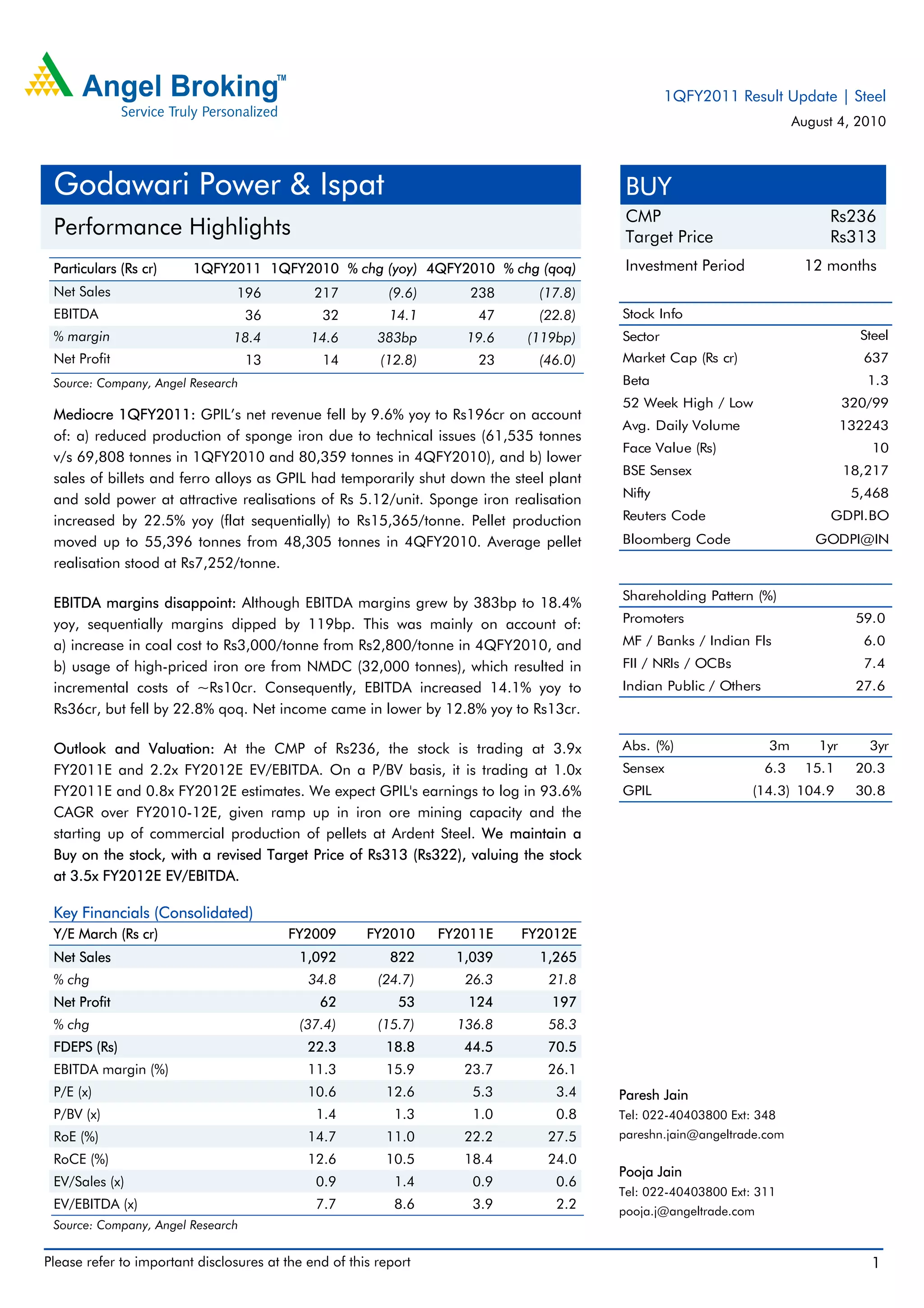

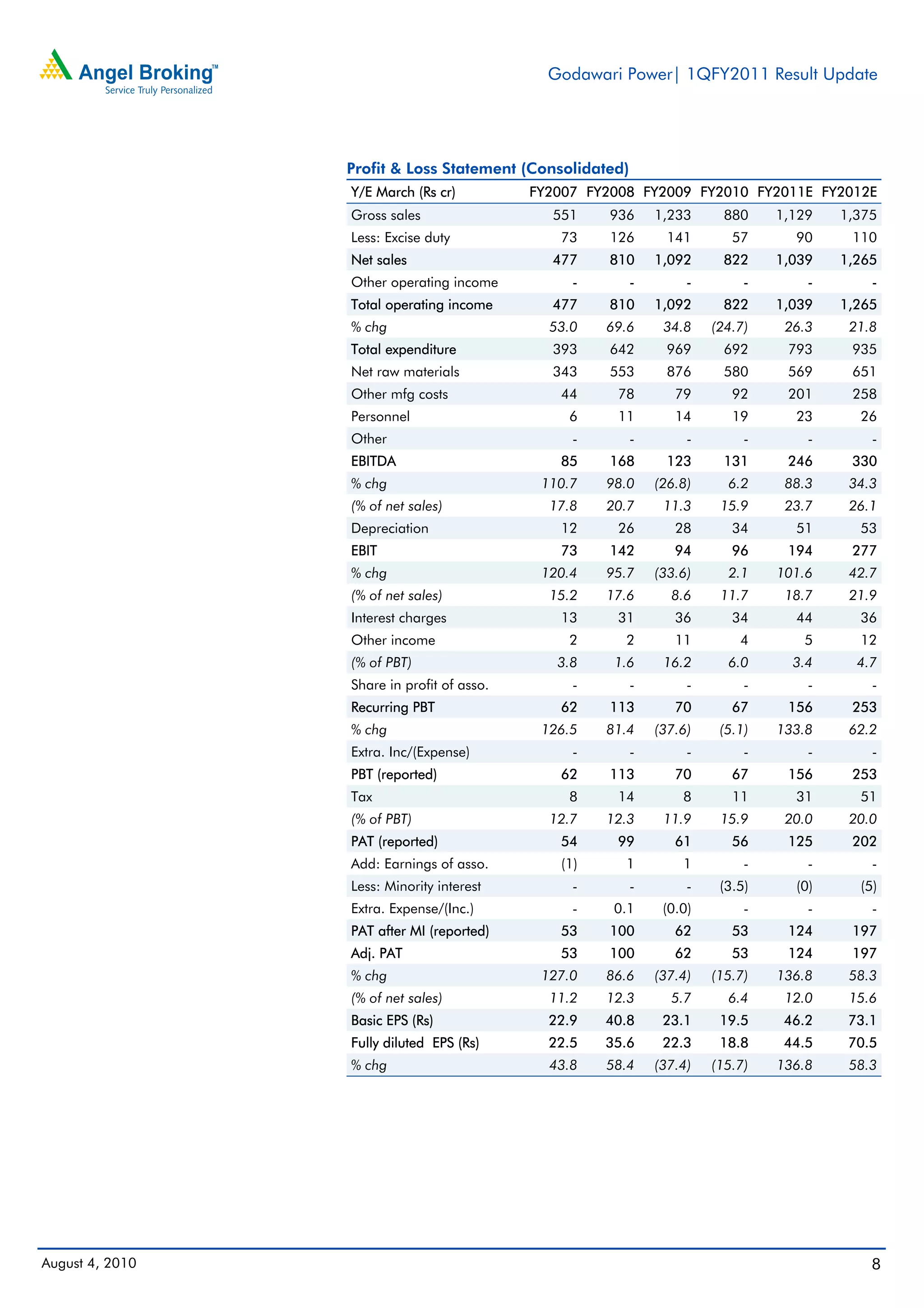

Godawari Power & Ispat reported mediocre results for the first quarter of FY2011 with net sales falling 9.6% year-over-year to Rs196 crore due to reduced sponge iron production and lower steel sales. EBITDA margins grew 383 basis points year-over-year to 18.4% but fell 119 basis points quarter-over-quarter due to higher coal and iron ore costs. Net profit declined 12.8% year-over-year to Rs13 crore. The brokerage maintains a 'Buy' rating with a revised target price of Rs313, expecting earnings to grow at a 93.6% CAGR through FY2012 given ramped up iron