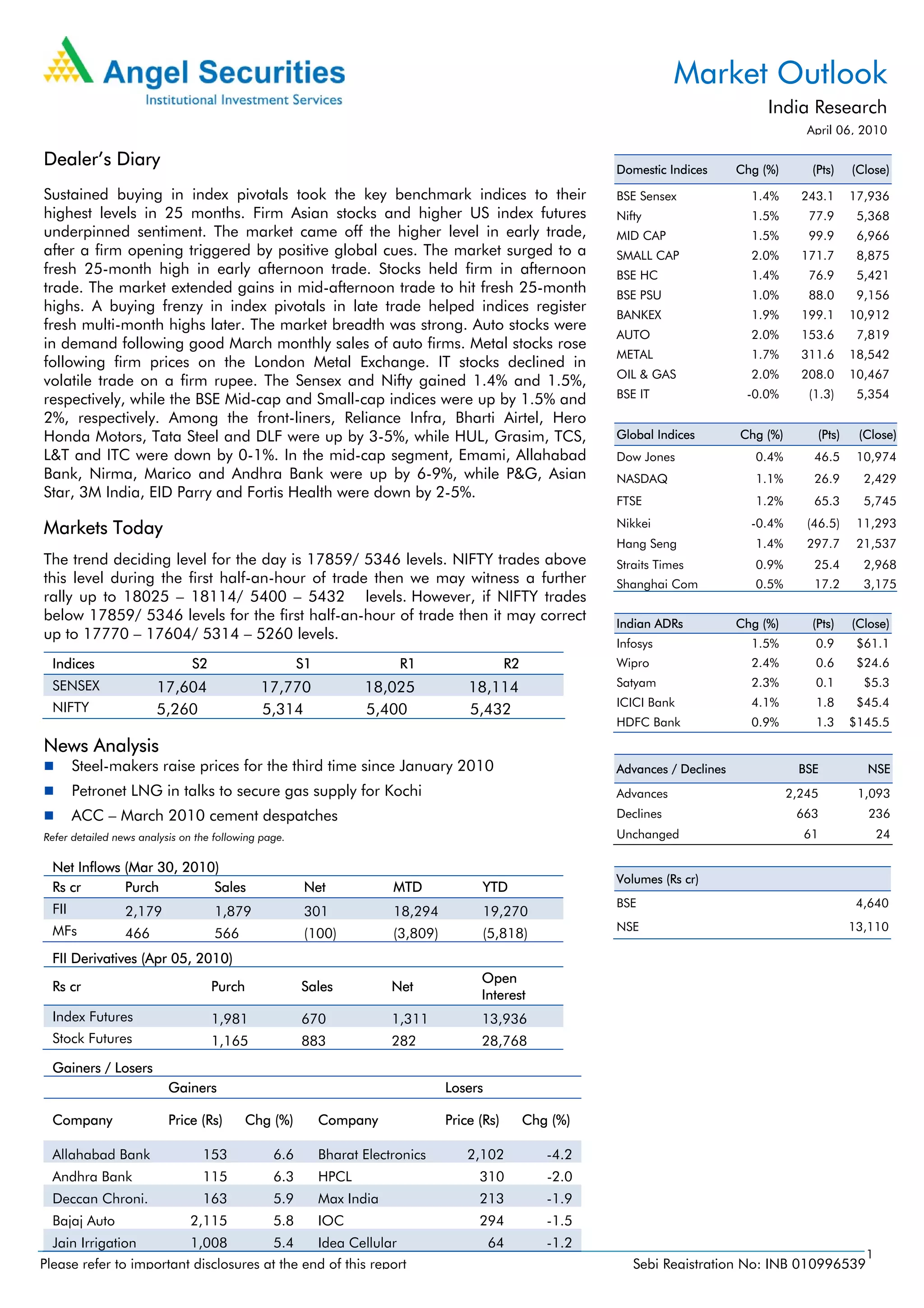

- Indian stock indices rose to their highest levels in 25 months, with the Sensex and Nifty gaining 1.4% and 1.5% respectively, lifted by sustained buying in index pivotals.

- Regional stocks were mixed, with metal and auto stocks rising on firm commodity prices and strong auto sales, while IT stocks declined due to a stronger rupee.

- In corporate news, steel makers raised prices for the third time in 2010 due to higher raw material costs, while ACC reported a 3.5% drop in cement dispatches for March.