings to preserve the firm’s liquidity position. In periods of prosperity - the management may not be liberal in dividend payments though the earning power of a company warrants it because of availability of larger profitable investment opportunities. In periods of inflation - the management retain larger proportion of the earnings for replacement of worn-out assets.

- 145. Chethan. S Asst Prof., Department of Management 49 2. State of capital market: In case a firm has an easy access to the capital market either because it is financially strong or because favourable conditions prevail in the capital market, it can follow a liberal dividend policy (retains less and distributes more). However, if the firm has no easy access to capital market because either of weak financial position or because of unfavourable conditions in the capital market. It is likely to adopt a more conservative dividend policy (retain more and distribute less profits to equity shareholders). 3. Legal restrictions: In India Companies Act 1956 has put several restrictions regarding payment and declaration of dividends. i) Dividends can only be paid out of current profits or past profits or money provided by the central government or state government. Payment of dividend out of capital is illegal. ii) Dividend should be paid only out of profits after providing for depreciation and transferring to reserves not less than 10%. 4. Contractual restrictions: Lenders of the firm generally put restrictions on dividend payment to protect their interest and capital repayment in periods when the firm is experiencing liquidity or profitability problems. For example it may be provided in a loan agreement that the firm shall not pay dividend of more than 12% so long the firm does not clear the loan. 5. Tax policy: The tax policy followed by the Government also affects the dividend policy. For example the Government gives tax incentives to companies retaining larger share of their earnings.

- 146. Chethan. S Asst Prof., Department of Management 50 Internal factors 1. Desire of the shareholders: Of course, the directors of the company have considerable freedom in declaring the dividend but the shareholders are the real owners of the company and therefore, their desires should not be overlooked by the directors while deciding about the divided policy. 2. Financial needs of the company: Shareholders’ desire and financial needs of the company are two conflict issues while determining the dividend policy. If company retains more profits, it may not meet the desires of the shareholders. 3. Nature of earnings: A firm having stable income may follow higher dividend payout ratio. For example Public Utility Companies like Electricity Boards and Air lines carrying business purely on cash system may pay higher dividends. Similarly Liquor Companies can follow liberal dividend policy since people used to drink liquor both in boom as well as in recession. But the companies which are engaged in Luxury Goods may follow conservative dividend policy because of stiff competition and low profits. 4. Desire of control: The company which follows low dividend payout ratio does not dilute the control of the existing shareholders whereas the company following high dividend payout ratio dilutes the control of the existing shareholders as it issues new shares to acquire funds to finance future finance requirements. 5. Liquidity position: The payment of dividends results in cash outflow from the firm. A firm may have adequate earnings but it may not have sufficient cash to pay dividends. It is therefore important for the management to take into account the cash position and the overall liquidity position of the firm before and after payment of dividends while making dividend decision.

- 147. Chethan. S Asst Prof., Department of Management 51 BONUS SHARE Bonus shares are the additional shares given to the current shareholders of the company free of cost, in proportion to their existing shareholding. Such an event is called a Bonus Issue. Bonus shares are given to the current shareholders in lieu of a dividend pay-out. ADVANTAGES OF BONUS SHARE Issue of bonus shares is beneficial both to the company as well as to the shareholders. To the company 1. Conservation of Cash: Issue of bonus shares makes possible for the company to declare a dividend without using the cash resources that may be needed for operation or expansion. The company can thus retain earnings as well as satisfy the desire of the shareholders to receive dividend. 2. Keeps EPS at a Reasonable Level: A company having a high EPS may have to face problems both from the workers and consumers. Workers may feel that they are underpaid while consumers think that they are overcharged for the company’s products. Issue of bonus shares results in increasing the number of shares and reducing the earning per share. Thus, EPS can be brought down to a reasonable level without affecting the interest of the shareholders. 3. Wider Marketability of shares: Issue of bonus shares reduces the market price of the company’s shares and thus even it reaches to the small investors who cannot afford for bigger price shares.

- 148. Chethan. S Asst Prof., Department of Management 52 To the investors 1. Tax Benefits: When dividend is received in cash, it is included in his income and taxed at usual income rates. However, stock dividend is not so taxable. The profit made on the sale of shares will be deemed as a capital gain and will be subject to lower rate of income tax. 2. Indication of Higher Future Profits: Issue of bonus shares is generally an indication of higher future profits. This is because a company declares a bonus issue only when its earnings are expected to increase. 3. Increase in Future Dividends: The shareholders will get extra dividends in future even if the existing cash dividend per share is continued. 4. High psychological Value: Issue of bonus shares is usually received positively in the market. This tends to create greater demand for the company’s shares. As a matter of fact, the share prices of the company may rise on the stock exchange after bonus issue in place of falling. DISADVANTAGES OF BONUS SHARE To the company 1. Issue of bonus shares leads to an increase in the capitalization of the company 2. Issue of bonus shares results in more liability on the company in respect of future dividends. 3. It prevents new investors from becoming the shareholders of the company. 4. Control of the existing shareholders is not diluted and the present management may misuse its position. To the investors 1. Shareholders who prefer cash dividend may disappoint. 2. Issue of bonus shares lowers the market value of existing shares too.

- 149. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 1 CORPORATE FINANCIAL MANAGEMENT UNIT-4 INVESTMENT DECISION INTRODUCTION:- Investment decision it relates to as how the funds of a firm are to be invested into different assets, so that the firm is able to earn highest possible return for the investors. Investment decision can be long-term, also known as capital budgeting where the funds are committed into long-term basis. Capital budgeting is made up of two words ‘capital’ and ‘budgeting.’ In this context, capital expenditure is the spending of funds for large expenditures like purchasing fixed assets and equipment, repairs to fixed assets or equipment, research and development, expansion and the like. Budgeting is setting targets for projects to ensure maximum profitability. Capital budgeting is the process of making investment decisions in long term assets. It is the process of deciding whether or not to invest in a particular project as all the investment possibilities may not be rewarding. MEANING OF CAPITAL BUDGETING:- Capital Budgeting is the process of selecting the asset or an investment proposal that will yield returns over a long period. Thus, the manager has to choose a project that gives a rate of return more than the cost financing such a project. That is why he has to value a project in terms of cost and benefit.

- 150. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 2 Thus, capital budgeting is the most important responsibility undertaken by a financial manager. This is because: 1. It involves the purchase of long term assets and such decisions may determine the future success of the firm. 2. These decisions help in maximizing shareholder’s value. 3. Principles applicable to capital budgeting process also apply to other corporate decisions like working capital management. Following are the categories of projects that can be examined using capital budgeting process: The decision to buy new machinery Expansion of business in other geographical areas Replacement of an obsolete equipment New product or market development etc PROCESS OF CAPITAL BUDGETING:- Step 1: Idea Generation The most important step of the capital budgeting process is generating good investment ideas. These investment ideas can come from a number of sources like the senior management, any department or functional area, employees, or sources outside the company. Step 2: Analyzing Individual Proposals A manager must gather information to forecast cash flows for each project in order to determine its expected profitability. This is because the decision to accept or reject a capital investment is based on such an investment’s future expected cash flows. Step 3: Planning Capital Budget An entity must give priority to profitable projects as per the timing of the project’s cash flows, available company resources, and a company’s overall strategies. Step 4: Project Execution In this stage finance manager must take necessary step for immediate execution of selected project. Step 5: Monitoring and Conducting a Post Audit It is important for a manager to follow up or track all the capital budgeting decisions. He should compare actual with projected results and give reasons as to why projections did not match with actual performance. Therefore, a systematic post-audit is essential in order to find out systematic errors in the forecasting process and hence enhance company operations.

- 151. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 3 OBJECTIVES OF CAPITAL BUDGETING:- 1. Selecting profitable projects An organization comes across various profitable projects frequently. But due to capital restrictions, an organization needs to select the right mix of profitable projects that will increase its shareholders’ wealth. 2. Capital expenditure control Selecting the most profitable investment is the main objective of capital budgeting. However, controlling capital costs is also an important objective. Forecasting capital expenditure requirements and budgeting for it, and ensuring no investment opportunities are lost is the crux of budgeting. 3. Finding the Right sources for funds Determining the quantum of funds and the sources for procuring them is another important objective of capital budgeting. Finding the balance between the cost of borrowing and returns on investment is an important goal of Capital Budgeting. IMPORTANCE [OR] ADVANTAGES OF CAPITAL BUDGETING 1. It encourages large Investment. 2. It increases earning capacity of the Business. 3. It increases Reputation of the Business. 4. It helps in better utilization of resources in organization. 5. It creates right decision for right investment. 6. It acts as a basis to forecast the future trends of the project. 7. It acts as a supporting element for the organization to achieve the objectives. 8. It provides large no of business opportunities.

- 152. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 4 DISADVANTAGES OF CAPITAL BUDGETING 1. It is irreversible in nature. 2. It is based on Assumption not reality. 3. It is not adopted by small business concerns because a total investment is small in size. 4. It is difficult to anticipate immediate returns. 5. It is influenced by various factors such as political, social, economical, technological factors etc., and it is very difficult to predict the changes in various factors. CAPITAL BUDGETING TECHNIQUES:- To assist the organization in selecting the best investment there are various techniques available based on the comparison of cash inflows and outflows. Techniques / Methods of Capital Budgeting Traditional Methods 1. Payback Period (PBP). 2. Accounting Rate of return method (ARR). Discount Cash Flow Methods / Modern Methods 1. Net Present Value (NPV). 2. Internal Rate of Return method (IRR). 3. Profitability Index (PI).

- 153. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 5 TRADITIONAL METHODS:- 1. PAYBACK PERIOD METHOD MEANING: - In this technique, the entity calculates the time period required to earn the initial investment of the project or investment. The project or investment with the shortest duration is opted for. Types of Payback Period:- A. Pay Back Period B. Post Pay Back Period & Post Pay back Profitability C. Discounted Pay Back Period FORMULAS:- A. When the cash flow are even or uniformed B. When the cash flow are Uneven Accept & Reject Criteria:- Shorter the payback period Project is Accepted Longer the payback period the Project is Rejected

- 154. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 6 PROBLEM 01 (When the cash flow are even or uniformed) From the Following information calculate the Pay Back Period and Suggest? Particulars Project A Project B Project Cost 5,50,000 6,50,000 Cash Flows: Year 1 1,00,000 1,50,000 Year 2 1,00,000 1,50,000 Year 3 1,00,000 1,50,000 Year 4 1,00,000 1,50,000 Year 5 1,00,000 1,50,000 SOLUTION:-

- 155. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 7 PROBLEM 02 (When the cash flow are Uneven) Calculate the Payback period from the Following Particulars and suggest suitable Projects. Particulars Project X Project Y Investment 1,00,000 50,000 Cash Flows: Year 1 10,000 10,000 Year 2 30,000 7,500 Year 3 40,000 20,000 Year 4 25,000 20,000 Year 5 15,000 15,000 SOLUTION:-

- 156. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 8

- 157. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 9 PROBLEM 03 (When the cash flow are Uneven) From the following information. Calculate the payback period and suggest which project is suitable to invest. Project - P Project - Q Project Cost 50,000 50,000 Year Cash Inflow (Rs.) Cash Inflow (Rs.) 1 12,000 5,000 2 26,000 15,000 3 10,000 20,000 4 8,000 20,000 5 8,000 10,000 SOLUTION:-

- 158. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 10

- 159. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 11 PROBLEM 04 (Problem on Post Payback Period & Post pay back Profitability) Rajesh and Company ltd is considering a purchase of 2 Assets namely A&B. Each costing Rs. 5, 00,000. Cash Flow is as Follows. Calculate Post payback period and Post payback profitability? Years Asset -A Asset - B Year 1 1,50,000 50,000 Year 2 2,00,000 1,50,000 Year 3 2,50,000 2,00,000 Year 4 1,50,000 3,00,000 Year 5 1,00,000 2,00,000 SOLUTION:-

- 160. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 12

- 161. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 13

- 162. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 14 PROBLEM 05 (Problem on Discounted Payback period) Alexa Company ltd is considering a purchase of 2 Assets namely M&N. Each costing Rs. 4,000. Cash Flow is as Follows. Years Asset - M Asset - N Year 1 3,000 0 Year 2 1,000 4,000 Year 3 1,000 1,000 Year 4 1,000 2,000 The present value factors at 10%. (Discount Factors 0.909, 0.826, 0.751, 0.683) Calculate the discounted payback period. SOLUTION:-

- 163. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 15

- 164. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 16 PROBLEM 06 (Problem when cash flow has not given) A company is considering expanding its production. It can go in either for an automatic machine costing Rs. 2,24,000 with an estimated life of 5 ½ years or an ordinary machine costing Rs.60,000 having an estimated life of 8 years. The annual sales and costs are estimated as follows: Particulars Automatic Machine (Rs.) Ordinary Machine (Rs.) Sales 1,50,000 1,50,000 Costs:- Material 50,000 50,000 Labour 12,000 60,000 Variable Overheads 24,000 20,000 Calculate the Payback period and advice the Management SOLUTION:- Particulars Amount (Automatic) Amount (Ordinary) Sales Less: Operating costs (Variable + Fixed cost) EBDT (Earnings Before Depreciation and Tax) Less: Depreciation EBT (Earnings Before Taxes) Less: Taxes @ 50% EAT (Earnings After Taxes) Add: Depreciation Cash Inflow (Earnings After Taxes But Before Depreciation)

- 165. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 17

- 166. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 18 PROBLEM 07 (Problem when cash flow has not given) A project costs Rs.20,00,000 and yields annually a profit of Rs.3,00,000 after depreciation at 12 ½ % but before tax at 50%. Calculate payback period. SOLUTION:- Particulars Amount EBT (Earnings Before Taxes) Less: Taxes @ 50% EAT (Earnings After Taxes) Add: Depreciation Cash Inflow (Earnings After Taxes But Before Depreciation)

- 167. Mr.CHETHAN.S Asst. Prof, Department of Management, AIGS. 19 2. ACCOUNTING RATE OF RETURN:- MEANING: - Accounting Rate of Return (ARR) is the percentage rate of return that is expected from an investment or asset compared to the initial cost of investment. In this technique, the total net income of the investment is divided by the initial or average investment to derive at the most profitable investment. Accounting rate of return, also known as the Average rate of return, or ARR is a financial ratio used in capital budgeting. FORMULA:-