Market outlook 12 05-10

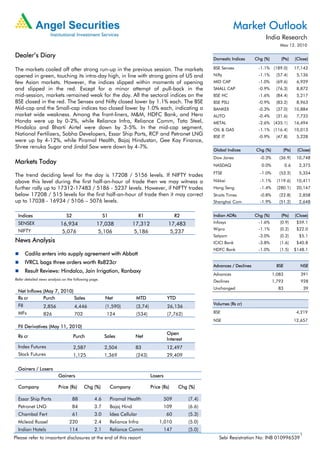

- 1. Market Outlook India Research May 12, 2010 Dealer’s Diary Domestic Indices Chg (%) (Pts) (Close) The markets cooled off after strong run-up in the previous session. The markets BSE Sensex -1.1% (189.0) 17,142 opened in green, touching its intra-day high, in line with strong gains of US and Nifty -1.1% (57.4) 5,136 few Asian markets. However, the indices slipped within moments of opening MID CAP -1.0% (69.6) 6,929 and slipped in the red. Except for a minor attempt of pull-back in the SMALL CAP -0.9% (76.3) 8,872 mid-session, markets remained weak for the day. All the sectoral indices on the BSE HC -1.6% (84.4) 5,217 BSE closed in the red. The Sensex and Nifty closed lower by 1.1% each. The BSE BSE PSU -0.9% (83.2) 8,963 Mid-cap and the Small-cap indices too closed lower by 1.0% each, indicating a BANKEX -0.3% (37.0) 10,884 market wide weakness. Among the front-liners, M&M, HDFC Bank, and Hero AUTO -0.4% (31.6) 7,733 Honda were up by 0-2%, while Reliance Infra, Reliance Comm, Tata Steel, METAL -2.6% (435.1) 16,494 Hindalco and Bharti Airtel were down by 3-5%. In the mid-cap segment, OIL & GAS -1.1% (116.4) 10,013 National Fertilizers, Sobha Developers, Essar Ship Ports, RCF and Petronet LNG BSE IT -0.9% (47.8) 5,228 were up by 4-12%, while Piramal Health, Bajaj Hindustan, Gee Kay Finance, Shree renuka Sugar and Jindal Saw were down by 4-7%. Global Indices Chg (%) (Pts) (Close) Dow Jones -0.3% (36.9) 10,748 Markets Today NASDAQ 0.0% 0.6 2,375 FTSE -1.0% (53.2) 5,334 The trend deciding level for the day is 17208 / 5156 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a Nikkei -1.1% (119.6) 10,411 further rally up to 17312-17483 / 5186 - 5237 levels. However, if NIFTY trades Hang Seng -1.4% (280.1) 20,147 below 17208 / 515 levels for the first half-an-hour of trade then it may correct Straits Times -0.8% (22.8) 2,858 up to 17038 - 16934 / 5106 – 5076 levels. Shanghai Com -1.9% (51.2) 2,648 Indices S2 S1 R1 R2 Indian ADRs Chg (%) (Pts) (Close) SENSEX 16,934 17,038 17,312 17,483 Infosys -1.6% (0.9) $59.1 NIFTY Wipro -1.1% (0.2) $22.0 5,076 5,106 5,186 5,237 Satyam -3.0% (0.2) $5.1 News Analysis ICICI Bank -3.8% (1.6) $40.8 HDFC Bank -1.0% (1.5) $148.1 Cadila enters into supply agreement with Abbott IVRCL bags three orders worth Rs823cr Advances / Declines BSE NSE Result Reviews: Hindalco, Jain Irrigation, Ranbaxy Advances 1,083 391 Refer detailed news analysis on the following page. Declines 1,793 928 Unchanged 83 39 Net Inflows (May 7, 2010) Rs cr Purch Sales Net MTD YTD FII Volumes (Rs cr) 2,856 4,446 (1,590) (3,74) 26,136 MFs 826 702 124 (534) (7,762) BSE 4,219 NSE 12,657 FII Derivatives (May 11, 2010) Open Rs cr Purch Sales Net Interest Index Futures 2,587 2,504 83 12,497 Stock Futures 1,125 1,369 (243) 29,409 Gainers / Losers Gainers Losers Company Price (Rs) Chg (%) Company Price (Rs) Chg (%) Essar Ship Ports 88 4.6 Piramal Health 509 (7.4) Petronet LNG 84 3.7 Bajaj Hind 109 (6.6) Chambal Fert 61 3.0 Idea Cellular 60 (5.3) Mcleod Russel 220 2.4 Reliance Infra 1,010 (5.0) Indian Hotels 114 2.1 Reliance Comm 147 (5.0) 1 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Market Outlook | India Research Cadila enters into supply agreement with Abbott Cadila and Abbott have entered into a strategic alliance under which Cadila will supply 24 branded generics products to Abbott for 15 emerging markets. The agreement also has an option for additional 40 products to be included over the term of the collaboration. The deal is likely to commercialise in CY2012. We expect the deal to be positive as it would enable Cadila to leverage its strong product pipeline and manufacturing capabilities. At Rs576, the stock is trading at 18.8x FY2011E and 14.5x FY2012E earnings. We continue to recommend a Buy on the stock with a Target Price of Rs634. IVRCL bags three orders worth Rs823cr IVRCL Infrastructures and Projects Ltd (IVRCL) has bagged three orders amounting to Rs823cr. The projects are spread across areas of Transportation, Water projects and Building Construction and are expected to be finished within a time frame ranging between 24-30months. The Outstanding Order Book of IVRCL stands at around Rs21,500cr or 3.6x its FY2010E revenues. We have valued IVRCL on an SOTP basis, valuing its core construction business at a FY2012E Target P/E of 14x, whereas its stake in Hindustan-Dorr Oliver and IVR Prime have been valued on a MCap basis. We maintain a Buy on the Stock with a Target Price of Rs240. Result Reviews Hindalco Hindalco’s standalone Top-line increased by 45.3% yoy and 1.4% qoq to Rs5,358cr which was lower than our estimate on account of lower copper production due to a shutdown of its smelter. Copper cathode production was lower by 14% yoy and 16.2% qoq to 74,734 tonnes. EBITDA increased by 165.8% yoy to Rs835cr as margins expanded by 707bp on account of higher LME prices. Net income was sharply ahead of our estimates by 36.5% on account of a) lower interest expense and b) tax write back of Rs113cr. For FY2010, Net sales increased by 7.5% yoy to Rs19,408cr on back of higher volumes, better product mix and better realizations. EBITDA de-grew by 2.8% as margins contracted by 162bp to 15.2% on account of higher raw material costs. Other income declined by 59.2% yoy to Rs260cr on account of low treasury corpus as the company repaid its bridge loan. Consequently, Net income de-grew by 14.1% yoy to Rs1,916cr. We feel the company is well placed to benefit from its ongoing aluminium expansion plans, lower cost at its new plants and turnaround at Novelis. We maintain a Buy on the stock with a SOTP Target Price of Rs208. Jain Irrigation Jain Irrigation declared its 4QFY2010 results. On a standalone basis, the company reported a Top-line growth of 37% yoy to Rs959cr (Rs699cr), largely aided by a strong growth witness in Micro Irrigation Systems segment. In terms of Earnings, the company reported a Net Profit of Rs117cr (Rs11cr), however post adjustment for forex gain adj PAT stands at Rs83cr (Rs33cr), which was slightly ahead of our estimate of Rs75cr. While, currently we have a Neutral rating on the stock, we would revise our estimates and rating post earnings call. May 12, 2010 2

- 3. Market Outlook | India Research Ranbaxy Ranbaxy announced its 1QCY2010 results which were ahead of our expectation. Net Sales came in at stellar Rs2,487cr (1,555cr) up 59.9% driven by the US region. The US sales increased by 266% to Rs1,210cr on back of Valtrex exclusivity while Europe increased by 10% to Rs310cr and India by 6% to Rs345.2cr. On the OPM front, the company recorded margins at 31.0% driven by exclusivity. Further, the company received US$50mn as one-time income from Flomax settlement which buoyed the other Operating Income to Rs280.3cr (Rs22.3cr). Ranbaxy reported strong Net profit of Rs960.5cr (loss of Rs767.3cr) driven by Valtrex exclusivity, higher other Operating income and Forex gains. Excluding the Forex gains, the Operational PAT came in at Rs657cr (loss of Rs26.2cr). The stock is under review. Economic and Political News Growing small cities to keep inflation high in FY11: Goldman 3G auction & proposed changes in 2G spectrum pricing to fetch Rs90,000cr Punjab & Haryana seek higher MSP for Paddy Corporate News Bajaj Hind to transfer thermal power project to subsidiary DLF pulls out of Chennai IT SEZ, seeks Rs700cr refund GSPC to merge two of its gas distribution units Source: Economic Times, Business Standard, Business Line, Financial Express, Mint May 12, 2010 3

- 4. Market Outlook | India Research Events for the day Bajaj Auto Dividend, Results Bajaj Holdings Dividend, Results Blue Star Dividend, Results D B Realty Results Mahindra Forge Results Mangalore Refineries Dividend, Results Muthoot Cap Dividend, Results Rohit Ferro Dividend, Results RPG Life Dividend, Results Thermax Dividend, Results Welspun India Results May 12, 2010 4

- 5. Market Outlook | India Research Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and is for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 May 12, 2010 5