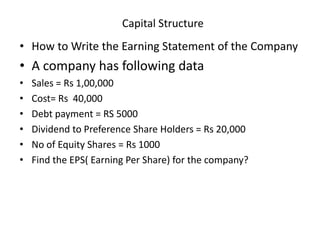

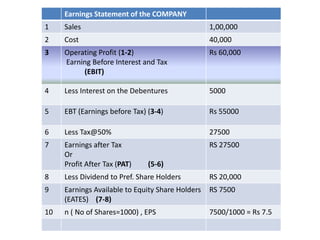

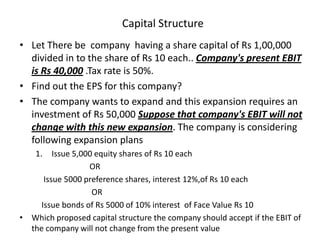

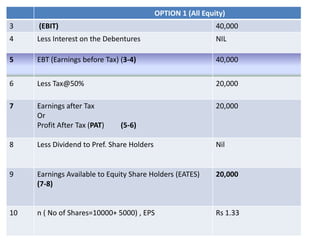

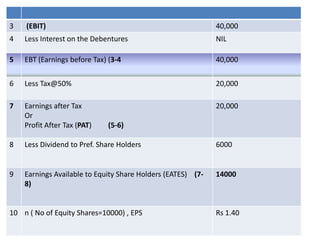

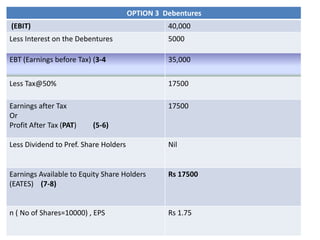

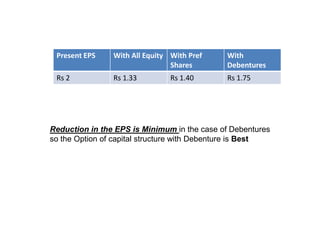

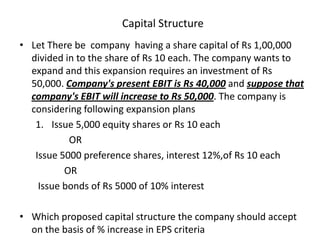

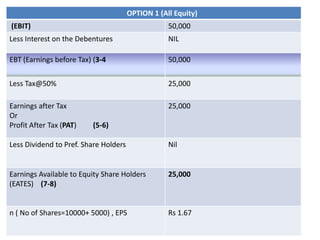

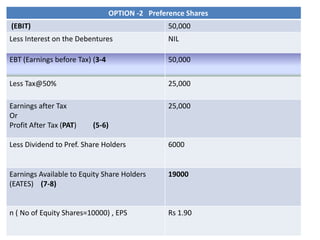

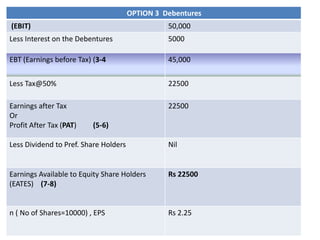

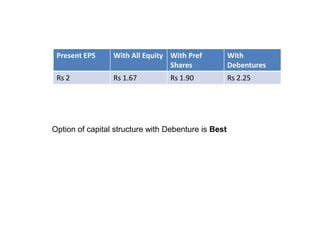

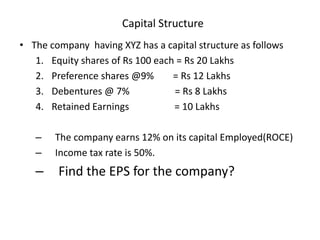

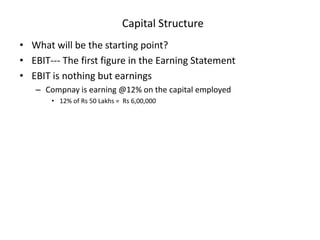

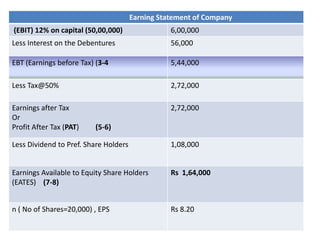

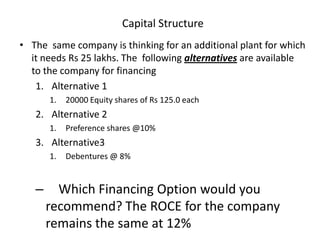

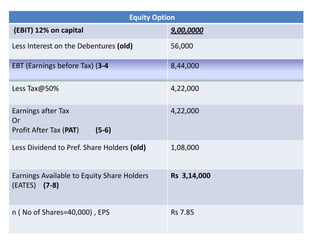

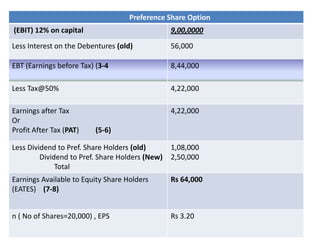

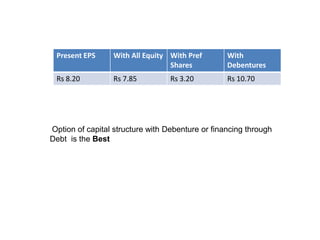

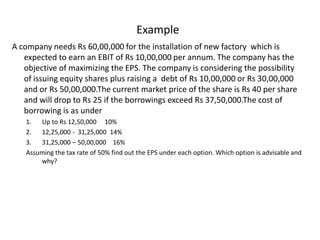

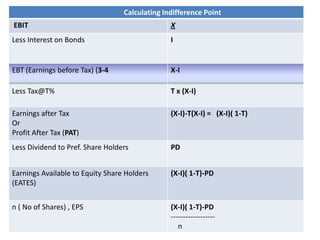

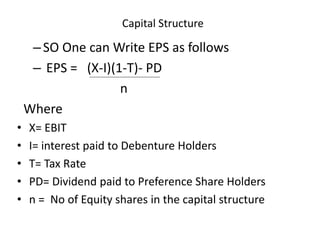

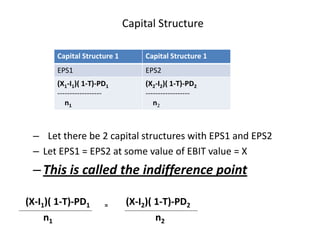

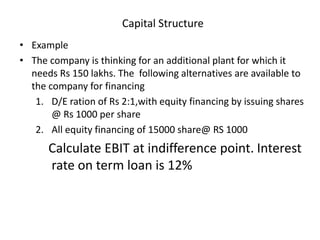

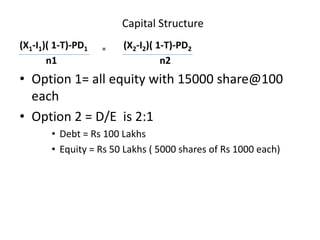

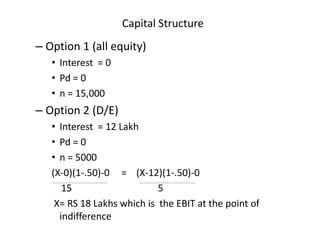

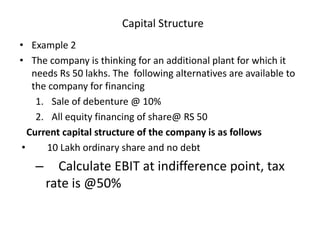

The document discusses capital structure, which refers to the mix of long-term financing sources like equity shares, preference shares, debentures, and retained earnings that a company uses. It provides examples of different capital structure patterns that companies can use, including all equity, equity with preference shares, and combinations including debt. The optimal capital structure balances the costs and benefits of debt versus equity to maximize shareholder value. Formulas for calculating earnings per share under different capital structures and the indifference point between structures are also presented.